Vietnam Military Truck Market Outlook to 2028

Region:Asia

Author(s):Abhinav Kumar

Product Code:KROD711

January 2025

99

About the Report

Vietnam Military Truck Market Overview

- The Vietnam Military Truck, driven by the country's defense modernization efforts and increasing defense budget. This growth is powered by the need for efficient military logistics and the acquisition of advanced vehicles to enhance operational capabilities across various terrains.

- The market is characterized by key players such as Vinamotor, Thaco, and TMT Motors, which have established a strong presence through local manufacturing and strategic partnerships with international defense contractors. These companies are noted for their technological innovations and extensive product portfolios.

- In 2022, Thaco established THACO INDUSTRIES to enhance its mechanical engineering and manufacturing capabilities. This initiative includes a $20 million R&D center, employing 1,000 experts to develop high-technology products for both domestic and international markets, aligning with global industrial trends​

- The city of Hanoi dominates the military truck market in Vietnam due to its strategic importance as the capital city and a central hub for military operations. Hanoi houses major military facilities, defense procurement bodies, and key decision-making institutions, making it a focal point for defense-related activities.

Vietnam Military Truck Market Segmentation

The Vietnam Military Truck Market can be segmented based on vehicle type, application, and region.

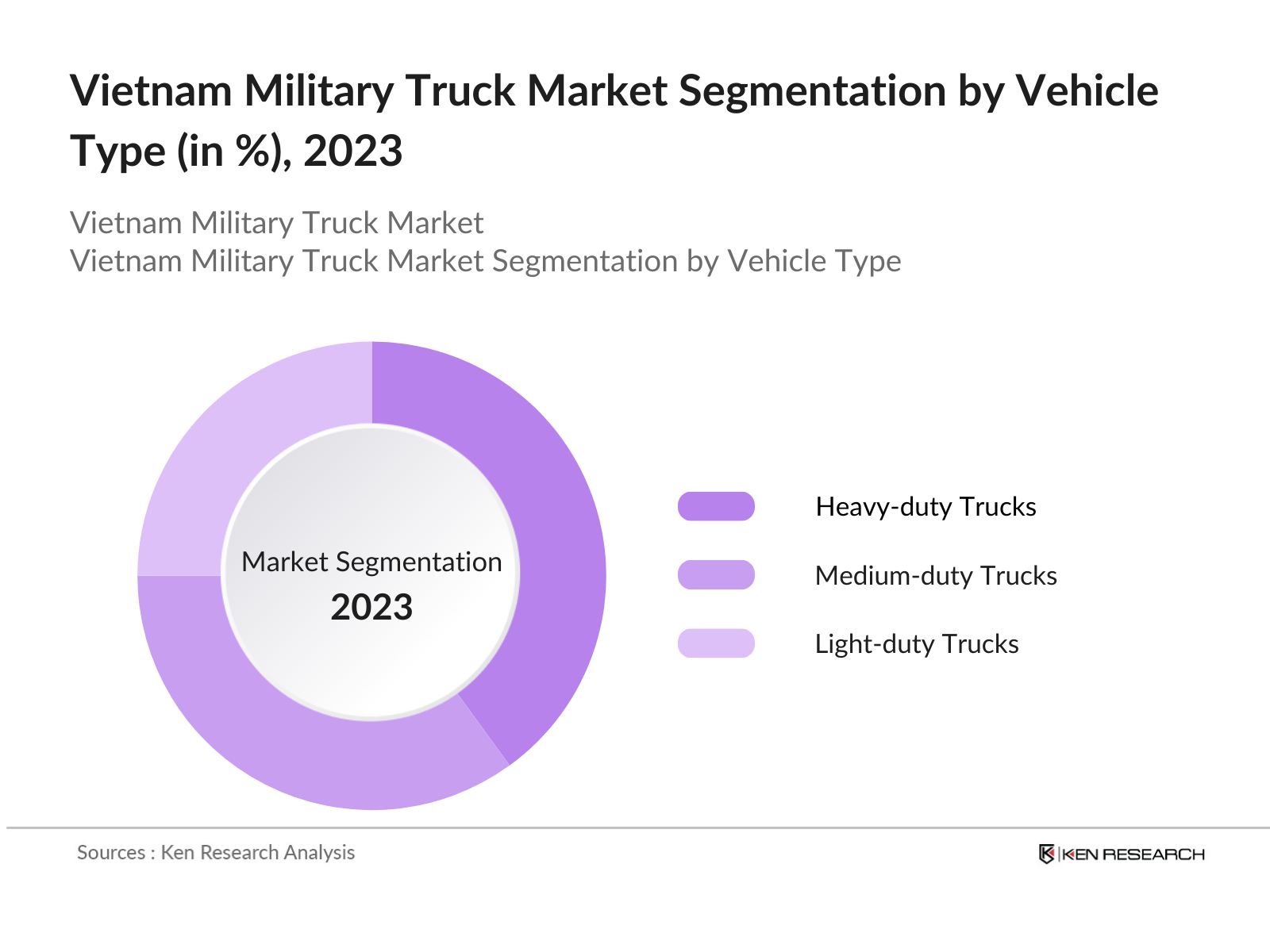

By Vehicle Type: The Vietnam military truck market is segmented by vehicle type into light-duty, medium-duty, and heavy-duty trucks. In 2023, Heavy-duty trucks dominate the market due to their critical role in transporting heavy equipment and supplies, essential for military operations in challenging terrains. Companies like Vinamotor and Thaco have focused on producing heavy-duty vehicles, which are highly valued for their durability and capacity.

