Vietnam Agricultural Equipment Market Outlook to 2027

Rising Food Demand, Government Support and Advances in Mechanization in the Country

Region:Asia

Author(s):Anchal Kumar

Product Code:KR1411

January 2024

127

About the Report

Market Overview:

Vietnam Agri-equipment market is anticipated to witness substantial growth propelled by Urban migration and government initiatives. In the coming years, tailored finance, fintech, and climate insurance embracing can address challenges and unlock growth. Agriculture's contribution to Vietnam's GDP is declining, but in 2022 the industry grew significantly, driven primarily by forestry and fisheries. Additionally, Vietnam is witnessing an acceleration of farm mechanization due to rising labour prices and scarcity. Import-dependent machinery is dominating the market and local manufacturers are finding it difficult to compete on cost.

Overall, Vietnam’s agricultural sector contributes 15% to Vietnam’s GDP. Tu Sang (Tien Giang province), Phan Tan (Dong Thap), and An Giang Engineering Co., Ltd. (An Giang) are some of the leading players in the Vietnam Agri-equipment market. The government incentives are promoting the domestic manufacturers of tractors, combine harvesters, and rice translators in the country. However, still, Vietnam's Agri-equipment industry heavily depends on countries such as China, Korea, Japan, and others.

The Vietnam Agricultural Equipment Market is extremely consolidated with approximately 100+ Foreign and Domestic Players operating across Vietnam. MNCs such as Kubota, Yanmar, John Deere, and Claas import machinery from around the world and assemble it in Vietnam. Kubota has a manufacturing partnership in the region. Thaco and VEAM are the two main local producers of Agri-equipment in the country. Additionally, around 35 financing companies are working in the overall ecosystem of the Vietnam Agricultural Equipment Market.

Vietnam Agricultural Equipment Market Analysis

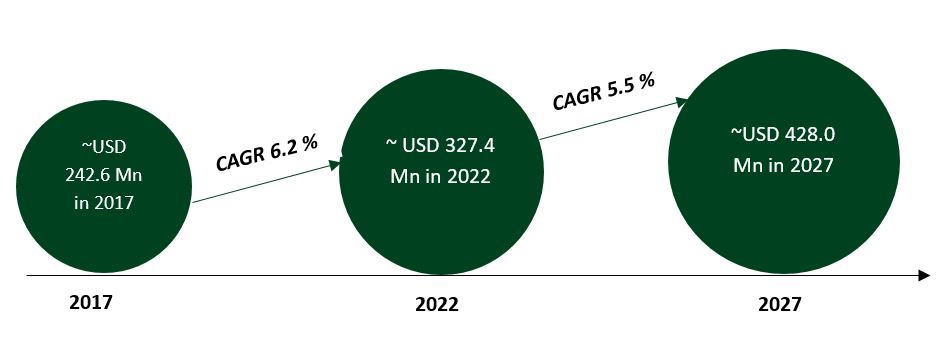

- The Vietnam Agricultural Equipment Market is developing consistently and is expected to grow at a CAGR of 5.5% in the forecasted period of 2022-2027. However, the industry is facing several obstacles in its growth including high costs, tax issues, illegal imports, dependency on imported raw materials, and skill shortages, necessitating strategic actions for sustainable growth.

- Vietnam's Agri-equipment market is dependent on imports, particularly for 4-wheel tractors, due to a lack of local manufacturing capacity, increased domestic expenses, and a lack of technical skills.

- The nation is reliant on imports because its manufacturers serve as small mechanical workshops lacking in technical knowledge and abilities related to manufacturing technologies. Furthermore, local agricultural machinery costs 15-20% more than their imported rivals.

- Vietnam has a lower level of utilization of cutting-edge technologies than other nations in the region. 75 % of the nation's rural yield comes from advanced mechanization, most of which is centred in the Mekong River delta region.

- The Ministry of Agriculture and Rural Development has set a 2030 deadline for switching from two-wheeled to four-wheeled tractors for rice growing in the northern regions. Mechanization of harvesting has reached about 70% in the southeast compared to about 40% in the north.

