Vietnam Lips Cosmetic Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD6107

December 2024

96

About the Report

Vietnam Lips Cosmetic Market Overview

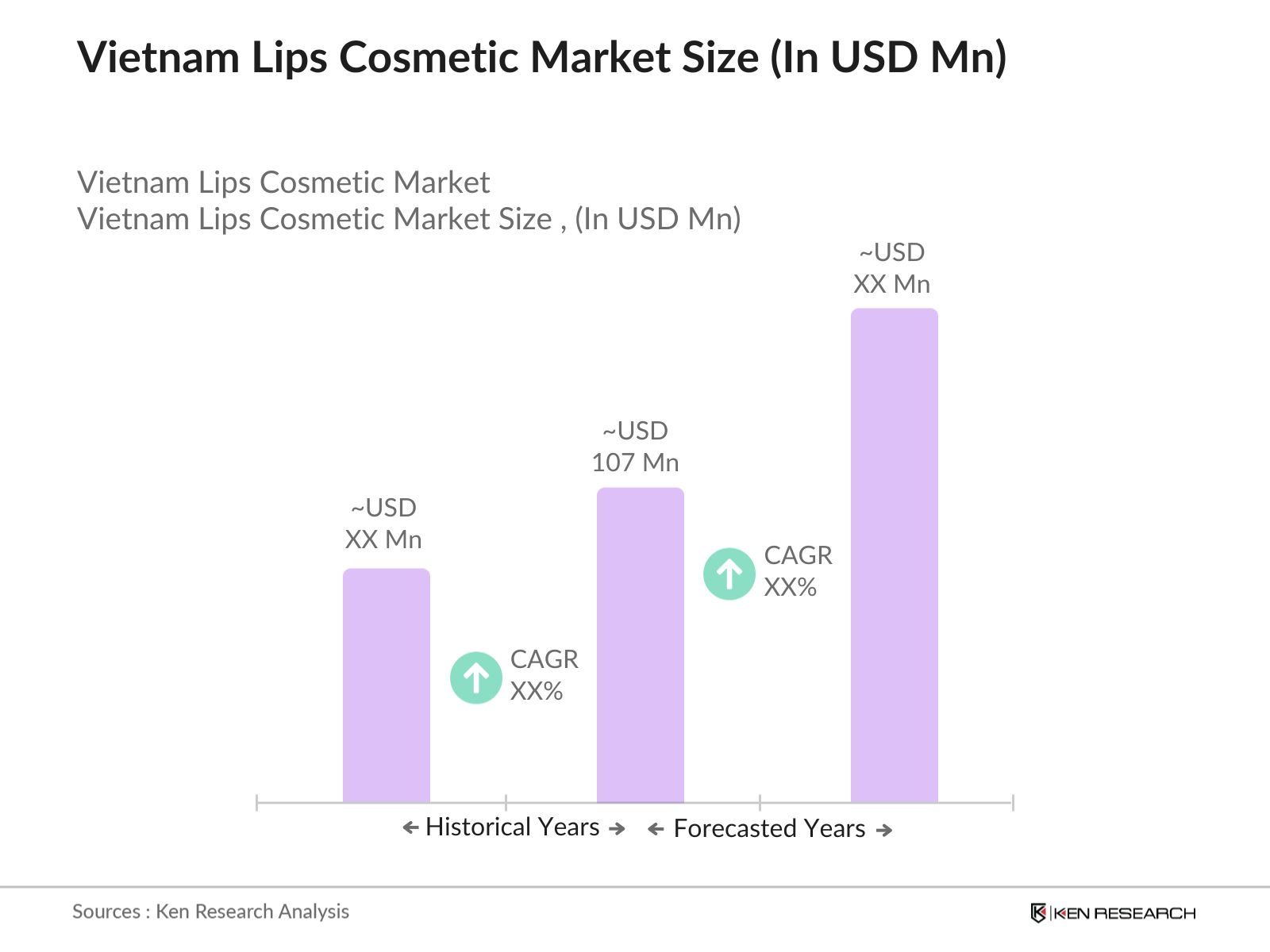

- The Vietnam lips cosmetic market is valued at USD 107 million, driven by growing consumer awareness of personal grooming and the influence of social media platforms. The increasing demand for high-quality, trendy, and innovative lip cosmetic products is the key factor contributing to the market's expansion. The Vietnamese population, especially the younger demographic, has shown a strong preference for global beauty trends, fueling the growth of premium and mid-range lip cosmetic products. In addition, the rise of e-commerce has made these products more accessible to consumers across the country.

