Vietnam Personal Hygiene Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD4845

October 2024

87

About the Report

Vietnam Personal Hygiene Market Overview

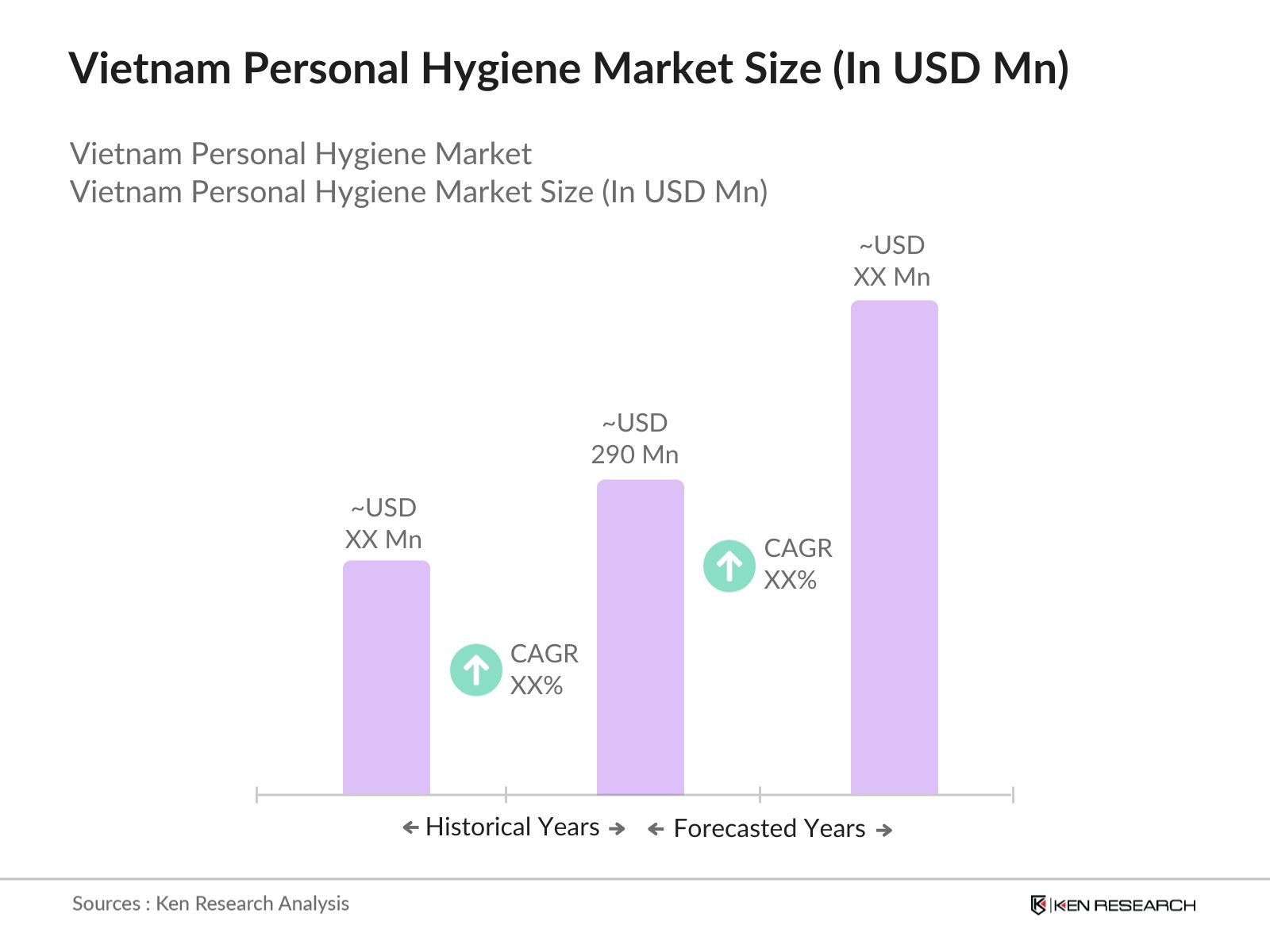

- The Vietnam Personal Hygiene Market is valued at USD 290 million, based on a comprehensive five-year historical analysis. The market's growth is driven by heightened hygiene awareness, rising disposable income, and the influence of government-led health campaigns promoting cleanliness. The COVID-19 pandemic has also accelerated demand for essential hygiene products like hand sanitizers, soaps, and oral care items. Urban areas, particularly Ho Chi Minh City and Hanoi, play a crucial role in this market, where consumer awareness and disposable incomes are higher, further fueling demand for premium and essential hygiene products.

- Ho Chi Minh City, Hanoi, and Da Nang dominate the personal hygiene market due to their high population density, advanced retail infrastructure, and greater access to personal care products. These cities benefit from a more developed distribution network and higher standards of living, leading to a preference for branded and premium hygiene products. Additionally, these urban centers have a more extensive health infrastructure, which enhances consumer awareness of hygiene-related products, compared to rural areas.

- The Vietnamese government has implemented several national health policies that affect the personal hygiene market. One of the most impactful is the National Strategy for Environmental Health 20212030, which aims to improve hygiene and sanitation practices across the country. This strategy has allocated $500 million in funding by 2024 to develop hygiene infrastructure and distribute hygiene products in underserved regions, which has accelerated the growth of the market