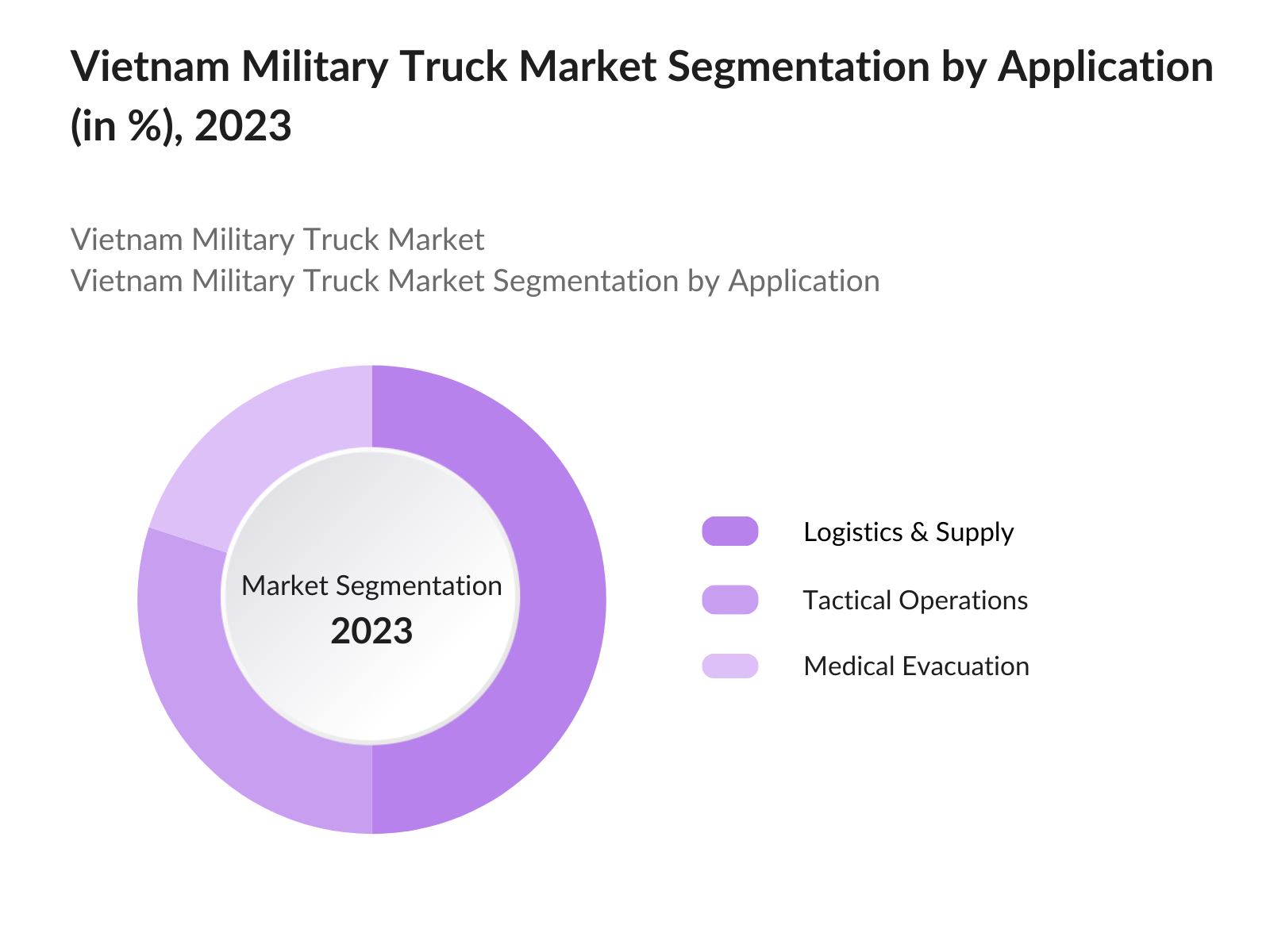

By Application: The market is segmented by application into logistics & supply, tactical operations, and medical evacuation. In 2023, the logistics & supply segment holds the largest market share, driven by the essential need for efficient and reliable transportation solutions within the military. This segment's dominance is underscored by the strategic importance of maintaining logistics networks, especially in remote and difficult-to-access areas.

By Region: The market is regionally segmented into North, South, East, and West Vietnam. The Northern region, encompassing Hanoi, has the largest market share due to its concentration of military installations and key defense organizations. The strategic location and infrastructure development in the North facilitate better logistics and supply chain management, making it a critical hub for military operations.

Vietnam Military Truck Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Vinamotor |

1965 |

Hanoi, Vietnam |

|

Thaco |

1997 |

Ho Chi Minh City |

|

TMT Motors |

2007 |

Hanoi, Vietnam |

|

Z751 |

1982 |

Ho Chi Minh City |

|

Auto Motor Co |

2003 |

Hanoi, Vietnam |

- Vinamotor, a significant player in Vietnam's military truck market, has increased its production capacity by 30% in 2023. This expansion, taking place at its facilities in Hanoi, is aimed at meeting the rising demand for military vehicles, thereby enhancing the company's market share. The company has successfully integrated advanced manufacturing technologies, allowing it to produce over 1,500 military trucks annually

- In 2023, TMT Motors has entered into a strategic cooperation agreement with SAIC-GM-Wuling (SGMW), a joint venture between General Motors and Chinese partners, to manufacture and distribute electric vehicles (EVs) in Vietnam. The first model to be launched will be the Wuling HongGuang MiniEV, which has been the world's best-selling mini electric car for three consecutive years (2020-2022).

Vietnam Military Truck Market Industry Analysis

Vietnam Military Truck Market Growth Drivers:

- Increased Defense Spending: Vietnam's government has prioritized defense spending, with the budget reaching 7.8 billion USD in 2024. This financial commitment reflects the country's focus on modernizing its military capabilities to address regional security threats. The emphasis on enhancing logistical support and troop mobility has led to a surge in demand for military trucks, which are essential for transportation and supply chain operations.