- Hanoi and Ho Chi Minh City are the dominant regions in the market due to their large urban populations and higher disposable incomes, fostering demand for luxury and premium cosmetic products. These cities also have a strong presence of international cosmetic brands, further cementing their position as the major contributors to the market. Additionally, the concentration of beauty influencers and the rapid adoption of global beauty trends in these areas drive the demand for lip cosmetics.

- The Vietnam Food Administration (VFA) enforces strict regulations on the safety of cosmetic ingredients, which directly impact the lip cosmetics market. In 2023, the VFA banned over 500 chemicals deemed harmful for use in cosmetics, leading to a wave of product reformulations. Manufacturers must comply with the updated ingredient safety guidelines, which involve rigorous testing and certification processes. Non-compliance can result in significant fines, product recalls, and delays in time-to-market.

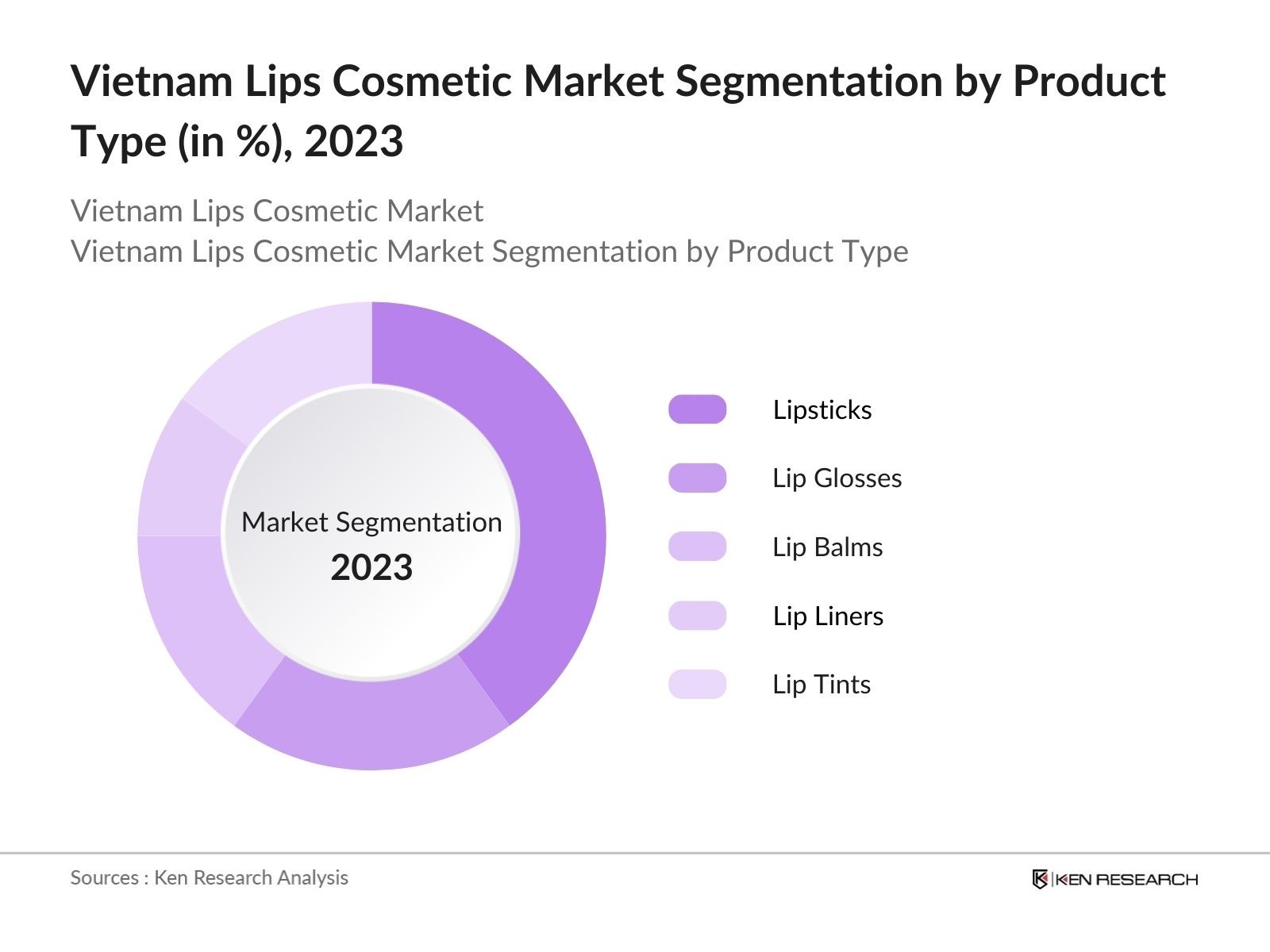

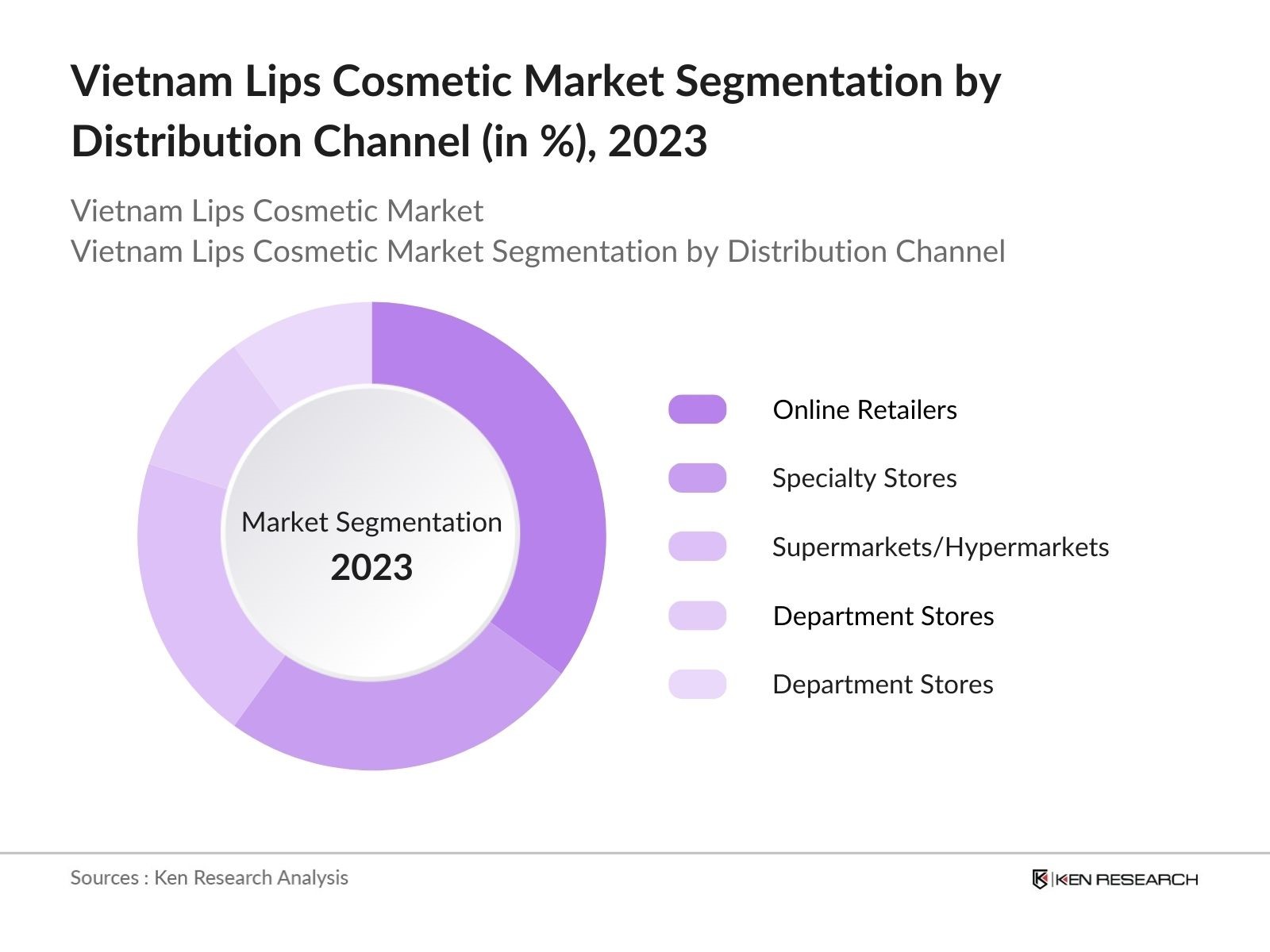

Vietnam Lips Cosmetic Market Segmentation

By Product Type: The market is segmented by product type into lipsticks, lip glosses, lip balms, lip liners, and lip tints. Recently, lipsticks have dominated the product type segment, accounting for 40% of the market share in 2023. This dominance is due to their broad appeal, wide variety of shades, and frequent product launches by leading brands. The popularity of matte and long-lasting lipsticks has continued to attract consumers looking for bold and sophisticated looks. Additionally, lipsticks have been a staple in beauty routines, making them the most purchased lip cosmetic product.