Vietnam Personal Hygiene Market Segmentation

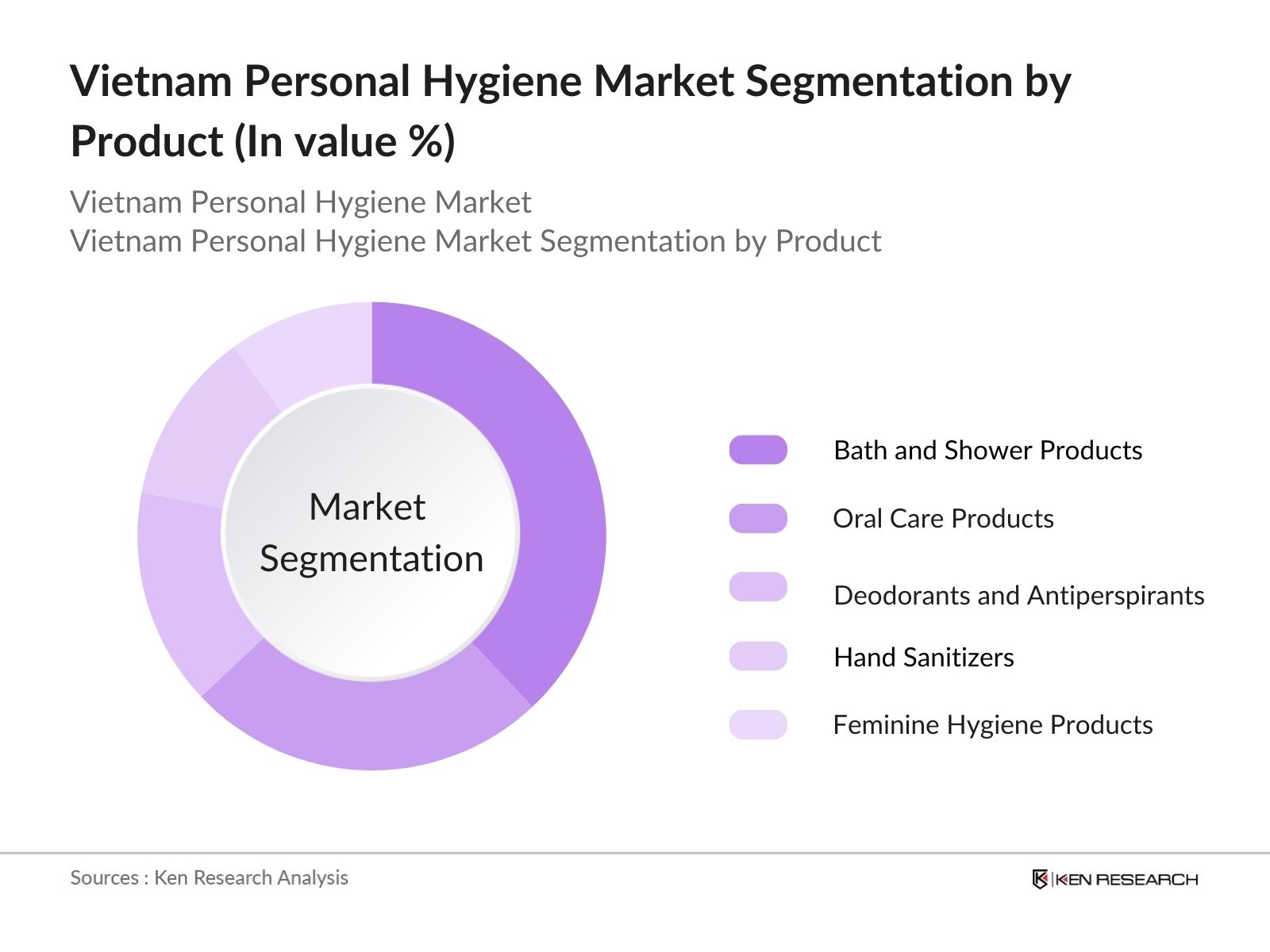

- By Product Type: The Market is segmented by product type into bath and shower products, oral care, deodorants and antiperspirants, hand sanitizers, and feminine hygiene products. Bath and shower products hold a dominant market share in Vietnam, as these products are essential to daily hygiene routines. The rising demand for liquid soaps and body washes, driven by increased consumer awareness about skin health, has contributed to the growth of this segment. Additionally, the presence of key players like Unilever and P&G, offering a wide range of bath products, ensures strong market penetration across both urban and rural regions.

