USA Soybean Market Oulook of 2030

Region:North America

Author(s):Pranav Krishn

Product Code:KROD889

July 2024

93

About the Report

USA Soybean Market Overview

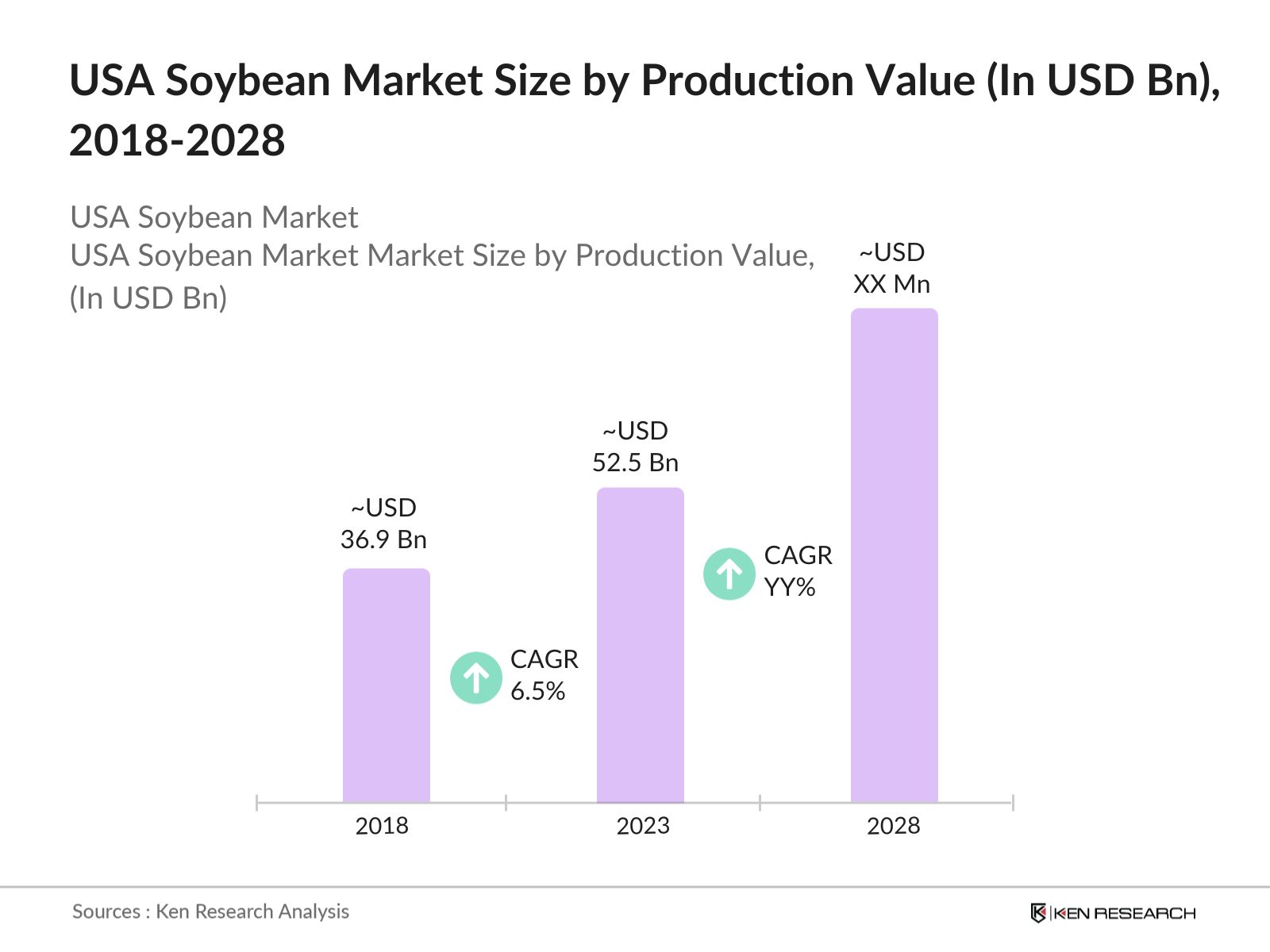

- The USA soybean market was valued at USD 52.5 billion in 2023 with a CAGR of 6.51% between 2018-2023. The rise in vegan and vegetarian diets, coupled with the demand for plant-based proteins, has significantly boosted the market.

- Major players in the USA soybean market include Archer Daniels Midland Company, Bunge Limited, Cargill, Inc., Louis Dreyfus Company, and CHS Inc. These companies play a crucial role in production, processing, and distribution, ensuring a steady supply chain from farms to consumers.