Key Trends by Market Segment:

By Type of Tractor: The Vietnam Tractor market is classified into two major categories based on the type of tractor 2W and 4W Tractors. 4W tractor type is dominating the Vietnam tractor market with a significant ~90% of the market share. The 4W tractor type is taking the market lead because of its dual functionality for both agricultural and non-agricultural works. Additionally, easy credit access to small farmers in the country has also persuaded them to invest in 4W tractors.

By Type of Power: The Vietnam Combine Harvester Market is categorized into six major types: Below 100 HP, 100-200 HP, 200-300 HP, 300-400 HP, 400-500 HP, and Above 500 HP. The Northern Region's traditional farmers primarily use the under 100 HP market, which makes up the majority of the market. 100 HP power type is dominating the market by a big margin as more than 1200 units of 100 HP power were sold in 2022 while any other power type fails to reach the mark of 50 units.

By Type of Rows: The Vietnam Rice Transplanter Market is divided into three major categories: 8 Row Rice Transplanters, 6 Row Rice Transplanters, and 4 Row Rice Transplanters. Vietnam Rice Transplanter Market is ruled by 4 Row Rice Transplanters which has sold approximately 2200 units of rice transplanters followed by 6 Row Rice Transplanters, and 8 Row Rice Transplanters. In Vietnam, the government's drive to increase farm mechanization and the anticipated increase in rice output will likely result in a significant rise in domestic demand for agricultural equipment like rice transplanters.

Competitive Landscape:

Major Players in The Vietnam Agricultural Equipment Market

- The Market for Agriculture Equipment is highly consolidated as it is dominated by unorganized players in Vietnam. More than 100 players are active in the Vietnam Agricultural Equipment Market.

- Kubota, Yanmar, John Deere, and Claas are some of the market leaders in Vietnam Agricultural Equipment industry. Another prominent player in the market, VEAM Group leads with over 30 years in Vietnam's Agri-equipment sector.

- Veam, Vikyono, Vinapro and others are some of the small-scale manufacturers working in the Vietnam agricultural equipment industry that assemble and manufacture Agri-equipment in the country.

- Reduced import duties (ranging from 0% to 5%) have discouraged investors from setting up production facilities in the nation, leading to a decline in the domestic sector. Moreover, misleading or underreported amounts of illegal imports further drive down the domestic industry.

- Kubota is the single largest player in the Vietnam 4W Tractor segment with a market share of approximately 50% followed by Yanmar, Thaco, and Veam. On the other hand, VEAM is dominating the 2W Tractor segment with a market share of approximately 20%.

Recent Developments:

- Over the next several years, the northwest mountainous region is predicted to retain the majority of tractors. It is anticipated that companies will introduce 4 W tractors with modest power (24 HP or less) to serve the small-hold farmer market.

- It is anticipated that domestic output will rise, resulting in a decrease in tractor prices. It is expected that more foreign companies will open local organizations or representative offices in Vietnam.

- The Ministry of Agriculture and Rural Development, or MARD, has established goals to expand the nation's agricultural mechanization and transition from two-wheeled to four-wheeled tractors. Additionally, the government has policies on soft loans from banks for the purchase of farm equipment.

Future Outlook:

- The market will grow at a CAGR of 5.5% during 2022-2028 owing to factors such as Rising Food Demand, Government Support and Advances in Mechanization in the Country.

- The government aims to achieve 70% mechanization in agricultural production by 2030 as a result the government has launched several initiatives in the country including financial assistance to the small farmers for the purchase of tractors.

- Vietnam's combine harvester income growth is expected to be driven by increasing rice production and the introduction of more powerful and diverse machines, especially those with horsepower over 90.

- During the forecast period of 2022-2027, the rice transplanter market in Vietnam is expected to grow significantly due to growing automation in agriculture and growing awareness of higher yield benefits.

