Vietnam Business Process Outsourcing (BPO) Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5557

December 2024

84

About the Report

Vietnam BPO Market Overview

- The Vietnam Business Process Outsourcing (BPO) market is valued at USD 0.58 billion, based on a five-year historical analysis. This market is primarily driven by the increasing need for cost-effective outsourcing services across industries such as banking, healthcare, and information technology. Vietnams strong IT infrastructure, combined with a large pool of skilled, affordable labor, has positioned the country as a key outsourcing destination for businesses aiming to optimize operational efficiency.

- Ho Chi Minh City and Hanoi lead the Vietnam BPO market due to their advanced infrastructure, access to skilled labor, and strategic geographical locations. Ho Chi Minh City, as the economic hub, attracts global BPO clients seeking large-scale operations, while Hanoi's growth is fueled by government initiatives supporting the IT and outsourcing sectors. These cities benefit from a stable political climate and strong foreign investment policies, making them the go-to locations for outsourcing services.

- The Vietnamese government has implemented several policies to promote the IT and BPO secuding tax incentives, free trade agreements, and infrastructure development projects. In 2023, the government allocated $1.2 billion to improve the countrys digital infrastructure and support the BPO industrys growth. These initiatives, coupled with Vietnam's participation in the Regional Comprehensive Economic Partnership (RCEP), have strengthened the countrys position as a leading outsourcing destination.

