Vietnam Pharmaceutical Market Outlook to 2027

Private Companies Driving the Future of the pharmaceutical market in Vietnam

Region:Asia

Author(s):Mahika Heda and Rohan Bagai

Product Code:KR1339

July 2023

75

About the Report

Market Overview:

The Vietnamese pharmaceutical market is experiencing significant growth, driven by an expanding middle class, increasing healthcare expenditure, and a rising demand for quality healthcare products. The market offers opportunities for both domestic and international pharmaceutical companies, with a focus on generic drugs and an increasing emphasis on research and development.

With a population of over 98 Mn and a growing affluent class, Vietnam's expenditure on medicines has risen significantly, showcasing its high paying capacity for healthcare. The country's aging population further contributes to the demand for pharmaceutical drugs. To address these needs, the Vietnamese government has implemented healthcare reforms and initiatives to boost domestic pharmaceutical production. Specialty drugs are sought after to combat the increasing prevalence of chronic diseases like cancer and diabetes, providing better outcomes for patients.

Vietnam Pharmaceutical Market Analysis

- Vietnam's growing affluent class and population of over 98 million have led to increased expenditure on medicines, reflecting a high paying capacity for healthcare.

- The country is undergoing a demographic shift, with an aging population expected to reach over 20% by 2038 and approximately 25% by 2049, further driving the demand for pharmaceutical drugs.

- The Vietnamese government has implemented proactive measures to enhance the healthcare system and pharmaceutical industry, including regulatory strengthening, streamlined drug registration processes, and support for domestic pharmaceutical production.

- Specialty drugs are in high demand due to the rising prevalence of chronic diseases like cancer and diabetes, offering targeted therapies and improved outcomes for patients amidst Vietnam's epidemiological transition.

Key Trends by Market Segment:

By Purchase Channel: Growing prevalence of chronic illnesses, such as cancer and cardiovascular diseases, boost demand for affordable and easy-to-access generic formulations in Vietnam and, in turn, enhance generic drug consumption.Pharma companies invest heavily in developing new complex molecules targeting niche ailments that are now being treated using costly drugs and complex treatment procedures to overcome the generics cliff.

By Type of Drug: Generic drugs are developed using the same chemical composition as branded/approved small molecule therapy.Registered drug companies sell branded/innovator drugs under a registered brand name or trademark and are protected by a patent.

By Sales Channel: Hospital pharmacies play a vital role in supporting patient care by ensuring the availability of essential medications within the hospital. They collaborate closely with healthcare professionals to meet the specific medication needs of patients and provide specialized pharmaceutical services. Retail pharmacies offer convenience to customers by providing a wide range of pharmaceutical products in a retail setting. Customers can purchase medications and healthcare products without the need for a hospital visit. Retail pharmacies may provide consultation services to customers, offering advice on minor ailments, general health issues, and proper usage of medications.

Competitive Landscape:

The competition landscape in the Vietnamese is characterized by a mix of domestic and international players. Major domestic companies include MWG entered the pharmaceutical market in 2018 with the establishment of its pharmaceutical retail brand, "Bach Hoa Xanh Drugstore." Leveraging their extensive retail network and strong brand presence. Players like Sanofi and GSK have played significant roles in shaping the pharmaceutical market in Vietnam and have established themselves as leaders. Players like Domesco, DHG, Pymepharco, and Traphaco are involved in the manufacturing and distribution of a diverse range of pharmaceutical products. The market is highly competitive, with players competing based on product quality, pricing, distribution networks, and strategic partnerships. Additionally, the government's initiatives to promote domestic production and reduce dependence on imports have further intensified competition in the market.

Recent Developments:

- Vietnam is experiencing an increase in its elderly population due to improved life expectancy and declining birth rates. This demographic shift presents new challenges for the healthcare industry as there is an increased demand specialized healthcare services for the elderly.

- In the face of a shortage of skilled labor, technology has become a potential solution to healthcare’s resource problems. For example, remote monitoring, telemedicine, and mobile devices will help doctors/medical staff to save physical consultation time

- Lifestyle changes are driving up incidences of chronic diseases (diabetes, heart-related, cancers, etc.), increasing demand for chronic care. This is more costly and demands new models and considerations for delivery of care.

- Consumers are demonstrating a lack of trust in traditional health systems, due to several long-lasting and unsettled issues (e.g., overloading, long-time queuing, administrative issues, mistrust of medicine/inputs/quality of care, etc).