- In 2023, Louis Dreyfus Company (LDC) is expanding its soybean processing capacity in the Midwest region of the United States. The company announced plans to build a new soy processing plant in Upper Sandusky, Ohio, which will have an annual soy crushing capacity of 1,500,000 MT, annual edible (RBD) soybean oil production capacity of 320,000 MT, and annual lecithin production capacity of 7,500 MT.

USA Soybean Market Analysis

- The U.S. soybean market has experienced a significant boost in export demand, especially from China. In 2023, China imported 35 million tons of U.S. soybeans, driven by its expanding livestock industry and demand for animal feed. The phase one trade agreement between the U.S. and China, renewed in 2024, continues to facilitate these high export volumes, ensuring sustained market growth.

- The soybean industry supports over 500,000 individuals involved in soy farm decision-making, including 223,000 paid, full-time equivalent jobs and an additional 62,000 family members who reside on farms and are integral to soybean farming operations.

- The Midwest region, often referred to as the "Soybean Belt," dominates the USA soybean market. States like Illinois, Iowa, and Minnesota lead in soybean production due to favorable climatic conditions and extensive farming infrastructure. For instance, Illinois alone produced over 600 million bushels of soybeans in 2023, making it the top soybean-producing state.

USA Soybean Market Segmentation

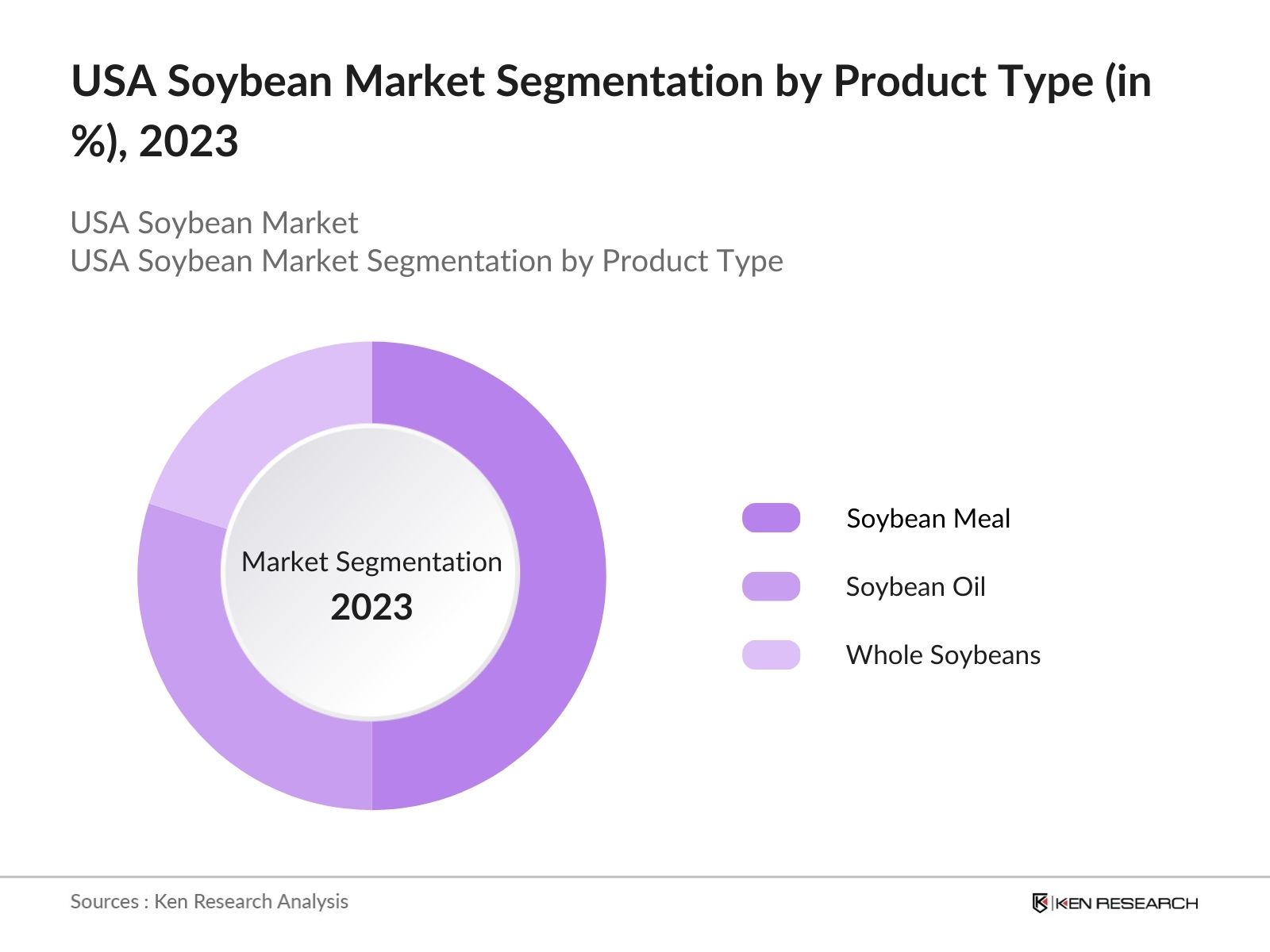

Product Type: In 2023, the US Soybean Market segmented by product type into soybean meal, soybean oil and whole soybean. Soybean meal asserts dominance in the product type segmentation owing to its critical function as a high-protein feed ingredient in the livestock and poultry sectors. Recognized for its nutritional richness and adaptability in feed formulations, soybean meal holds a prominent and indispensable position in the market, meeting the protein requirements of animals efficiently and cost-effectively.

