Vietnam Spice Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3639

November 2024

81

About the Report

Vietnam Spice Market Overview

- The Vietnam Spice Market has experienced robust growth in the historical period, reaching a market size of USD 1.4 Bn driven by the country's rich agricultural diversity and increasing demand for high-quality spices in both domestic and international markets. Vietnam is recognized as one of the largest producers and exporters of spices such as black pepper, cinnamon, star anise, and cardamom. The market is bolstered by favorable climatic conditions and government initiatives supporting agricultural development.

- Major provinces such as Gia Lai, Quang Ngai, and Dak Lak serve as the key hubs for spice production, with a high concentration of spice plantations and processing units. Vietnams agricultural sector benefits from a strong focus on export-oriented growth, and the spice industry has emerged as a critical contributor to this effort. Additionally, increasing awareness of organic and sustainable farming practices has led to greater global demand for Vietnamese spices.

- Vietnam's government has implemented agricultural policies that encourage the expansion of spice cultivation, providing subsidies for farmers and promoting research into high-yield crop varieties. In 2024, the Ministry of Agriculture and Rural Development announced financial incentives aimed at enhancing the quality and export potential of Vietnamese spices, further solidifying the countrys position in the global spice market.

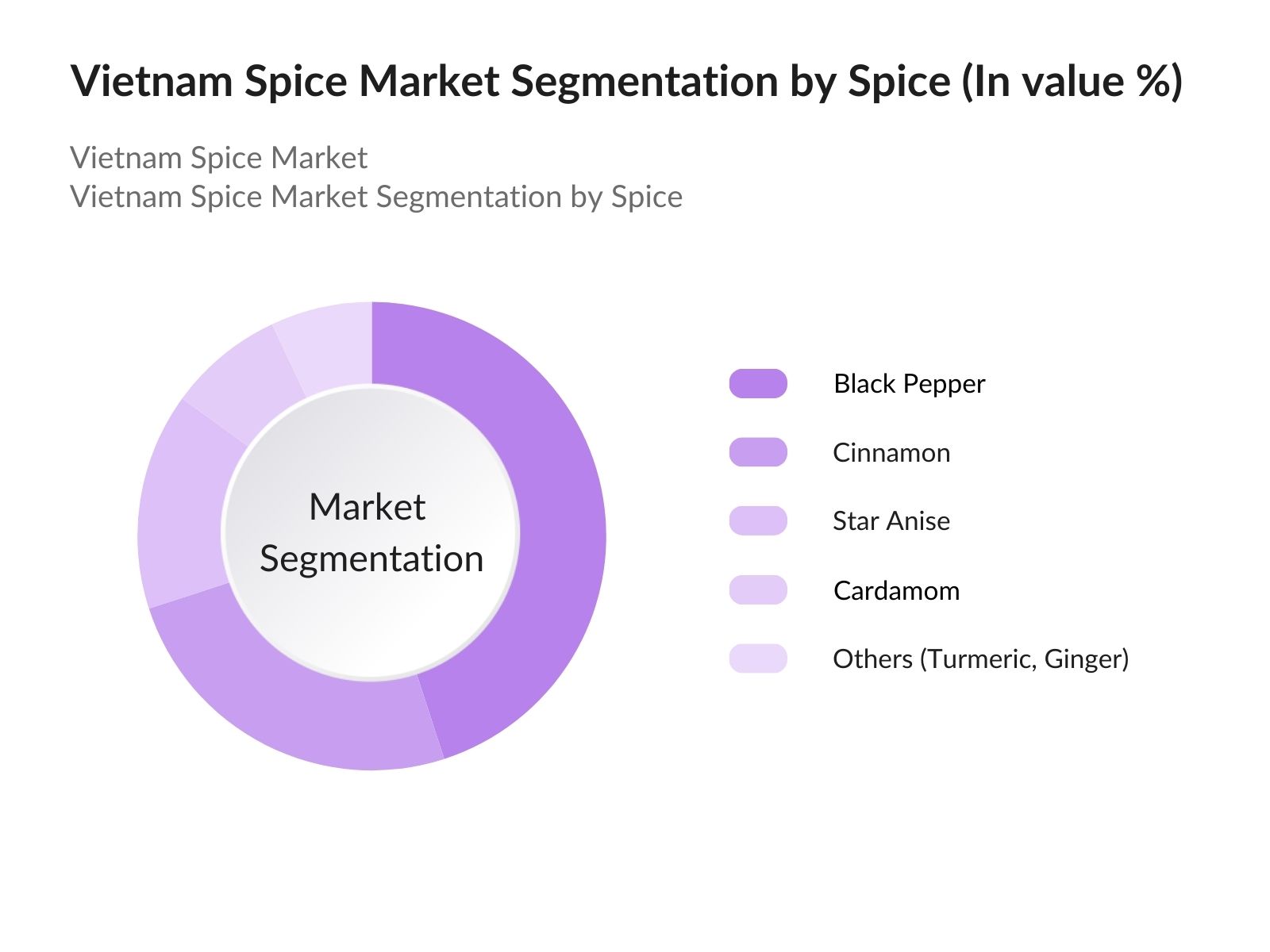

Vietnam Spice Market Segmentation

- By Spice Type: The market is segmented into black pepper, cinnamon, star anise, cardamom, and others. Black pepper holds the largest market share, driven by Vietnam's position as the top global producer and exporter of this spice. Cinnamon and star anise are also significant contributors, with high demand from the pharmaceutical and food industries. Cardamom, though smaller in volume, has been gaining traction due to its medicinal properties and culinary applications.