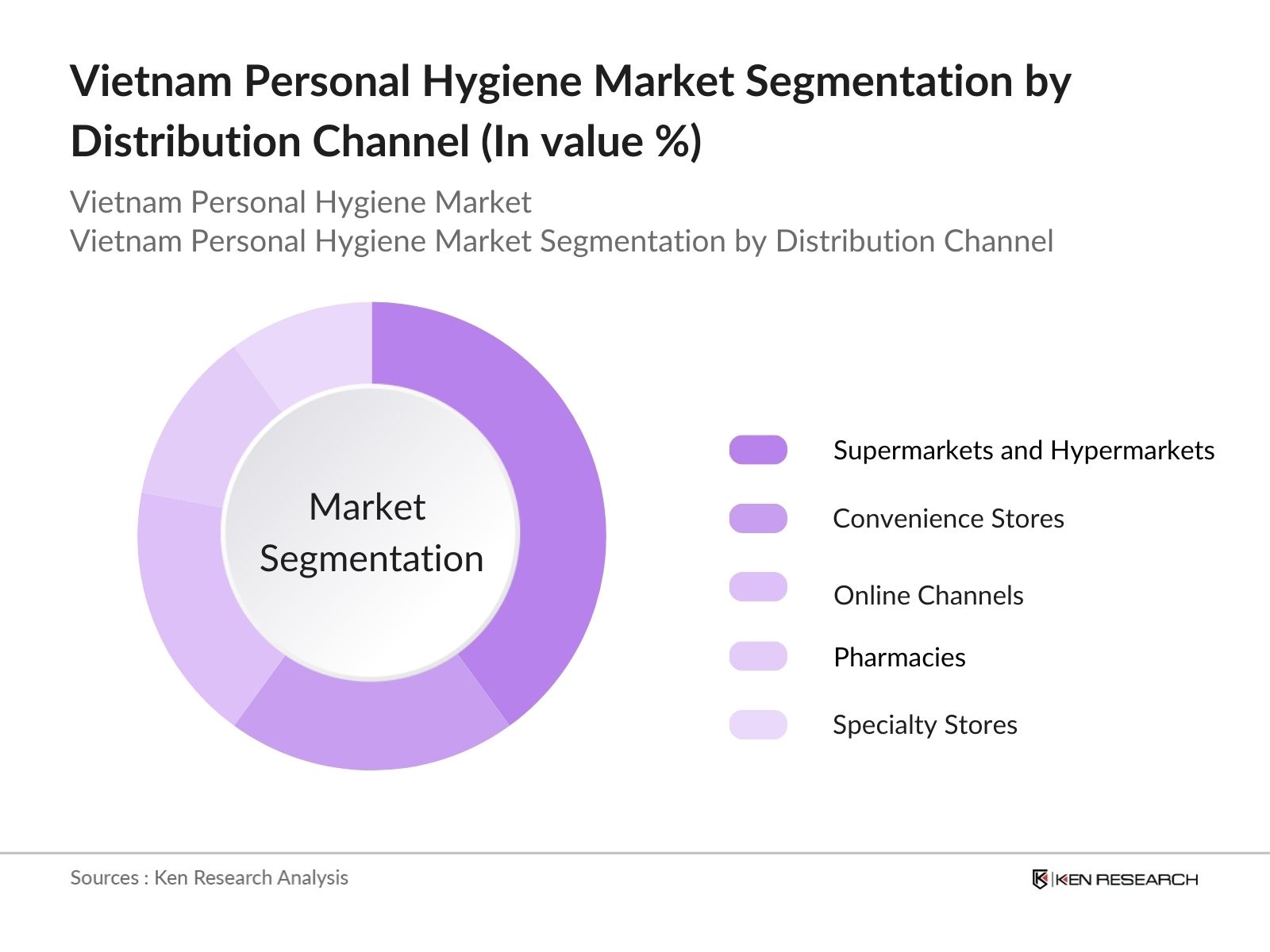

- By Distribution Channel: The Market is also segmented by distribution channels into supermarkets and hypermarkets, convenience stores, online channels, pharmacies, and specialty stores. Supermarkets and hypermarkets dominate the market as they offer a broad range of personal hygiene products at competitive prices, attracting urban consumers. With increasing urbanization and modern retail infrastructure, these channels provide consumers with easy access to various personal care brands under one roof. Their dominance is reinforced by promotions, discounts, and the availability of both local and international brands.

Vietnam Personal Hygiene Market Competitive Landscape

The Vietnam Personal Hygiene Market is highly competitive, with both local and international brands vying for consumer loyalty. Key local players such as Vietcos and Saigon Cosmetics Corporation dominate the market, catering to budget-conscious consumers with affordable yet effective hygiene solutions. These companies benefit from their understanding of local preferences and distribution networks, allowing them to reach consumers in both urban and rural areas.

International brands like Unilever, Procter & Gamble, and Colgate-Palmolive also have a significant presence in Vietnam, known for their premium product offerings and extensive product portfolios. These brands leverage their global reputation and continuous product innovation to cater to the growing demand for personal hygiene products. The competition is expected to intensify as companies focus on expanding their product lines and distribution channels to capture a larger market share.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