- Geopolitical Tensions in the Region: The ongoing territorial disputes in the South China Sea are driving growth in the Vietnam military truck market. In response to heightened security concerns, the Vietnamese government is prioritizing the acquisition of advanced military vehicles, including trucks, to enhance operational readiness. In the first half of 2024 alone, Vietnam developed 280 hectares of land across ten features it controls in the South China Sea, further fueling demand for military trucks to support its strategic and logistical needs.

- Development of Domestic Manufacturing Capabilities: The Vietnamese government is actively promoting the development of its domestic defense industry, which includes the production of military trucks. By 2024, initiatives aimed at increasing local manufacturing capabilities are expected to reduce reliance on foreign imports by around 30%.

Vietnam Military Truck Market Challenges:

- Supply Chain Disruptions: The military truck market in Vietnam faces significant challenges due to recent global supply chain disruptions. Factors such as geopolitical tensions in the South China Sea, trade restrictions, and logistical bottlenecks specific to Southeast Asia have hindered production schedules and increased costs. These disruptions impact the timely delivery of military trucks to the Vietnamese armed forces, posing a challenge in meeting operational requirements and maintaining fleet readiness.

- Budgetary Constraints Amid Economic Pressures: Despite increased defense spending, the Vietnamese government must balance military expenditures with other pressing economic needs, such as infrastructure development and social programs. In 2024, budgetary constraints may limit the extent of military truck acquisitions, with an estimated $2.2 billion USD required for infrastructure development alone. This financial strain necessitates careful allocation of funds, potentially restricting the budget available for military truck procurement.

Vietnam Military Truck Market Government Initiative:

- Defense Industry Development Strategy 2025: The Defense Industry Development Strategy 2025 aims to enhance Vietnam's domestic production capabilities for military vehicles, including trucks. This strategy focuses on promoting local manufacturing and aims to reduce reliance on imports by 25% by 2025. The emphasis on developing dual-purpose industries to serve national defense and security is consistent with the country's broader industrial goals.

- National Defense and Security Strategy 2021-2030: The National Defense and Security Strategy 2021-2030 outlines Vietnam's commitment to modernizing its armed forces and improving logistical support systems. By 2024, this strategy is expected to lead to an increase in military truck procurement, with projected acquisitions valued at around 1 billion USD. The overall defense budget for Vietnam is $6.65 billion in 2023, with a focus on modernizing military capabilities in response to regional security challenges, including disputes in the South China Sea.

Vietnam Military Truck Market Outlook

The Vietnam military truck market is projected to experience substantial growth by 2028, driven by ongoing technological advancements and the expansion of online retail channels, which are expected to enhance accessibility and efficiency in procurement processes for military logistics and operations.

Future Trends

-

- Increased Adoption of Electric Military Trucks: Vietnam is expected to witness a significant shift towards the development and procurement of electric military trucks. By 2028, the government is projected to invest approximately 200 million USD in electric vehicle technology, aiming to reduce fuel dependency and enhance operational efficiency. This trend is anticipated to influence the design and manufacturing processes of military vehicles.

- Expansion of Domestic Manufacturing Capabilities: Vietnam is anticipated to see a marked expansion in its domestic manufacturing capabilities for military trucks. By 2028, local manufacturers are expected to produce over 60% of the military trucks used by the armed forces, significantly reducing reliance on imports and fostering a robust local industry.

Scope of the Report

Â

|

By Vehicle Type |

Heavy-duty Trucks Medium-duty Trucks Light-duty Trucks |

|

By Application |

Logistics & Supply Tactical Operations Medical Evacuation |

|

By Region |

North South East West |

Â

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

- Defense Procurement Agencies

- Military Logistics Departments

- Vehicle Manufacturing Companies

- Military Transport Companies

- Government & Regulatory Bodies (e.g., Ministry of Defense)

- Defense Equipment Suppliers

- Defense Contractors

- Investments and Venture Capitalist Firms

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report: Â

- Vinamotor

- Thaco

- TMT Motors

- Z751

- Auto Motor Co

- SAMCO

- Tuan Anh Co., Ltd.