By Distribution Channel: The market is further segmented by distribution channels into online retailers, specialty stores, supermarkets/hypermarkets, department stores, and pharmacies/drug stores. Among these, online retailers have gained a dominant share of 35% in 2023 due to the rising popularity of e-commerce platforms like Lazada and Shopee, which offer a wide variety of brands and products. Additionally, online platforms offer convenience, discounts, and access to international brands that are otherwise unavailable in physical stores, making them a preferred shopping channel for consumers across the country.

Vietnam Lips Cosmetic Market Competitive Landscape

The Vietnam lips cosmetic market is dominated by both global giants and local players who have established strong brand presence and distribution networks. The competitive landscape is characterized by frequent product launches, extensive advertising campaigns, and strategic partnerships with influencers. The market is highly competitive with brands focusing on product innovation, such as vegan formulations, long-lasting effects, and sustainable packaging to attract the environmentally conscious consumer base. The market is characterized by product innovation and sustainability efforts, with leading brands like MAC Cosmetics and L'Oral focusing on environmentally friendly packaging and inclusive beauty ranges.

|

Company Name |

Established Year |

Headquarters |

Product Range |

R&D Investment |

Sustainability Initiatives |

Revenue (USD Mn) |

Market Share |

Global Presence |

|

L'Oral Vietnam |

1995 |

Paris, France |

||||||

|

Shiseido Vietnam |

1872 |

Tokyo, Japan |

||||||

|

Unilever Vietnam |

1930 |

London, UK |

||||||

|

Maybelline |

1915 |

New York, USA |

||||||

|

MAC Cosmetics |

1984 |

Toronto, Canada |