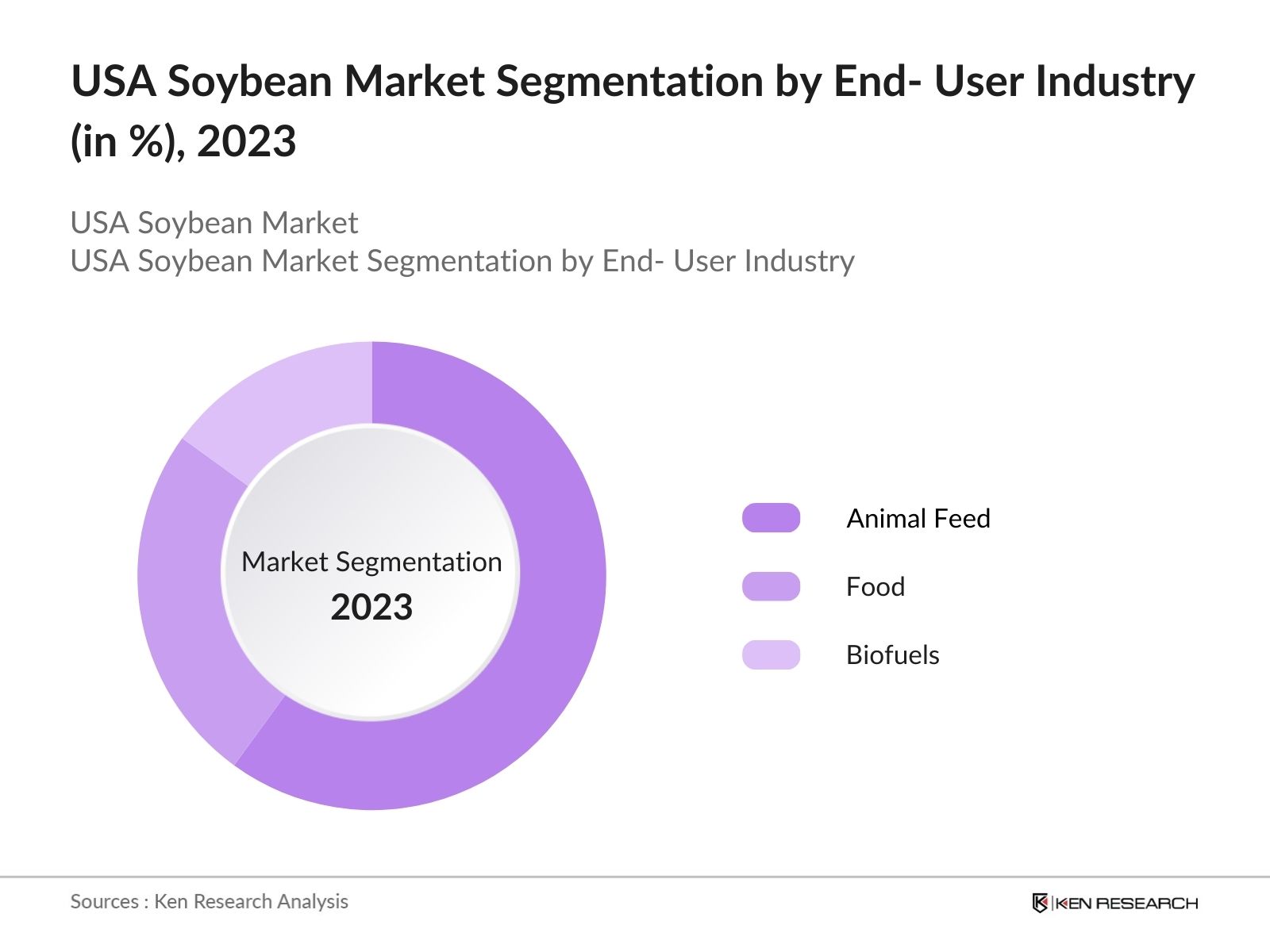

End-Use Industry: In 2023, the US Soybean Market segmented by end- use industry into animal feed, food and biofuels. Dominance of the animal feed segment stems from the crucial role soybean meal plays as a primary protein source in livestock and poultry diets. With a high protein content and balanced amino acid profile, soybean meal fulfills the nutritional requirements of animals, contributing to their growth, health, and productivity.

Region: In 2023, the US Soybean Market segmented by geography into north, south, east, and west. The western region holds dominance in the regional segmentation of the USA Soybean market due to its extensive cultivation and processing infrastructure. Renowned as the "Corn Belt," it boasts vast agricultural lands conducive to soybean cultivation, along with established processing facilities. This region's robust agricultural economy and favorable climate conditions solidify its position as a primary contributor to the nation's soybean output.

USA Soybean Market Competitive Landscape

- Archer Daniels Midland Company: A leading player in the soybean market, impacting the industry through its extensive processing facilities and innovation in soy-based products. In 2023, ADM reported revenues of $102 billion, reflecting its dominant position in the market.

- Bunge Limited: Bunge Limited significantly influences the market due to its large-scale operations and focus on sustainability and renewable energy. In 2024, Bunge announced a partnership with Chevron to develop renewable fuel feedstocks, a project valued at $600 million.

- Cargill, Inc.: Recent investments in processing capacity highlight Cargill's commitment to meeting increasing demand and strengthening its market position. In 2023, Cargill invested $475 million to expand its soybean processing facilities in Iowa.

USA Soybean Market Industry Analysis

USA Soybean Market Growth Drivers

- Rising Demand for Plant-Based Proteins: The increasing consumer preference for plant-based diets has significantly boosted the demand for soy-based products. The plant-based food market in the USA is expected to reach $10.4 billion by 2023, with soy being a major contributor. This trend is driven by health-conscious consumers and sustainability concerns