Scope of the Report

|

Vietnam Agricultural Equipment Market |

|

|

By Type of Tractor |

· 2W · 4W Tractors

|

|

By Type of Power |

· Below 100 HP · 100-200 HP · 200-300 HP · 300-400 HP · 400-500 HP · Above 500 HP

|

|

By Type of Rows |

· 8 Row Rice Transplanters · 6 Row Rice Transplanters · 4 Row Rice Transplanters

|

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Manufacturers & Distributors

Fleet & Equipment Owners

Government Entity

Environmental Advocates

Automotive & Machinery Professionals

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

Kubota Vietnam

Yanmar Agricultural Machinery Vietnam

VEAM: Vietnam Engine and Agriculture

Machinery Corporation

Thaco Vietnam

Table of Contents

1. Executive Summary

1.1. Executive Summary – Vietnam Agricultural Equipment Market

2. Country Overview

2.1. Vietnam Country Overview

2.2. Vietnam Socio-economic Situation

2.3. Vietnam Agricultural Demographic

3. Agricultural Sector Analysis

3.1. Overview of Agriculture in Vietnam

3.2. Agricultural Household in Vietnam

3.3. Characteristics of Farmers in Vietnam

3.4. Status of Modernization of Farm Activities in Vietnam

3.5. Cross Comparison of Vietnam Farm Mechanization with Asian Countries

3.6. Cropping Pattern of Rice in Vietnam

3.7. Production of Major Crops in Vietnam and Export / Import Scenario

3.8. Overview of Major Crops in Vietnam and Paddy / Rice Production

4. Vietnam Agricultural Market Size Analysis, 2017 – 2022

4.1. Ecosystem – Vietnam Agricultural Market

4.2. Business Cycle and Genesis of Vietnam Agricultural Equipment Market

4.3. Timeline of Major Players of Vietnam Agricultural Equipment Market

4.4. Value Chain Analysis of Vietnam Agriculture Equipment Market

4.5. Import Scenario of Vietnam Agriculture Equipment Market

4.6. Export Scenario of Vietnam Agriculture Equipment Market

4.7. Vietnam Agricultural Market Size Analysis, 2017-2022

4.8. Market Segmentation of Vietnam Agriculture Equipment Market by Product, 2017 and 2022

5. Vietnam Agricultural Tractor Market, 2017-2027F

5.1. Executive Summary of Vietnam Tractor Market

5.2. Market Size Analysis of Vietnam Tractor Market, 2017-2022

5.3. Market Segmentation of Vietnam Agriculture Tractor Market by 2W & 4W, 2017-2022

5.4. Overview of 2W and 4W Tractor

5.5. Market Segmentation of Vietnam Agriculture Tractor Market by Power, 2017 and 2022

5.6. Market Segmentation Vietnam Agriculture Tractor Market by Region, 2017 & 2022

5.7. Market Size Analysis of Vietnam Tractor Implements Market, 2017-2022

5.8. Competition Scenario of Vietnam Agricultural Tractor Market

5.9. Market Share of Major Players in Vietnam for Two and Four Wheel Tractors Market, 2022

5.10. Future Market Sizing and Segmentation of Vietnam Agriculture Tractor Market, 2022 to 2027F

5.11. Vietnam Tractor Market Overview

5.12. Future Market Size of Vietnam Agriculture 2W Tractor Market, 2022 to 2027F

5.13. Future Market Size of Vietnam Agriculture 4W Tractor Market, 2022 to 2027F

5.14. Future Market Segmentation By Power of Vietnam Agriculture Tractor Market, 2022 and 2027F

5.16. Future Market Segmentation By Region of Vietnam Agriculture Tractor Market, 2022 and 2027F

5.17. Future Market Size of Vietnam Tractor Implements Market, 2022-2027F

6. Vietnam Agricultural Combine Harvesters Market, 2017-2027F

6.1. Executive Summary of Vietnam Combine Harvesters Market

6.2. Market Size Analysis of Vietnam Combine Harvester Market, 2017-2022

6.3. Market Segmentation of Vietnam Combine Harvester Market By Power, 2017 and 2022

6.4. Market Segmentation Analysis By Region of Vietnam Combine Harvester Market, 2017 and 2022

6.5. Market Share of Major Players in Vietnam for Combine Harvesters Market, 2022

6.6. Future Market Sizing and Segmentation of Vietnam Combine Harvester Market, 2022-2027F

7. Vietnam Agricultural Rice Transplanter Market, 2017-2027F