- Xuan Kien Auto

- VEAM Corporation

- Truong Hai Auto Corporation

- Dong Tam Auto

- Quyet Tien Co., Ltd.

- Phu Lam Co., Ltd.

- Tien Phong Auto

- Truong Thanh Group

Table of Contents

1. Vietnam Military Truck Market OverviewÂ

1.1 Vietnam Military Truck Market TaxonomyÂ

2. Vietnam Military Truck Market Size (in USD Mn), 2018-2023Â

3. Vietnam Military Truck Market AnalysisÂ

3.1 Vietnam Military Truck Market Growth DriversÂ

3.2 Vietnam Military Truck Market Challenges and IssuesÂ

3.3 Vietnam Military Truck Market Trends and DevelopmentÂ

3.4 Vietnam Military Truck Market Government RegulationÂ

3.5 Vietnam Military Truck Market SWOT AnalysisÂ

3.6 Vietnam Military Truck Market Stake EcosystemÂ

3.7 Vietnam Military Truck Market Competition EcosystemÂ

4. Vietnam Military Truck Market Segmentation, 2023Â

4.1 Vietnam Military Truck Market Segmentation by Vehicle Type (in value %), 2023Â

4.2 Vietnam Military Truck Market Segmentation by Application (in value %), 2023Â

4.3 Vietnam Military Truck Market Segmentation by Region (in value %), 2023Â

5. Vietnam Military Truck Market Competition BenchmarkingÂ

5.1 Vietnam Military Truck Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)Â

6. Vietnam Military Truck Future Market Size (in USD Mn), 2023-2028Â

7. Vietnam Military Truck Future Market Segmentation, 2028Â

7.1 Vietnam Military Truck Market Segmentation by Vehicle Type (in value %), 2028Â

7.2 Vietnam Military Truck Market Segmentation by Application (in value %), 2028Â

7.3 Vietnam Military Truck Market Segmentation by Region (in value %), 2028Â

8. Vietnam Military Truck Market Analysts’ RecommendationsÂ

8.1 Vietnam Military Truck Market TAM/SAM/SOM AnalysisÂ

8.2 Vietnam Military Truck Market Customer Cohort AnalysisÂ

8.3 Vietnam Military Truck Market Marketing InitiativesÂ

8.4 Vietnam Military Truck Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key VariablesÂ

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market BuildingÂ

Collating statistics on the Vietnam military truck market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the Vietnam military truck market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3: Validating and FinalizingÂ

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research OutputÂ

Our team will approach multiple military truck market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from military truck market companies.

Frequently Asked Questions

01 How big is the Vietnam military truck market?

The Vietnam Military TruckMarket has experienced notable growth, this is reflected by the GlobalMilitary TruckMarket reaching a valuation ofUSD 22.9 billion in 2023, driven by the country's defense modernization efforts and increasing defense budget. This growth is fueled by the need for efficient military logistics and the acquisition of advanced vehicles to enhance operational capabilities across various terrains.

02 What are the challenges in the Vietnam military truck market?

Challenges in the Vietnam military truck market include stringent regulatory requirements for defense procurement, high costs associated with advanced technology integration, and competition from foreign manufacturers. Additionally, supply chain disruptions and geopolitical tensions can impact market stability.

03 Who are the major players in the Vietnam military truck market?

Major players in the Vietnam military truck market include Vinamotor, Thaco, TMT Motors, Z751, and Auto Motor Co. These companies have established a strong presence through local manufacturing, partnerships with international defense firms, and a focus on meeting military specifications.

04 What are the growth drivers of the Vietnam military truck market?

The growth of the Vietnam military truck market is driven by the government's commitment to defense modernization, increased defense spending, and the need for enhanced military logistics. The Vietnam Defense Modernization Initiative 2023-2028 further boosts market demand for advanced military vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.