Vietnam Game Market Outlook to 2028

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3132

November 2024

96

About the Report

Vietnam Game Market Overview

- The Vietnam Game Market has witnessed growth in the historical period, reaching a market size of USD 1.30 Bn, driven by the country's young and tech-savvy population, with a strong interest in online gaming and esports. The market is bolstered by increasing access to smartphones, affordable data plans, and the rise of mobile gaming, which has become the dominant form of gaming in Vietnam. Key drivers of the market include rapid urbanization, rising disposable income, and the growing popularity of multiplayer and competitive gaming.

- Major cities such as Ho Chi Minh City and Hanoi serve as key hubs for gaming, with a high concentration of gaming cafes, esports arenas, and gaming communities. Vietnams thriving digital infrastructure and increasing investment in high-speed internet have also contributed to the rapid growth of the gaming industry.

- Vietnam's government has established a comprehensive digital economy policy to foster the gaming industry. In 2024, the Ministry of Information and Communications announced incentives aimed at game developers, including tax cuts and subsidies for start-ups. These measures have encouraged the creation of local gaming companies and supported the overall digital economy.

Vietnam Game Market Segmentation

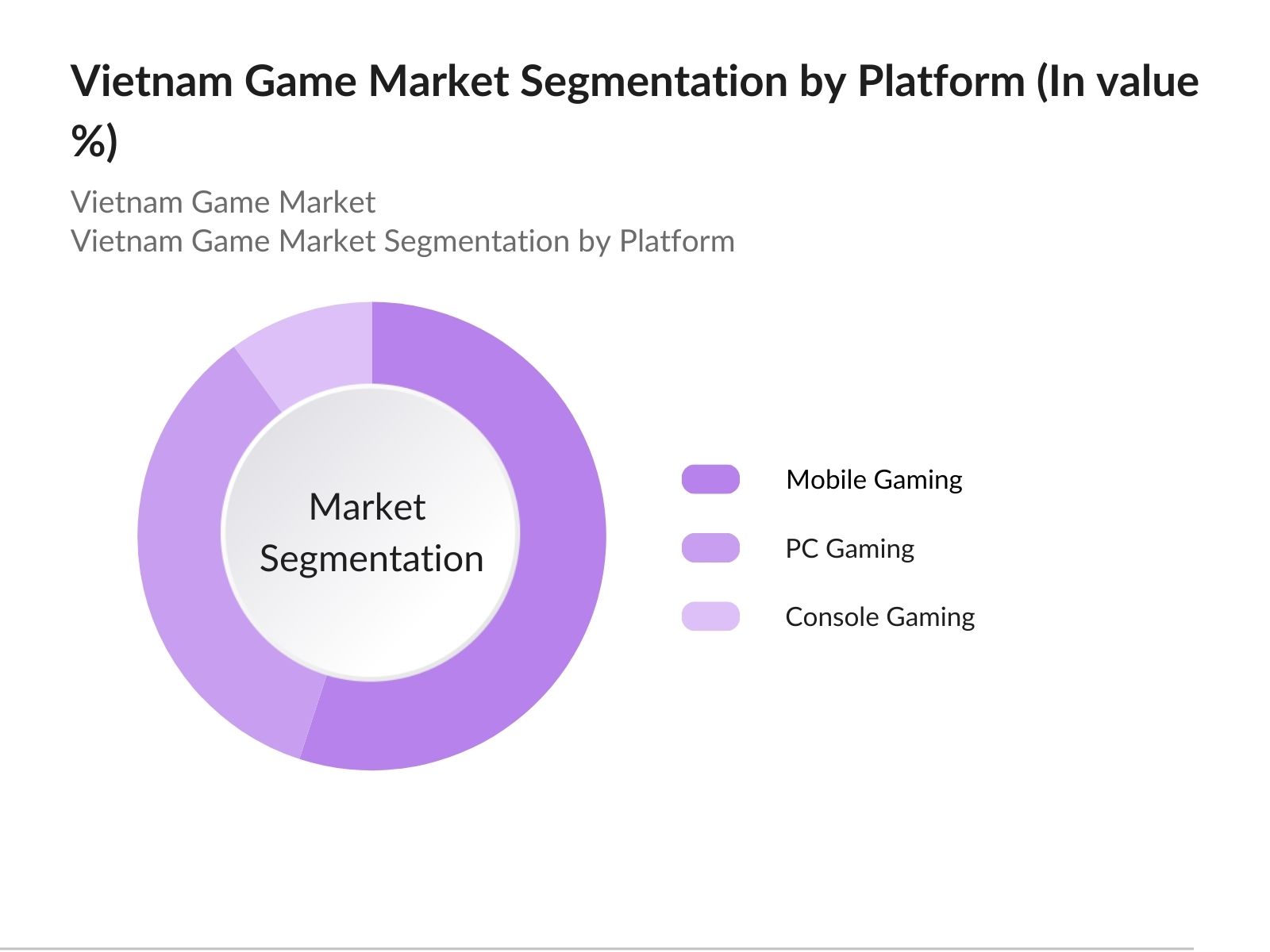

- By Platform Type: The market is segmented into mobile gaming, PC gaming, and console gaming. Mobile gaming holds the largest share, driven by the widespread use of smartphones and affordable mobile internet. PC gaming remains popular, particularly in gaming cafes where multiplayer online games thrive, while console gaming, although smaller in comparison, is gaining traction among dedicated gamers seeking premium experiences.

- By Genre: The market is further segmented into action, role-playing games (RPGs), sports, strategy, and others. Action games dominate the market, largely due to the popularity of multiplayer battle games and first-person shooters. Role-playing games (RPGs) and sports games are also contributors, as players seek immersive and competitive experiences. The strategy genre is growing, reflecting the increasing complexity and variety of games available in the market.

Vietnam Game Market Competitive Landscape

The Vietnam Game Market is highly competitive, with both domestic and international players striving for market share. Local game developers such as VNG Corporation and SohaGame are key players in mobile gaming, particularly with localized content that resonates with Vietnamese gamers. International companies like Tencent and Garena have established a strong presence, especially in the multiplayer online battle arena (MOBA) and battle royale segments. Companies are increasingly investing in esports, as the growing interest in competitive gaming has led to the formation of professional teams and leagues. Strategic initiatives, such as partnerships with global game developers and the expansion of esports events, are helping companies strengthen their foothold in the Vietnamese gaming market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Key Products |