Revenue |

R&D Investments |

Market Reach |

Sustainability Initiatives |

Export Markets |

Certifications |

|

Vietcos |

1997 |

Hanoi, Vietnam |

|||||||

|

Saigon Cosmetics Corp |

1990 |

Ho Chi Minh City, Vietnam |

|||||||

|

Unilever |

1929 |

London, UK |

|||||||

|

Procter & Gamble |

1837 |

Ohio, USA |

|||||||

|

Colgate-Palmolive |

1806 |

New York, USA |

Vietnam Personal Hygiene Market Analysis

Growth Drivers

- Hygiene Awareness Initiatives: Vietnam's government has increased its focus on public health education, particularly after the COVID-19 pandemic. In 2023, the Vietnamese Ministry of Health launched nationwide awareness campaigns promoting regular handwashing and the importance of sanitation, leading to a surge in demand for hygiene products. Additionally, through the Vietnam Health Strategy 2030, the government is working to improve sanitation facilities in urban and rural areas, affecting the market's demand for personal hygiene products like soaps and sanitizers. According to the World Bank, over 86% of Vietnam's population now has access to improved sanitation facilities, further driving this growth.

- Urbanization Driving Product Accessibility: Vietnam's rapid urbanization has directly influenced the personal hygiene market by making products more accessible to urban populations. The countrys urban population grew from 38% in 2020 to over 41% in 2024, as reported by the World Bank. The surge in urban residents has led to increased consumer demand for personal hygiene products, particularly in cities like Ho Chi Minh and Hanoi, where retail distribution networks are robust. Urban dwellers also tend to adopt more frequent hygiene practices compared to rural populations, which is boosting product consumption.

- Rise in Disposable Income: Vietnams Gross National Income (GNI) per capita rose from USD 3,560 in 2020 to USD 4632 in 2024, according to the World Bank. This increase in disposable income has allowed more Vietnamese consumers to spend on personal hygiene products beyond basic needs, such as premium soaps, shampoos, and oral care items. As income rises, consumers are prioritizing health and hygiene, thus driving growth in the personal hygiene sector. Increased purchasing power in the middle class, particularly in urban areas, has further amplified demand for higher-quality hygiene products.

Market Challenges

- Price Sensitivity in Lower-Income Groups: Despite rising disposable incomes in urban areas, price sensitivity remains a major issue for low-income populations, especially in rural regions. The General Statistics Office of Vietnam reported that themajority of the rural population still lives on less than USD 1,500 per year in 2024, making it difficult for them to afford premium hygiene products. This limits the adoption of higher-end personal hygiene products, with consumers opting for cheaper, locally produced alternatives.

- Low Penetration in Rural Areas Although urbanization is progressing, Vietnam's rural areas still suffer from low penetration of personal hygiene products. According to the Vietnam Rural Development Strategy 2024, a major portion of rural households still rely on traditional methods for hygiene due to limited access to commercial hygiene products. Moreover, logistics and distribution challenges in rural regions hamper market growth, as transporting goods to remote areas significantly increases costs

Vietnam Personal Hygiene Market Future Outlook

The Vietnam Personal Hygiene Market is expected to maintain steady growth, driven by increasing hygiene awareness, government initiatives, and rising disposable income. The market will continue to be dominated by bath and shower products, with oral care and deodorants seeing strong growth as consumer preferences evolve. Urbanization and a growing middle class will further drive demand for premium personal hygiene products, while rural areas will see increasing penetration of basic hygiene products.

Future Market Opportunities

- Sustainable Product Demand: The growing environmental consciousness among consumers has created a significant opportunity for the development of sustainable hygiene products. Vietnam's Ministry of Environment and Natural Resources reported that a noteworthy of urban consumers in 2024 prefer eco-friendly products. This demand is pushing manufacturers to invest in biodegradable packaging and sustainably sourced ingredients. Major local brands have already begun introducing eco-friendly hygiene products to tap into this market segment.

- Growth of E-Commerce Platforms: Vietnam's booming e-commerce market is a major opportunity for the personal hygiene sector. According to Vietnams Ministry of Industry and Trade, online retail sales reached billions in 2024, with personal hygiene products being one of the fastest-growing categories. E-commerce platforms like Tiki and Shopee offer a convenient distribution channel, especially for rural consumers who otherwise face challenges in accessing physical retail stores. This has made personal hygiene products more accessible across Vietnam.