Future Outlook:

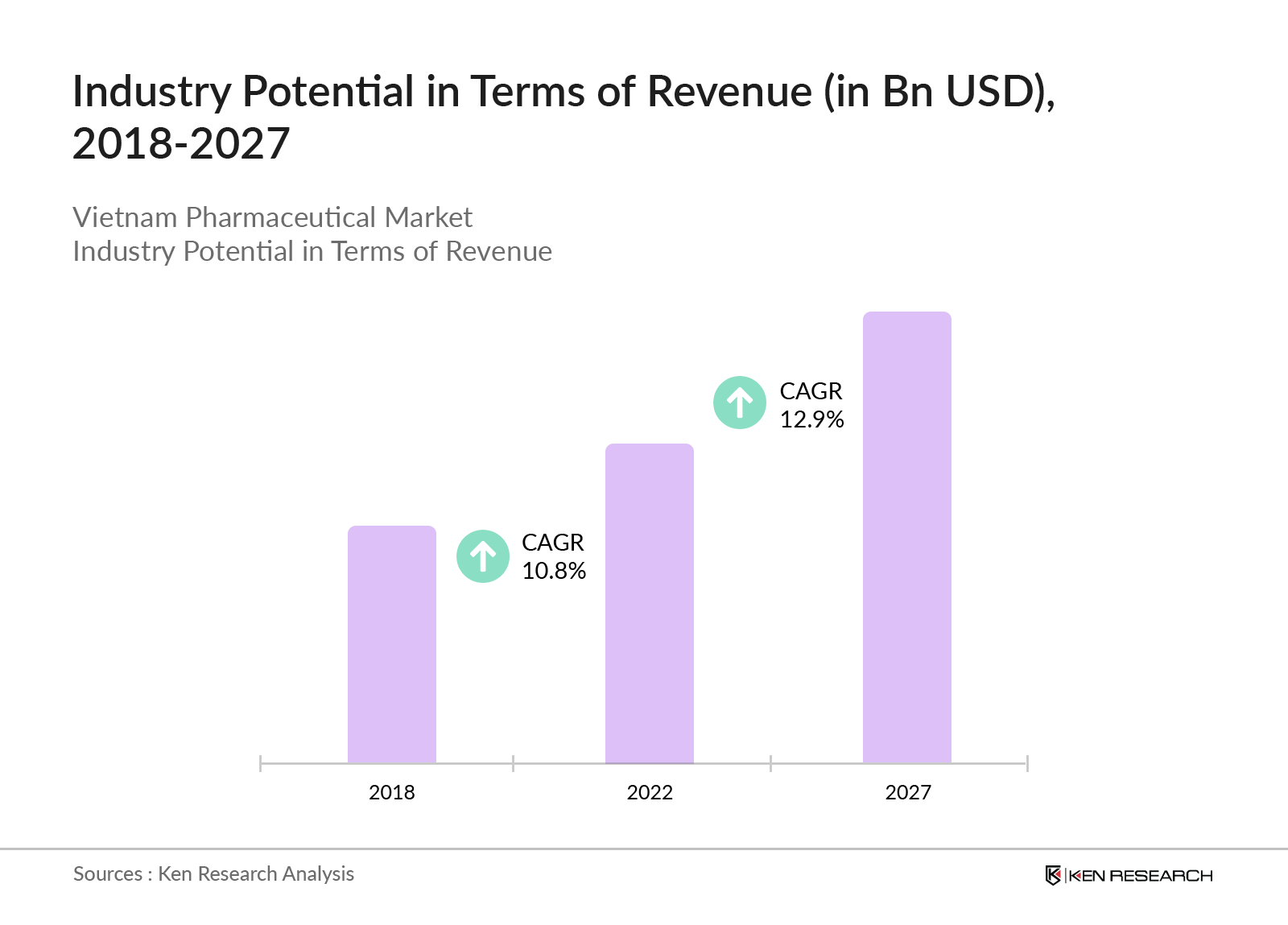

Vietnam Pharmaceutical Industry is expected to show increasing and is expected to grow at a CAGR of ~12% from 2022 to 2027 with Government initiatives for infrastructure development are expected to enhance the connectivity within Vietnam.

- Vietnam has a large and rapidly growing population, with a median age of around 30 years. The rising population, along with increasing urbanization and a growing middle class, creates a larger consumer base for pharmaceutical products.

- The Vietnamese government has been increasing its investment in healthcare infrastructure and services. This includes expanding access to healthcare facilities, improving healthcare quality, and enhancing the affordability of pharmaceutical products.

- The Vietnamese government has implemented policies and reforms to develop the pharmaceutical industry. This includes streamlining the drug registration process, improving intellectual property protection, promoting local production of pharmaceuticals.

- The rising death rate from non-communicable diseases among the Vietnamizes, along with the growing purchasing power, is expected to contribute to the market growth over the forecast period.