Vietnam BPO Market Segmentation

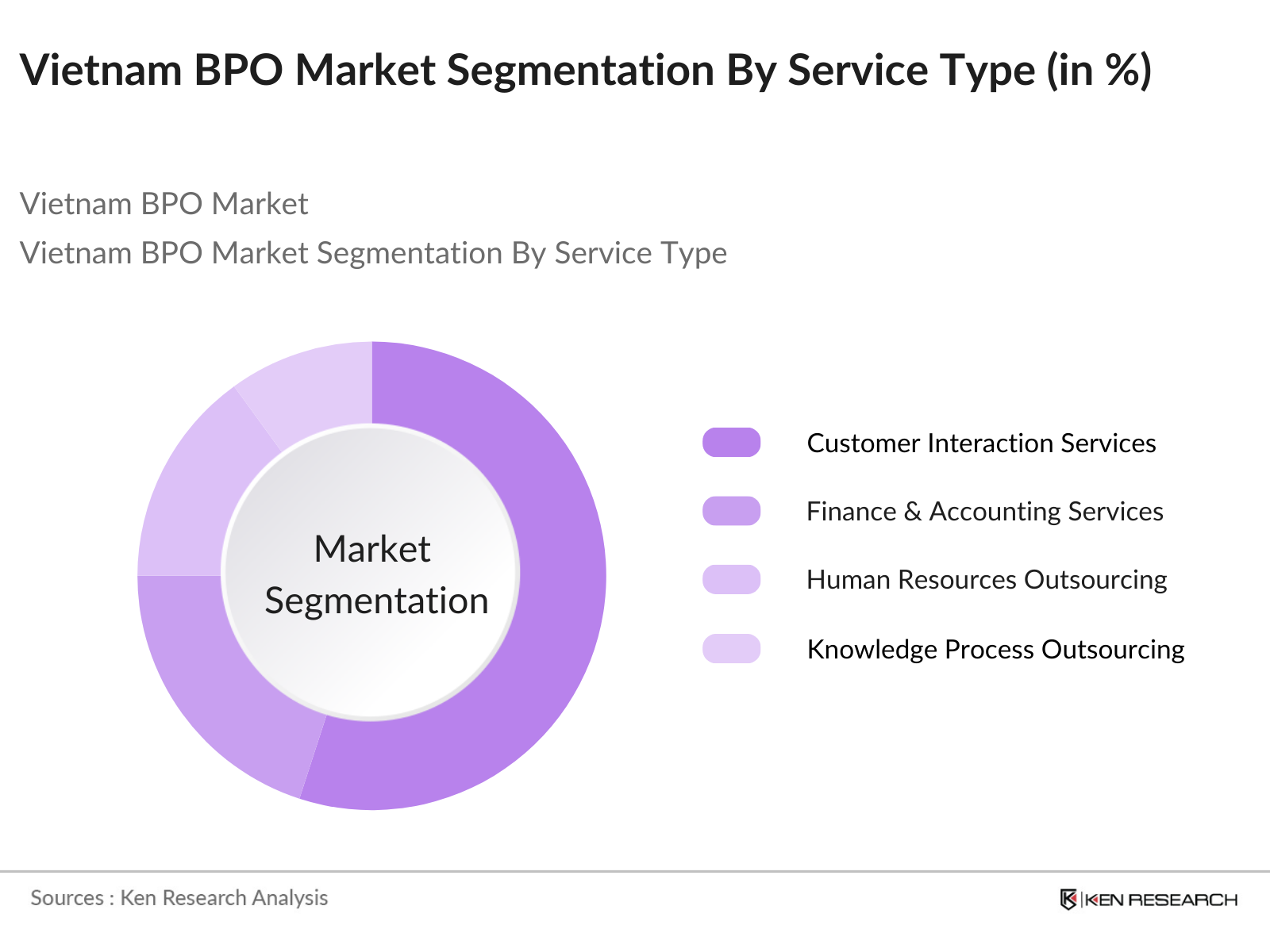

By Service Type: The market is segmented by service type into customer interaction services, finance & accounting services, human resources outsourcing, knowledge process outsourcing (KPO), and IT and software outsourcing. Recently, customer interaction services have maintained a dominant market share due to the increasing demand for customer support centers that handle global clients.

By End-User Industry: The market is also segmented by end-user industries, including Banking, Financial Services & Insurance (BFSI), healthcare, manufacturing, retail & e-commerce, and telecom & IT. The BFSI segment has emerged as the dominant player in the BPO market, primarily due to the increasing need for cost reduction and efficient back-office management in financial institutions.

Vietnam BPO Market Competitive Landscape

The Vietnam BPO market is characterized by a few major players that dominate the landscape. These companies benefit from a combination of local expertise and international client bases, providing a diverse range of BPO services. Local companies like FPT Corporation have managed to thrive through extensive IT solutions, while international firms maintain their presence through high-quality service delivery and innovative technologies.

Vietnam BPO Industry Analysis

Growth Drivers

- Digital Transformation in Business Operations: Vietnams BPO market is benefiting from the ongoing digital transformation of businesses, particularly in sectors like finance, healthcare, and e-commerce. In 2023, Vietnam ranked 64th in the UNs E-Government Development Index, showing continuous improvement in its digital infrastructure. The country has seen significant growth in broadband subscriptions, with nearly 98 million mobile internet users in 2023, which supports the expansion of BPO services.

- Rising Demand for Cost Efficiency: Vietnam offers a cost-efficient alternative to traditional outsourcing destinations, driven by lower wages and operational costs. As of 2023, the average monthly salary for skilled workers in Vietnam is approximately USD 290, significantly lower than in developed nations. This affordability attracts global companies looking to outsource back-office and customer support operations, providing significant cost savings without compromising on quality.

- Skilled Workforce Availability: Vietnam boasts a rapidly growing and highly skilled workforce, with over 1.5 million university graduates in 2023, according to the General Statistics Office of Vietnam. The countrys educational reforms, particularly in IT and engineering fields, have contributed to a pool of skilled workers suitable for BPO services. In 2024, the Vietnamese labor market is expected to grow further, driven by the increasing number of vocational programs aimed at boosting technical skills.

Market Challenges

- Data Security and Compliance Issues: One of the major challenges facing the BPO sector in Vietnam is the issue of data security and regulatory compliance. In 2023, Vietnam reported over 12,000 cyber incidents, including breaches of data privacy laws. This represents a risk for businesses outsourcing critical operations that involve sensitive information. The country's cybersecurity framework is evolving, but gaps remain in data protection and enforcement.