Scope of the Report

|

By Product Type |

Bath and Shower Products Oral Care Products Deodorants and Antiperspirants Feminine Hygiene Products Hand Sanitizers and Disinfectants |

|

By Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Channels Pharmacies and Drugstores Specialty Stores |

|

By Age Group |

Children (0-12 Years) Teenagers (13-19 Years) Adults (20-59 Years) Senior Citizens (60+ Years) |

|

By Gender |

Male Female Unisex |

|

By Region |

North Vietnam Central Vietnam South Vietnam |

Products

Key Target Audience

Personal Hygiene Manufacturers

Distributors and Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Vietnam Food Administration)

Importers and Exporters

Healthcare Institutions

Online and E-commerce Platforms

Pharmacies and Drugstores

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Unilever

Procter & Gamble

Colgate-Palmolive

Saigon Cosmetics Corporation

Vietcos

L'Oral

Kimberly-Clark

Johnson & Johnson

Beiersdorf

The Himalaya Drug Company

Kao Corporation

Shiseido

Lion Corporation

Watsons Vietnam

AmorePacific Corporation

Table of Contents

1. Vietnam Personal Hygiene Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (By Product Type, By Distribution Channel, By Age Group, By Gender, By Region)

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview (Five-Level Segmentation)

2. Vietnam Personal Hygiene Market Size (In USD Mn)

2.1. Historical Market Size (Market Value in USD Mn, Volume in Mn Units)

2.2. Year-On-Year Growth Analysis (Market Growth by Year)

2.3. Key Market Developments and Milestones (Major Regulatory Changes, Innovations, Product Launches)

3. Vietnam Personal Hygiene Market Analysis

3.1. Growth Drivers (Hygiene Awareness, Urbanization, Rise in Disposable Income, Health Campaigns)

3.2. Market Challenges (Price Sensitivity, Low Penetration in Rural Areas, Environmental Impact of Packaging)

3.3. Opportunities (Sustainable Products, Digital and E-commerce Growth, Premiumization of Hygiene Products)

3.4. Trends (Demand for Natural and Organic Products, Rise in Male Grooming, Health-Oriented Hygiene Solutions)

3.5. Government Regulation (Vietnams National Health Policies, ASEAN Cosmetic Directive, Emission Regulations in Packaging)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, Consumers)

3.8. Porters Five Forces Analysis (Buyer Power, Supplier Power, Industry Rivalry, Threat of New Entrants, Threat of Substitutes)

3.9. Competitive Ecosystem (Local vs. International Players, Market Share Breakdown)

4. Vietnam Personal Hygiene Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bath and Shower Products

4.1.2. Oral Care Products

4.1.3. Deodorants and Antiperspirants

4.1.4. Feminine Hygiene Products

4.1.5. Hand Sanitizers and Disinfectants

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Channels

4.2.4. Pharmacies and Drugstores

4.2.5. Specialty Stores

4.3. By Age Group (In Value %)

4.3.1. Children (0-12 Years)

4.3.2. Teenagers (13-19 Years)

4.3.3. Adults (20-59 Years)

4.3.4. Senior Citizens (60+ Years)

4.4. By Gender (In Value %)

4.4.1. Male

4.4.2. Female

4.4.3. Unisex

4.5. By Region (In Value %)

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam Personal Hygiene Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever

5.1.2. Procter & Gamble

5.1.3. Colgate-Palmolive

5.1.4. Saigon Cosmetics Corporation

5.1.5. Vietcos

5.1.6. L'Oral

5.1.7. Kimberly-Clark

5.1.8. Johnson & Johnson

5.1.9. Beiersdorf

5.1.10. The Himalaya Drug Company

5.1.11. Kao Corporation

5.1.12. Shiseido

5.1.13. Lion Corporation

5.1.14. Watsons Vietnam

5.1.15. AmorePacific Corporation

5.2. Cross Comparison Parameters

5.3. Market Share Analysis (By Product Type, Distribution Channel)

5.4. Strategic Initiatives (Product Launches, Mergers and Acquisitions)

5.5. Mergers and Acquisitions (Historical and Forecasted Transactions)

5.6. Investment Analysis (Top Companies, Private Equity Involvement)

5.7. Venture Capital Funding (Emerging Startups)

5.8. Government Grants (Vietnams Personal Care Sector Initiatives)

5.9. Private Equity Investments (Influence on the Market)

6. Vietnam Personal Hygiene Market Regulatory Framework

6.1. Vietnams National Hygiene and Cosmetic Regulation Standards

6.2. ASEAN Cosmetic Directive (Compliance and Impact)

6.3. Certification Processes (Product Safety, Environmental Sustainability)

6.4. Labeling Requirements and Consumer Protection Laws

7. Vietnam Personal Hygiene Market Future Size (In USD Mn)

7.1. Future Market Size Projections (Value and Volume)

7.2. Key Factors Driving Future Market Growth (Rising Health Consciousness, E-commerce Adoption, Sustainable Alternatives)

8. Vietnam Personal Hygiene Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Age Group (In Value %)

8.4. By Gender (In Value %)

8.5. By Region (In Value %)

9. Vietnam Personal Hygiene Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Age Group, Gender, Region)

9.3. Marketing Initiatives (Influencer Marketing, Digital Campaigns, Targeting Rural Markets)

9.4. White Space Opportunity Analysis (Unexplored Segments, Product Innovation Opportunities)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map that includes all relevant stakeholders in the Vietnam Personal Hygiene Market. Extensive desk research is conducted using secondary sources and proprietary databases to gather critical data points such as consumer preferences, regulatory environment, and distribution networks. This phase is crucial for identifying market variables that drive product demand and market segmentation.

Step 2: Market Analysis and Construction

The second step focuses on compiling and analyzing historical data to assess the market's current penetration, volume, and growth rate. This includes evaluating the ratio of market penetration across various product types, distribution channels, and demographic segments. Data from market participants are validated through key performance metrics such as consumer purchasing behavior and sales performance.

Step 3: Hypothesis Validation and Expert Consultation

In this step, the market assumptions are tested and validated through detailed interviews with industry experts, leveraging a combination of primary and secondary data. These consultations help verify the market dynamics and provide deeper insights into specific areas like the growing demand for premium products, sustainability trends, and government initiatives.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research findings into actionable insights and recommendations. This step also includes engaging with major personal hygiene product manufacturers to cross-validate the data, ensuring the report's conclusions are both reliable and accurate. Final outputs include market size forecasts, trend analysis, and strategic insights tailored to business professionals in the personal hygiene market.

Frequently Asked Questions

01. How big is the Vietnam Personal Hygiene Market?

The Vietnam Personal Hygiene Market is valued at USD 290 million, driven by heightened consumer awareness and demand for essential hygiene products such as bath soaps, oral care items, and hand sanitizers. This market size is based on a five-year historical analysis of industry data.

02. What are the challenges in the Vietnam Personal Hygiene Market?

Challenges in the Vietnam Personal Hygiene Market include price sensitivity among consumers, particularly in rural areas, and the environmental impact of product packaging. Another significant hurdle is the penetration of hygiene products in underserved rural regions due to logistical and supply chain issues.

03. Who are the major players in the Vietnam Personal Hygiene Market?

Major players in the Vietnam Personal Hygiene Market include Unilever, Procter & Gamble, Colgate-Palmolive, Saigon Cosmetics Corporation, and Vietcos. These companies dominate the market with a strong product portfolio, extensive distribution networks, and high brand recall.

04. What are the growth drivers of the Vietnam Personal Hygiene Market?

Key growth in the Vietnam Personal Hygiene Market drivers include rising consumer hygiene awareness, increasing disposable income, government health campaigns, and the influence of international personal care brands. The shift towards sustainable and eco-friendly products also drives market growth in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.