Esports Involvement |

No. of Employees |

Regional Presence |

Market Position |

Partnerships |

|

VNG Corporation |

2004 |

Ho Chi Minh City |

|||||||

|

SohaGame |

2011 |

Hanoi |

|||||||

|

Garena |

2009 |

Singapore |

|||||||

|

Tencent |

1998 |

Shenzhen, China |

|||||||

|

Gameloft |

2000 |

Paris, France |

Vietnam Game Market Analysis

Growth Drivers

- Rising Smartphone Penetration and Internet Access: Vietnam has seen rapid growth in smartphone ownership and internet connectivity, driving the gaming market. In 2024, there are 78.44 million internet users, with broadband subscriptions reaching 21 million, up from 18 million in 2022. This widespread access to the internet has led to a massive increase in mobile game downloads and active gaming sessions. Additionally, smartphone users now account for over 84% of the population, making Vietnam a mobile-first gaming market, propelling growth in mobile game engagement and revenue generation.

- Esports Popularity and Sponsorship Growth: Esports in Vietnam has grown exponentially, driven by increasing sponsorship deals and viewership. By 2024, esports events are expected to attract over 10 million viewers, up from 8.3 million in 2022. Sponsorship revenues from brands and tech companies have reached increased substantially, supporting local gaming leagues and competitive tournaments. Vietnams esports scene is also gaining attention from international investors, fueling the creation of more professional teams and gaming events.

- Government Support for Digital Economy and Gaming Industry: Vietnam's government has heavily invested in its digital economy, allocating millions to develop digital infrastructure between 2022 and 2025. This includes improved broadband access and incentives for tech start-ups, including gaming studios. Game developers receive tax benefits and subsidies, encouraging local talent to enter the industry. These government initiatives aim to increase the contribution of the digital economy, including gaming, to Vietnam's GDP, which reached USD 429 billion in 2023.

Market Challenges

- Regulatory Barriers: The gaming industry in Vietnam faces regulatory challenges, particularly in areas such as content censorship and licensing. Games that are deemed inappropriate by the government can be banned or subject to strict content modifications, making it difficult for international developers to enter the market. Additionally, there are limitations on gaming hours for minors, which can impact user engagement and retention, especially for multiplayer games.

- Lack of Local Game Development Talent: Despite the growth of Vietnams gaming market, the majority of games consumed are developed by international companies. Local game development remains limited, with domestic companies facing challenges in terms of funding, talent acquisition, and intellectual property protection. This has led to a reliance on foreign content, which may not always align with the preferences of Vietnamese gamers. Encouraging local content creation remains a critical challenge for the industry.