- Lack of Infrastructure in Rural Areas: While urban centers such as Ho Chi Minh City and Hanoi offer world-class facilities, the lack of infrastructure in Vietnams rural areas poses challenges for the BPO sector. In 2023, nearly 60% of the population still lived in rural areas where internet penetration is lower, and power supply is less reliable. This imbalance in infrastructure development hinders the expansion of BPO services beyond urban hubs, limiting the growth of the sector in less-developed regions.

Vietnam BPO Market Future Outlook

Over the next five years, the Vietnam BPO market is expected to experience significant growth, driven by advancements in artificial intelligence, automation technologies, and increasing demand for high-quality outsourcing services. Vietnams evolving digital ecosystem, paired with government support for the IT and outsourcing industries, will further propel the market.

Market Opportunities

- Adoption of AI and Automation in BPO Processes: Vietnams BPO market is increasingly adopting AI and automation to improve service delivery and efficiency. In 2023, the Vietnamese government earmarked over USD 100 million to promote the development of AI technologies across sectors, including BPO. Companies are leveraging these technologies to streamline repetitive tasks such as data entry and customer service, reducing human error and improving turnaround times.

- Growing Demand for Knowledge Process Outsourcing (KPO): As global businesses seek to outsource more complex processes; Vietnam is becoming an attractive destination for Knowledge Process Outsourcing (KPO). In 2023, the country saw an increase in outsourcing requests for sectors such as legal services, research and development, and financial analytics. Vietnam's KPO potential is driven by its skilled workforce, with 37% of the labor force having tertiary education.

Scope of the Report

|

Service Type |

Customer Interaction Services Finance & Accounting Services Human Resources Outsourcing Knowledge Process Outsourcing (KPO) IT and Software Outsourcing |

| End-User |

Banking, Financial Services & Insurance (BFSI) Healthcare Manufacturing Retail & E-commerce Telecom & IT |

|

Delivery Model |

Onshore Outsourcing Offshore Outsourcing Nearshore Outsourcing |

|

Organization Size |

Large Enterprises Small & Medium Enterprises (SMEs) |

|

By Region |

Ho Chi Minh City Hanoi Da Nang Binh Duong Other Provinces |

Products

Key Target Audience

BFSI Sector

Healthcare Providers

IT & Telecom Companies

E-commerce & Retail Firms

Manufacturing Industries

Government and Regulatory Bodies (Ministry of Information and Communications, Vietnam)

Investment and Venture Capitalist Firms

Data Processing and Analytics Companies

Companies

Players Mentioned in the Report

FPT Corporation

TMA Solutions

Harvey Nash Vietnam

Rikkeisoft

DIGI-TEXX Vietnam

Vinh Tuong Outsourcing

KMS Technology

Swiss Post Solutions Vietnam

Global Cybersoft

ArrowHiTech

Table of Contents

1. Vietnam Business Process Outsourcing (BPO) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam BPO Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam BPO Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation in Business Operations

3.1.2. Rising Demand for Cost Efficiency

3.1.3. Skilled Workforce Availability

3.1.4. Outsourcing as a Strategic Tool

3.2. Market Challenges

3.2.1. Data Security and Compliance Issues

3.2.2. Lack of Infrastructure in Rural Areas

3.2.3. Increased Competition from Neighboring Countries

3.3. Opportunities

3.3.1. Adoption of AI and Automation in BPO Processes

3.3.2. Growing Demand for Knowledge Process Outsourcing (KPO)

3.3.3. Expansion in Niche Sectors (Healthcare, Legal, etc.)

3.4. Trends

3.4.1. Transition to Cloud-based BPO Services

3.4.2. Rise of Remote and Hybrid Working Models

3.4.3. Outsourcing of High-Skill Tasks (Analytics, R&D)

3.5. Government Regulations

3.5.1. Vietnam IT/BPO Industry Promotion Policies

3.5.2. Data Protection Laws

3.5.3. Tax Incentives for IT and Outsourcing Sectors

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam BPO Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Customer Interaction Services