Vietnam Lips Cosmetic Industry Analysis

Growth Drivers

- Rising Demand for Personal Grooming: The demand for personal grooming products in Vietnam, including lip cosmetics, has surged due to increasing awareness of self-care and beauty enhancement. According to the World Bank, Vietnam's per capita income has grown to USD 4,165 in 2023, compared to USD 3,699 in 2021, signaling greater disposable income, which allows consumers to spend more on non-essential goods like cosmetics. Additionally, urbanization rates increased to over 38% by mid-2024, fostering more exposure to global beauty standards, further boosting the personal grooming segment.

- Increasing Disposable Income: Vietnams economy has experienced steady growth, with GDP per capita rising significantly. By 2024, the average household monthly income reached VND 8.2 million, up from VND 7.2 million in 2022. This rise in disposable income, driven by a growing middle class, has resulted in increased spending on beauty and personal care products, including lip cosmetics. The growth of retail sales in Vietnams urban centers has also contributed, with an 11% increase in 2023 alone, signifying the higher affordability of premium beauty products.

- Influence of social media and Beauty Trends: Vietnamese consumers, particularly millennials and Gen Z, are highly influenced by global beauty trends on social media platforms. Instagram and TikTok have seen a rise in beauty-related content, with over 70% of young consumers using these platforms to discover new beauty products. The rise of local influencers endorsing lip cosmetics has driven demand significantly. In 2023, over 75 million people in Vietnam were active social media users, contributing to the popularity of lip cosmetics influenced by viral beauty trends.