Vietnam Game Market Future Outlook

The Vietnam Game Market is expected to continue its upward trajectory, driven by increasing demand for mobile games, esports, and government-backed initiatives to boost local game development. The integration of virtual reality (VR) and augmented reality (AR) into gaming is also anticipated to create new opportunities for growth in the forecasted period. Furthermore, the expansion of high-speed internet infrastructure across rural areas is expected to increase access to online gaming.

Future Market Opportunities

- Growth of Cloud Gaming and Subscription Services: Vietnams expanding digital infrastructure provides an opportunity for cloud gaming and subscription-based gaming models. In 2024, Vietnam has 21 million broadband subscriptions, up from 18 million in 2022, supporting seamless streaming for cloud gaming. Cloud gaming platforms like Google Stadia and Microsoft xCloud have begun penetrating the market, offering subscription services that allow gamers to play high-quality games without hardware limitations. This shift opens new revenue streams for game developers and companies as more consumers switch to cloud gaming.

- Investment in Local Game Development Studios: Government incentives in 2024, including tax breaks and funding grants, have provided local studios with the resources to develop homegrown games. Investments of millions have been allocated to local gaming start-ups, leading to the creation of over 200 games by domestic studios in 2023. The development of local games reduces reliance on international imports and allows Vietnamese cultural elements to be incorporated into gaming, which appeals to both domestic and regional market.

Scope of the Report

|

By Fertilizer Type |

Nitrogen-based Fertilizers Phosphorus-based Fertilizers Potassium-based Fertilizers Compound Fertilizers Organic Fertilizers |

|

By Platform |

Mobile Gaming PC Gaming Console Gaming |

|

By Genre |

Action Role-Playing Games (RPG) Sports Strategy Other Genres |

|

By Business Model |

Freemium (In-Game Purchases, Subscription) Pay-to-Play Ad-Supported Games |

|

By Region |

North East West South |

Products

Key Target Audience

- Game Developers

- Investors and Venture Capitalist Firms

- Gaming Publishers

- Digital Advertising Agencies

- Esports Event Organizers

- Mobile Network Providers

- Government and Regulatory Bodies (Ministry of Information and Communications, General Department of Sports)

- Gaming Hardware Manufacturers

- Banks and Financial Institutions

Companies

Players Mentioned in the Report

- VNG Corporation

- SohaGame

- Garena

- Tencent

- Gameloft

- Riot Games

- Microsoft (Xbox)

- Sony (PlayStation)

- Ubisoft

- Valve Corporation

- Electronic Arts (EA)

- NetEase

- Appota

- Nintendo

- VTC Game

Table of Contents

01 Vietnam Game Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview (Game Platforms, Genre, Business Models, Gamer Demographics, Regional Segmentation)

02 Vietnam Game Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Mobile Gaming, PC Gaming, Console Gaming)

2.3. Key Market Developments and Milestones

03 Vietnam Game Market Analysis

3.1. Growth Drivers

3.1.1. Rising Smartphone Penetration and Internet Access (Percentage of Smartphone Users, Broadband Penetration)

3.1.2. Esports Popularity and Sponsorship Growth (Esports Viewership, Sponsorship Revenue)

3.1.3. Government Support for Digital Economy and Gaming Industry (Investment in Digital Infrastructure, Game Developer Incentives)

3.1.4. Expanding Gaming Audience (Gamer Demographics, Age Distribution)

3.2. Market Challenges

3.2.1. Regulatory Hurdles (Censorship Laws, Gaming Restrictions)

3.2.2. Lack of Local Game Development Talent (Investment in Game Development, Domestic vs. International Game Developers)

3.2.3. Intellectual Property Concerns (Counterfeit Games, IP Protection Issues)

3.3. Opportunities

3.3.1. Growth of Cloud Gaming and Subscription Services (Subscription Models, Cloud Gaming Adoption Rate)

3.3.2. Investment in Local Game Development Studios (Government Support, Funding Opportunities)

3.3.3. Expansion of Esports and Gaming Events (Event Attendance, Sponsorship Deals)

3.4. Trends

3.4.1. Increasing Focus on Mobile Gaming (Mobile Game Revenue Share, Popular Titles)

3.4.2. Adoption of Blockchain and NFTs in Gaming (Blockchain Game Investments, NFT Popularity)

3.4.3. Growing Popularity of Casual and Hyper-casual Games (Casual Game Engagement, Revenue from Hyper-casual Games)

3.5. Government Regulation

3.5.1. Digital Economy Policy and Game Development Frameworks (Government Initiatives, Incentives for Developers)

3.5.2. Game Licensing and Content Censorship (Licensing Process, Content Restrictions)

3.5.3. Regulations on Esports and Professional Gaming (Esports Regulations, Professional Gaming Standards)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Game Developers, Publishers, Esports Organizations, Retailers)