4.1.2. Finance & Accounting Services

4.1.3. Human Resources Outsourcing

4.1.4. Knowledge Process Outsourcing (KPO)

4.1.5. IT and Software Outsourcing

4.2. By End-User Industry (In Value %)

4.2.1. Banking, Financial Services & Insurance (BFSI)

4.2.2. Healthcare

4.2.3. Manufacturing

4.2.4. Retail & E-commerce

4.2.5. Telecom & IT

4.3. By Delivery Model (In Value %)

4.3.1. Onshore Outsourcing

4.3.2. Offshore Outsourcing

4.3.3. Nearshore Outsourcing

4.4. By Organization Size (In Value %)

4.4.1. Large Enterprises

4.4.2. Small & Medium Enterprises (SMEs)

4.5. By Region (In Value %)

4.5.1. Ho Chi Minh City

4.5.2. Hanoi

4.5.3. Da Nang

4.5.4. Binh Duong

4.5.5. Other Provinces

5. Vietnam BPO Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. FPT Corporation

5.1.2. Rikkeisoft

5.1.3. Harvey Nash Vietnam

5.1.4. Vinh Tuong Outsourcing

5.1.5. KMS Technology

5.1.6. TMA Solutions

5.1.7. NashTech

5.1.8. DIGI-TEXX Vietnam

5.1.9. Global Cybersoft

5.1.10. Swiss Post Solutions Vietnam

5.1.11. Vietnam Outsourcing

5.1.12. S3Corp

5.1.13. CMC Global

5.1.14. ArrowHiTech

5.1.15. HITC Vietnam

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Service Portfolio, Geographical Reach, Market Share, Certification, Client Industry)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam BPO Market Regulatory Framework

6.1. Compliance and Regulatory Standards

6.2. Data Privacy and Cybersecurity Regulations

6.3. Certification Requirements

6.4. Government Initiatives for the IT/BPO Sector

7. Vietnam BPO Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam BPO Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Delivery Model (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Region (In Value %)

9. Vietnam BPO Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing and Sales Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out key stakeholders in the Vietnam BPO market. A combination of desk research and proprietary databases helps identify critical variables such as market drivers, client preferences, and technological adoption in the BPO sector.

Step 2: Market Analysis and Construction

Historical data related to Vietnams BPO market is collected, including data on key service providers and their revenue streams. This phase involves analyzing client outsourcing preferences across industries such as BFSI, healthcare, and retail.

Step 3: Hypothesis Validation and Expert Consultation

The next step involves conducting interviews with industry professionals and BPO experts. This feedback helps validate the market assumptions and provides a deeper understanding of market drivers and challenges.

Step 4: Research Synthesis and Final Output

Finally, comprehensive research insights are synthesized to produce a well-rounded analysis of the Vietnam BPO market. This includes detailed revenue estimations and future projections based on primary and secondary research inputs.

Frequently Asked Questions

01. How big is the Vietnam BPO Market?

The Vietnam Business Process Outsourcing (BPO) market is valued at USD 0.58 billion, based on a five-year historical analysis. This market is primarily driven by the increasing need for cost-effective outsourcing services across industries such as banking, healthcare, and information technology.

02. What are the challenges in the Vietnam BPO Market?

Challenges include data privacy concerns, intense competition from neighboring outsourcing destinations like India and the Philippines, and a shortage of highly specialized skills required for complex BPO tasks.

03. Who are the major players in the Vietnam BPO Market?

Key players include FPT Corporation, TMA Solutions, Harvey Nash Vietnam, Rikkeisoft, and DIGI-TEXX Vietnam. These companies dominate the market due to their extensive service portfolios and global client base.

04. What are the growth drivers of the Vietnam BPO Market?

Growth drivers include the rising demand for digital transformation services, cost optimization strategies by businesses, and the country's skilled, low-cost labor force, which appeals to global clients.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.