Market Challenges

- Fluctuations in Raw Material Prices: The lip cosmetics industry in Vietnam is heavily dependent on imported raw materials, which exposes it to fluctuations in global supply chains and price volatility. In 2023, Vietnam saw a 9% rise in raw material costs for cosmetic production, as global crude oil prices fluctuated around USD 8090 per barrel, affecting the price of petrochemical-based ingredients. Additionally, disruptions in the supply chain from China, Vietnams primary raw material supplier, further exacerbated price increases, making it challenging for local producers to maintain cost-effective production.

- Intense Competition: The Vietnamese lip cosmetics market is highly competitive, with both international brands such as MAC, Maybelline, and L'Oral and local brands vying for market share. In 2024, over 300 cosmetic brands were operating in the country, with an increasing number of local players entering the market. The intense competition has led to price wars, with brands constantly undercutting each other to attract price-sensitive consumers. The availability of counterfeit products has further challenged legitimate brands, resulting in potential losses of VND 3.4 trillion in revenue in 2023.

Vietnam Lips Cosmetic Market Future Outlook

Over the next five years, the Vietnam lips cosmetic market is expected to witness substantial growth driven by increasing consumer interest in premium beauty products, the rising influence of beauty influencers, and the growing popularity of organic and vegan cosmetics. Urbanization and increasing disposable incomes are also expected to contribute to the markets growth. Moreover, continuous innovations in product formulations, such as long-lasting and smudge-proof lipsticks, are likely to attract a larger consumer base.

Future Market Opportunities

- Growing Male Grooming Market: The male grooming segment in Vietnam has grown rapidly in recent years, offering significant opportunities for the lip cosmetics market. In 2023, the number of men using grooming products, including lip balms and moisturizers, grew. This shift is driven by increasing awareness of self-care among Vietnamese men, who are adopting beauty routines influenced by Korean beauty trends. The male grooming market was valued at VND 12 trillion in 2023, creating a substantial opportunity for brands to tap into this emerging consumer base.

- Rise in Vegan and Cruelty-Free Cosmetics: There is a growing consumer preference for vegan and cruelty-free lip cosmetics in Vietnam, especially among younger, environmentally conscious consumers. In 2023, 26% of Vietnamese consumers reported a preference for ethically produced cosmetics. This trend aligns with global shifts towards more sustainable beauty products, creating opportunities for brands to innovate in the vegan and cruelty-free space. Additionally, international regulations on animal testing have prompted local brands to adopt cruelty-free practices to compete in export markets.

Scope of the Report

|

Product Type |

Lipstick |

|

Formulation |

Gel |

|

Texture |

Matte |

|

Material |

Chemical |

|

Distribution Channel |

Online |

Products

Key Target Audience

Cosmetic Manufacturers

E-commerce Retailers

Beauty Retail Chains

Distributors and Wholesalers

Venture Capital and Private Equity Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Vietnam Food Administration, Ministry of Health)

Influencers and Beauty Experts

Pharmacies and Drug Store Chains

Companies

Major Players

L'Oral Vietnam

Shiseido Vietnam

Unilever Vietnam

MAC Cosmetics

Maybelline

NYX Professional Makeup

Revlon

Este Lauder

The Face Shop

Laneige

Innisfree Vietnam

ColourPop

Lush Vietnam

AmorePacific Corporation

Procter & Gamble Vietnam

Table of Contents

Vietnam Lip Cosmetics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Vietnam Lip Cosmetics Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Vietnam Lip Cosmetics Market Analysis

3.1. Growth Drivers

3.1.1. Influence of Social Media and Beauty Influencers

3.1.2. Rising Disposable Income

3.1.3. Urbanization and Changing Lifestyles

3.1.4. Increasing Awareness of Personal Grooming

3.2. Market Challenges

3.2.1. Intense Market Competition

3.2.2. Regulatory Compliance

3.2.3. Economic Fluctuations

3.3. Opportunities

3.3.1. Product Innovation and Diversification

3.3.2. Expansion into Rural Markets

3.3.3. E-commerce Growth

3.4. Trends

3.4.1. Preference for Natural and Organic Products

3.4.2. Demand for Long-Lasting and Mask-Friendly Lip Products

3.4.3. Customization and Personalization in Lip Cosmetics

3.5. Government Regulations

3.5.1. Cosmetic Product Registration Requirements

3.5.2. Import and Export Regulations

3.5.3. Safety and Quality Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

Vietnam Lip Cosmetics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Lipstick