Scope of the Report

|

Vietnam Pharmaceutical Market Segmentation |

|

|

By Type of Therapeutic Drug |

Metabolism & Nutritional Medicine Cardiovascular System Infection CNS Oncology Respiratory Musculoskeletal Others |

|

By Purchase Channel |

ETC (Prescription Drugs) OTC |

|

By type of Freight End Users |

Retail Automobile Pharma Others |

|

By Type of Drug |

Generic Drug Patented Drug |

|

By Sales Channel |

Hospitals & Hospital owned Pharmacy Individual Drug Stores & retailers |

|

By Sales Mode |

Offline Online |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Healthcare Companies

Third-Party medicine Providers

Potential Market Entrants

Drug Associations

Pharma Companies

Industry Associations

Consulting Agencies

Government Bodies & Regulating Authorities

Time Period Captured in the Report:

Historical Period: 2018-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

Sanofi

DHG

GSK

MSD

Traphaco

Ha Tay Pharma

AstraZeneca

Pymepharco

Bidiphar

Domesco Medica Import Export

Table of Contents

1.Executive Summary

1.1 Executive Summary: Vietnam Pharmaceutical Market

2. Country Overview: Vietnam

2.1 Country Demographics, 2022

2.2 Population Analysis for Vietnam

2.3 Urbanization in Vietnam

2.4 Healthcare Analysis for Vietnam

2.5 Diseases Overview in Vietnam

3. Vietnam Healthcare Industry Overview

3.1 Vietnam Healthcare Overview

3.2 Vietnam Disease Statistics

3.3 Epidemic Diseases and Food Poisoning, 2021

3.4 Trends & Developments in Vietnam Healthcare Industry

3.5 Business Cycle and Genesis of Vietnam Pharmaceutical Market

4. Overview of Vietnam Pharmaceutical Market 2022

4.1 Vietnam Pharmaceutical Market Ecosystem

4.2 Timeline of Major Players in Vietnam Pharmaceutical Market

5. Vietnam Pharmaceutical Market Segmentation

5.1 Market Sizing Analysis of Vietnam Pharmaceutical Market, 2018-2022

5.2 By Type of Therapeutic Drug, 2022

5.3 By Purchase Channel, 2022

5.4 By Type of Drug, 2022

5.5 By Sales Channel, 2022

5.6 By Sales Mode, 2022

6. Industry Analysis: Vietnam Pharmaceutical Market

6.1 Growth Drivers in Vietnam Pharmaceutical Market

6.2 Challenges and Bottlenecks in Vietnam Pharmaceutical Market

6.3 Trends & Developments in Vietnam Pharmaceutical Market

6.4 SWOT Analysis for Vietnam Clinical Laboratories Market

6.5 Regulatory Framework in Vietnam Pharmaceutical Market (1/2)

6.6 Regulatory Framework in Vietnam Pharmaceutical Market (2/2)

7. Competition Framework for Vietnam Pharmaceutical Market

7. 1 Vietnam Pharmaceutical Market Growth Quadrant

7.2 Market Share of Major Players in the Vietnam Pharmaceutical Market

7.3 Cross-Comparison of Major Players in Vietnam Pharmaceutical Market

7.4 Sanofi Company Overview

7.5 DHG Pharma Company Overview

7.6 Traphaco Company Overview

7.7 Bidiphar Company Overview

8. Future Outlook & Projections of Vietnam Pharmaceutical Market

8.1 Future Market Sizing Analysis of Vietnam Pharmaceutical Market, 2022-2027

8.2 By Type of Therapeutic Drug, 2027

8.3 By type of purchase channels and Types of Drugs, 2027

8.4 By Sales Channel and By Sales Mode, 2027

9. Analyst Recommendations

9.1 Factors to consider while Setting-up a Pharmaceutical Company in Vietnam

9.2 Growth Approach for Pharmaceutical Businesses

9.3 Case Study: AstraZeneca

9.4 Case Study: Pfizer-BioNTech

Research Methodology

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on pharma market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for logistics services. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team has approached multiple drug supplier services providing channels and understanded nature of product segments and sales, consumer preference and other parameters, which supported us validate statistics derived through bottom to top approach from vaccines to general drug providers.

Frequently Asked Questions

01 How big is the pharmaceutical market in Vietnam?

The market size of Vietnamese pharamceutical market has been at $5.4 billion in 2022

02 What is the largest pharmaceutical company in Vietnam Pharmaceutical Market?

Sanofi is the largest pharmaceutical company by revenue

03 Who are the key players in Vietnam Pharmaceutical Market?

Sanofi, DHG, Ha Tay Pharma, AstraZeneca are some of the key players in Vietnam Pharmaceutical Market

04 What is the market trend in Vietnam Pharmaceutical industry?

Vietnam Pharmaceutical market is expected to reach $9.9 billlion by 2027 at a CAGR of 12.9%

05 Which segment is showing maximum growth in Vietnam Pharmaceutical Market?

Metabolism & Nutritional Medicine has experienced maximum growth in Vietnam Pharmaceutical Market in 2022

06 Why Vietnam Pharmaceutical Market is growing?

Vietnam's high paying capacity & increasing aging populations has led to a surge in pharmaceutical market

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.