- Biofuel Production: The growth of the U.S. biofuel industry has significantly contributed to soybean demand. In 2024, U.S. biofuel production required 7 billion bushels of soybeans, an increase from previous years due to federal mandates and rising crude oil prices. The Renewable Fuel Standard (RFS) program has been a critical driver, mandating higher biofuel blends in transportation fuels.

- Technological Advancements in Farming: The adoption of precision agriculture and genetically modified (GM) soybean varieties has enhanced yield and efficiency. In 2024, U.S. farmers harvested an average of 50 bushels per acre, up from 47 bushels per acre in 2023.

USA Soybean Market Challenges

- Climate Change and Weather Variability: Extreme weather events and unpredictable climate patterns pose significant risks to soybean production. In 2024, unseasonal droughts affected 3 million acres of soybean crops in the Midwest, leading to substantial yield losses. Such variability in weather conditions continues to threaten consistent production levels and market stability.

- Trade Policy Uncertainties: Fluctuating trade policies and tariffs impact the U.S. soybean market. In 2024, renewed trade tensions with the European Union resulted in a temporary halt of soybean exports worth $1.5 billion. These uncertainties can disrupt market access and create volatility in prices, affecting farmers and exporters.

- Pest and Disease Infestations: Soybean crops are susceptible to pests and diseases, which can lead to significant yield reductions. In 2024, an outbreak of soybean cyst nematode (SCN) affected 1.2 million acres, causing estimated losses of 40 million bushels. Managing these biological threats requires constant vigilance and investment in resistant crop varieties and pest control measures.

USA Soybean Market Government Initiatives

- Renewable Fuel Standard (RFS) Program: The RFS program mandates the blending of renewable fuels, including biodiesel from soybeans, into transportation fuels. In 2024, the RFS target was increased, requiring 20.9 billion gallons of renewable fuel blending, thereby boosting soybean oil demand and supporting farmers.

- Research and Development Grants: The U.S. government has allocated $500 million in grants for agricultural research and development in 2024. These grants focus on improving soybean yields, developing pest-resistant varieties, and enhancing sustainable farming practices, ensuring the long-term viability of the soybean market.