4.1.2. Lip Balm

4.1.3. Lip Gloss

4.1.4. Lip Liner

4.1.5. Others

4.2. By Formulation (In Value %)

4.2.1. Gel

4.2.2. Liquid

4.2.3. Pencil

4.2.4. Others

4.3. By Texture (In Value %)

4.3.1. Matte

4.3.2. Shimmer

4.3.3. Wet

4.3.4. Others

4.4. By Material (In Value %)

4.4.1. Chemical

4.4.2. Natural

4.4.3. Organic

4.4.4. Halal

4.5. By Distribution Channel (In Value %)

4.5.1. Online

4.5.2. Offline

Vietnam Lip Cosmetics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. L'Oréal

5.1.2. Maybelline

5.1.3. Revlon

5.1.4. MAC Cosmetics

5.1.5. Estée Lauder

5.1.6. Shiseido

5.1.7. Chanel

5.1.8. Dior

5.1.9. Lancôme

5.1.10. NARS Cosmetics

5.1.11. Innisfree

5.1.12. 3CE (3 Concept Eyes)

5.1.13. The Face Shop

5.1.14. Sivanna Colors

5.1.15. Miss Hana

5.2. Cross Comparison Parameters (Product Portfolio, Pricing Strategy, Market Presence, Marketing Initiatives, Innovation Capability, Distribution Network, Customer Loyalty, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

Vietnam Lip Cosmetics Market Regulatory Framework

6.1. Cosmetic Product Registration Procedures

6.2. Compliance with ASEAN Cosmetic Directive

6.3. Labeling and Advertising Regulations

6.4. Import Tariffs and Duties

Vietnam Lip Cosmetics Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Vietnam Lip Cosmetics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Formulation (In Value %)

8.3. By Texture (In Value %)

8.4. By Material (In Value %)

8.5. By Distribution Channel (In Value %)

Vietnam Lip Cosmetics Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing a detailed ecosystem map of all key stakeholders within the Vietnam Lips Cosmetic Market. Desk research and analysis from proprietary databases were used to gather comprehensive market insights. This step helped in identifying critical variables like consumer preferences, brand penetration, and distribution channel dynamics.

Step 2: Market Analysis and Construction

The second phase focused on compiling and analyzing historical data of the Vietnam Lips Cosmetic Market. This included assessing key market drivers, segmentation, and the resultant revenue generation. The reliability and accuracy of the data were cross-checked using multiple industry sources.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market assumptions were validated through structured interviews with industry experts. These consultations provided deep operational insights into the market trends and competitive landscape, further refining the research findings.

Step 4: Research Synthesis and Final Output

The final phase synthesized insights from product manufacturers, distributors, and retailers to ensure comprehensive and accurate market analysis. The synthesis of top-down and bottom-up data collection methods validated all the findings.

Frequently Asked Questions

01. How big is the Vietnam Lips Cosmetic Market?

The Vietnam lips cosmetic market is valued at USD 107 million, driven by increasing demand for premium beauty products and the influence of social media on consumer behavior.

02. What are the challenges in the Vietnam Lips Cosmetic Market?

Challenges in the Vietnam lips cosmetic market include high competition among global and local brands, fluctuating raw material prices, and stringent regulations related to product ingredients.

03. Who are the major players in the Vietnam Lips Cosmetic Market?

Major players in the Vietnam lips cosmetic market include L'Oral Vietnam, Shiseido Vietnam, Unilever, MAC Cosmetics, and Maybelline. These companies dominate due to their strong distribution networks, product innovation, and brand loyalty.

04. What are the growth drivers of the Vietnam Lips Cosmetic Market?

The Vietnam lips cosmetic market is driven by factors like increasing disposable incomes, the rising popularity of beauty influencers, and consumer demand for sustainable and cruelty-free products.

05. What trends are shaping the Vietnam Lips Cosmetic Market?

Key trends in the Vietnam lips cosmetic market include the rise of clean beauty products, the influence of social media marketing, and growing consumer interest in organic and vegan formulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.