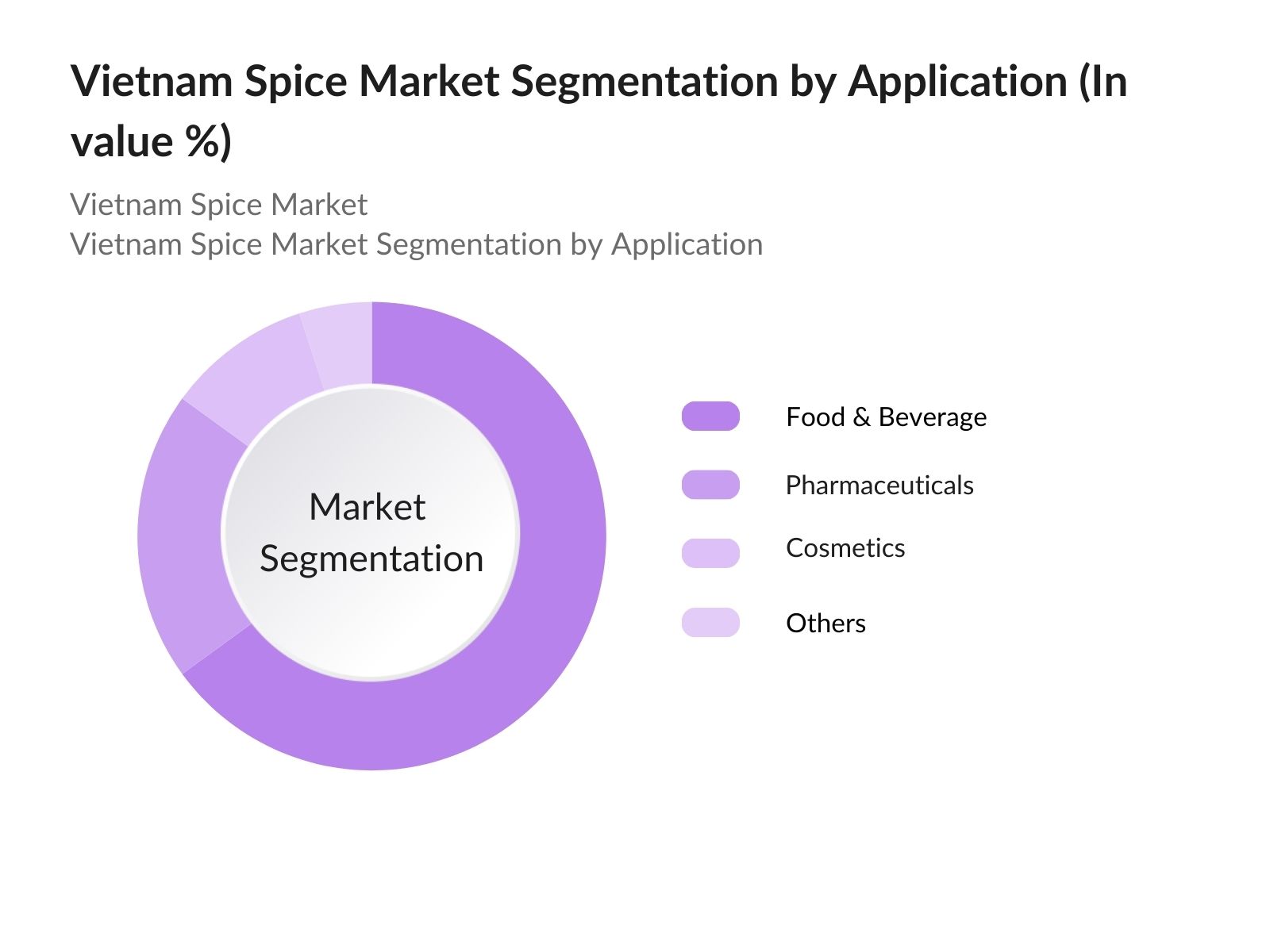

- By Application: The market is further segmented into food & beverage, pharmaceuticals, cosmetics, and others. The food & beverage sector dominates the market, accounting for the largest share due to the widespread use of spices in cooking and food preservation. The pharmaceutical industry also plays a crucial role, utilizing spices like star anise and cinnamon for their therapeutic properties. The cosmetic industry is increasingly incorporating spices such as cinnamon and cardamom in beauty and skincare products, further driving demand.

Vietnam Spice Market Competitive Landscape

The Vietnam Spice Market is highly competitive, with both domestic and international players striving for market dominance. Local companies such as Tran Chau and Dace are key players in the production and export of spices, particularly black pepper and cinnamon. International companies like McCormick & Company and Olam International have established a strong presence, particularly in the procurement and distribution of spices. Companies are increasingly focusing on organic certification and sustainable farming practices to cater to the growing demand for ethically sourced products. Strategic initiatives such as partnerships with local farmers and investment in advanced processing facilities are helping companies strengthen their position in the Vietnamese spice market.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

Certifications |

Export Markets |

Number of Employees |

Regional Presence |

Sustainability Initiatives |

R&D Investments |

|

Tran Chau |

1995 |

Ho Chi Minh City |

|||||||

|

Dace |

2000 |

Hanoi |

|||||||

|

Phuc Sinh Group |

2001 |

Ho Chi Minh City |

|||||||

|

McCormick & Company |

1889 |

Maryland, USA |

|||||||

|

Olam International |

1989 |

Singapore |

Vietnam Spice Market Analysis

Growth Drivers

- Modernization of Agricultural Practices: To combat the adverse effects of climate change, Vietnam has modernized its agricultural practices, particularly in spice farming. The country has invested in climate-resilient farming technologies, including drought-resistant spice varieties and smart irrigation systems. In 2023, the government allocated a substantial amount towards these initiatives, benefiting thousands of farmers. According to the World Bank, this modernization led to remarkable increase in spice yield per hectare, particularly in regions like the Central Highlands, which are vulnerable to climate variability.