USA Soybean Market Future Outlook:

By 2028, the USA soybean market is poised for substantial expansion, driven by the increasing demand for soybean-based products such as oil and meal, the rising popularity of soy foods among health-conscious consumers, and the growing biofuel industry​

Future Trends

- Expansion of Organic Soybean Farming: The future will see a rapid expansion of organic soybean farming to meet consumer demand for organic products. By 2025, organic soybean acreage will have increased by 200,000 acres, driven by premium prices and growing market demand. Organic soybeans will be used in food products, animal feed, and specialty markets, contributing to market diversification.

- Shift Towards Sustainable Farming Practices: The trend towards sustainable and regenerative farming practices in the U.S. soybean market will continue to grow. By 2026, 10 million acres of soybean farms will adopt cover cropping and reduced tillage techniques to improve soil health and reduce carbon emissions. These practices will support long-term agricultural sustainability and environmental health.

Scope of the Report

|

By Product Type |

Soybean Meal Soybean Oil Whole Soybeans |

|

By End- Use Industry |

Animal Feed Food Biofuels |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Soybean Farmers

Soybean Processors

Biodiesel Manufacturers

Plant-Based Food Companies

Livestock Feed Producers

Agricultural Equipment Manufacturers

Agricultural Biotechnology Firms

Exporters and Importers of Soybeans

Food and Beverage Companies

Environmental and Sustainability Organizations

Renewable Energy Companies

Agricultural Research Institutions

Financial Analysts and Investors

USDA (United States Department of Agriculture)

EPA (Environmental Protection Agency)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Cargill, Incorporated

- Louis Dreyfus Company (LDC)

- Wilmar International Limited

- Ag Processing Inc (AGP)

- CHS Inc

- Cofco International

- Donlinks Grain and Oil Co., Ltd

- Hill International, Inc

- Lauritzen A/S

- Kanematsu Corporation

- Louisiana Grain Export Association

- Marubeni Corporation

- Noble Group Limited

Table of Contents

1. USA Soybean Market Overview

1.1 USA Soybean Market Taxonomy

2. USA Soybean Market Size (in USD Bn), 2018-2023

3. USA Soybean Market Analysis

3.1 USA Soybean Market Growth Drivers

3.2 USA Soybean Market Challenges and Issues

3.3 USA Soybean Market Trends and Development

3.4 USA Soybean Market Government Regulation

3.5 USA Soybean Market SWOT Analysis

3.6 USA Soybean Market Stake Ecosystem

3.7 USA Soybean Market Competition Ecosystem

4. USA Soybean Market Segmentation, 2023

4.1 USA Soybean Market Segmentation by Product Type (in %), 2023

4.2 USA Soybean Market Segmentation by End- Use Industry (in %), 2023

4.3 USA Soybean Market Segmentation by Geography (in %), 2023

5. USA Soybean Market Competition Benchmarking

5.1 USA Soybean Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics

6. USA Soybean Market Future Market Size (in USD Bn), 2023-2028

7. USA Soybean Market Future Market Segmentation, 2028

7.1 USA Soybean Market Segmentation by Product Type (in %), 2028

7.2 USA Soybean Market Segmentation by End- Use Industry (in %), 2028

7.3 USA Soybean Market Segmentation by Geography (in %), 2028

8. USA Soybean Market Analysts’ Recommendations

8.1 USA Soybean Market TAM/SAM/SOM Analysis

8.2 USA Soybean Market Customer Cohort Analysis

8.3 USA Soybean Market Marketing Initiatives

8.4 USA Soybean Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on USA Soybean Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Soybean Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research output:

Our team will approach multiple soybean producing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such soybean industry companies.

Frequently Asked Questions

01 How big is USA Soybean Market?

The market size by production value of the USA Soybean Market was USD 52.5 billion in 2023. The rise in vegan and vegetarian diets, coupled with the demand for plant-based proteins, has significantly boosted the market.

02 Who are the major players in the USA Soybean Market?

The major players in the USA Soybean Market are Archer Daniels Midland Company (ADM), Bunge Limited, Cargill, Incorporated, Louis Dreyfus Company (LDC) and Wilmar International Limited. These companies play a crucial role in production, processing, and distribution, ensuring a steady supply chain from farms to consumers.

03 What are the growth drivers of USA Soybean Market?

The growth drivers of USA Soybean Market include government incentives, health and wellness trends, global demand and trade policies. The increasing consumer preference for plant-based diets has significantly boosted the demand for soy-based products.

04 What are the challenges in USA Soybean Market?

Challenges in USA Soybean Market include raw material price fluctuations, regulatory compliance, supply chain disruptions and competition from alternatives. Extreme weather events and unpredictable climate patterns pose significant risks to soybean production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.