7.1. Executive Summary of Vietnam Rice Transplanter Market

7.2. Market Size Analysis of Vietnam Rice Transplanter Market, 2017-2022

7.3. Market Segmentation of Vietnam Rice transplanter Market By Power, 2017 and 2022

7.4. Market Share of Major Players in Vietnam for Rice Transplanters Market, 2022

7.5. Future Market Sizing and Segmentation of Vietnam Rice Transplanter Market, 2022-2027F

8. Industry Analysis

8.1. SWOT Analysis of Vietnam Agricultural Equipment Market

8.2. Growth Drivers in Vietnam Agriculture Equipment Market

8.3. Challenges in Vietnam Agriculture Equipment Market

8.4. Regulatory Landscape in Vietnam Agriculture Machinery Market

8.5. Import Regulations for Agricultural Machinery in Vietnam

8.6. Import Procedures for Agricultural Machinery in Vietnam

8.7. Agricultural Machinery Rental Market

8.8. Recommendations for Agricultural Machinery Rental-Digitization of Services

8.9. Second Hand Agriculture Equipment Market in Vietnam

8.10. Financing Options in Vietnam Agricultural Machinery Market

9. Vietnam Agricultural Equipment Product Analysis

9.1. Pricing Analysis of Agriculture Equipment Market in Vietnam, 2022

9.2. Product Portfolio of Major Players in Vietnam Agriculture Equipment Market, 2022

10. Competition Overview

10.1. Cross Comparison of Major Players Operating in Vietnam Agricultural Equipment Market

10.2. Key Player Insights (Kubota, Yanmar, Veam, Thaco)

10.3. Other Players Operating in Vietnam Agricultural Machinery Market

11. End User Analysis

11.1. Analysis of End User Segmentation

11.2. Analysis of End User Segmentation Basis on Product

11.3. Future Demand Potential of End User and Government

11.4. Factors Influencing Farmer’s Choice

12. Futura Outlook of Vietnam Agricultural Equipment Market, 2022-2027F

12.1. Future Market Size of Vietnam Agriculture Equipment Market, 2022 to 2027F

12.2. Vietnam Agriculture Equipment Future Market Segmentation by Product Type, 2027F

13. Analyst Recommendations

13.1. Strategic Financial Solutions for Vietnam's Agricultural Challenges

13.2. Recommendations on Collateral Less Digital/ Cash Loan for Agriculture Equipment

13.3. Other Analyst Recommendations

14. Industry Speaks

14.1. Interview with Industry Experts

15. Research Methodology

15.1. Market Definitions and Assumptions and Abbreviations

15.2. Market Sizing Approach

15.3. Consolidated Research Approach

15.4. Sample Size Inclusion

15.5. Limitation and Future Conclusion

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables: Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step: 2 Market Building: Collating statistics on the agricultural equipment market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the Vietnam equipment market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing: Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output: Our team will approach multiple agricultural equipment-providing channels and understand the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from agricultural providers.

Frequently Asked Questions

How big is the Vietnam Agri-Equipment Market?

The Vietnam Agri-Equipment Market was valued at ~USD 327.4 Mn in 2022.

What are the Key Factors Driving the Vietnam Agri-Equipment Market?

Rising Food Demand, Government Support and Advances in Mechanization in the Country to fuel the growth in the Vietnam Agricultural Equipment Market.

Who are the Key Players in the Vietnam Agri-Equipment Market?

Kubota Vietnam, Yanmar Agricultural Machinery Vietnam, VEAM: Vietnam Engine and Agriculture, Machinery Corporation, and Thaco Vietnam are some of the key players in the Vietnam Agri-Equipment Market.

What is the Future of the Vietnam Agri-Equipment Market?

The Vietnam Agri-Equipment Market is expected to reach ~USD 428 Mn at a CAGR of 5.5% during the forecasted period of 2022-2027.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.