3.8. Porters Five Forces (Competitive Rivalry, Buyer Power, Supplier Power, Threat of Substitutes, New Entrants)

3.9. Competition Ecosystem (Local vs. International Developers, Esports Teams, Event Organizers)

04 Vietnam Game Market Segmentation

4.1. By Platform Type (In Value %)

4.1.1. Mobile Gaming

4.1.2. PC Gaming

4.1.3. Console Gaming

4.2. By Genre (In Value %)

4.2.1. Action

4.2.2. Role-Playing Games (RPG)

4.2.3. Sports

4.2.4. Strategy

4.2.5. Other Genres

4.3. By Business Model (In Value %)

4.3.1. Freemium (In-Game Purchases, Subscription)

4.3.2. Pay-to-Play

4.3.3. Ad-Supported Games

4.4. By Gamer Demographics (In Value %)

4.4.1. Age Group (Teens, Adults, Seniors)

4.4.2. Gender (Male, Female, Non-Binary)

4.4.3. Gamer Type (Casual, Hardcore, Professional)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

05 Vietnam Game Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. VNG Corporation

5.1.2. SohaGame

5.1.3. Garena

5.1.4. Tencent

5.1.5. NetEase

5.1.6. Gameloft

5.1.7. Riot Games

5.1.8. VTC Game

5.1.9. Microsoft (Xbox)

5.1.10. Sony (PlayStation)

5.1.11. Appota

5.1.12. Nintendo

5.1.13. Ubisoft

5.1.14. Valve Corporation (Steam)

5.1.15. Electronic Arts (EA)

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Game Portfolio, Esports Involvement, Local Market Share, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06 Vietnam Game Market Regulatory Framework

6.1. Game Licensing Process

6.2. Compliance with Local Content Regulations

6.3. Intellectual Property Protection in Gaming

6.4. Tax Incentives for Game Development

07 Vietnam Game Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Esports, Mobile Gaming, Local Game Development)

08 Vietnam Game Market Future Segmentation

8.1. By Platform Type (In Value %)

8.2. By Genre (In Value %)

8.3. By Business Model (In Value %)

8.4. By Gamer Demographics (In Value %)

8.5. By Region (In Value %)

09 Vietnam Game Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives (Target Audience, Engagement Strategies)

9.3. White Space Opportunity Analysis (Untapped Genres, Emerging Platforms)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive map of all relevant stakeholders within the Vietnam Game Market. This is supported by desk research, utilizing proprietary databases to gather a complete understanding of market dynamics and influential variables.

Step 2: Market Analysis and Construction

This step includes compiling and analyzing historical data on the Vietnam Game Market. Evaluations of game penetration, user demographics, and overall revenue generation are carried out to ensure reliable estimates of market growth and competition levels.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on gathered data and validated through in-depth interviews with industry experts, including representatives from game development companies, esports organizers, and publishers, ensuring that insights are grounded in industry realities.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the gathered data and expert opinions into actionable insights. This includes a detailed analysis of key segments, competitive landscapes, and potential growth areas in the Vietnam Game Market.

Frequently Asked Questions

01. How big is the Vietnam Game Market?

The Vietnam Game Market is valued at USD 1.30 billion, driven by factors such as rising smartphone penetration, affordable mobile data, and the growing popularity of esports and mobile games.

02. What are the challenges in the Vietnam Game Market?

Key challenges in the Vietnam Game Market include regulatory hurdles such as strict content censorship, intellectual property issues, and a lack of local game development talent. Additionally, international companies dominate the market, making it difficult for local developers to compete.

03. Who are the major players in the Vietnam Game Market?

Major players in the Vietnam Game Market include VNG Corporation, SohaGame, Garena, Tencent, and Gameloft. These companies dominate due to their strong distribution networks, partnerships, and leadership in mobile and multiplayer games.

04. What are the growth drivers of the Vietnam Game Market?

Growth drivers in the Vietnam Game Market include increasing smartphone adoption, rising interest in esports, and government support for the digital economy. The expansion of mobile internet and investment in digital infrastructure also plays a role in market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.