- Rising Global Demand for Organic Spices: The global market for organic products, including spices, has been expanding due to rising health awareness and preferences for chemical-free food. Vietnam has significantly increased its organic spice exports to cater to this demand. In 2022, the organic food and beverage market expanded remarkably, with organic spices playing a critical role. Vietnam's agriculture sector has benefited from this trend, with its spice export volumes rising. According to the Ministry of Agriculture, organic agriculture in Vietnam consists of4.3 % of thetotal cultivation area in 2023, focusing heavily on spice exports like cinnamon and star anise.

- Supportive Government Policies and Trade Agreements: Vietnam has benefited from several free trade agreements (FTAs), which have reduced tariffs and opened up new markets for Vietnamese spices. The Regional Comprehensive Economic Partnership (RCEP), implemented in 2022, has provided easier access to key Asian markets, driving up the export volume of spices. Furthermore, the governments agricultural policies, including subsidies and tax incentives for spice farmers, continue to support industry growth.

Market Challenges

- Fluctuating Global Spice Prices: Global spice prices have been highly volatile, impacting Vietnam's export revenue. Economic downturns and fluctuating demand have been key drivers of this volatility. This has reduced the profit margins for Vietnamese spice exporters as they face challenges from lower prices and reduced demand from major importers such as India and the U.S. This volatility presents a significant challenge for Vietnamese spice producers and exporters who depend heavily on stable global prices to maintain revenue growth.

- Environmental Factors and Climate Change: Vietnams spice production has been severely impacted by climate change, particularly erratic weather patterns and extreme temperatures. Key spice-growing regions like the Central Highlands have experienced yield reductions due to prolonged droughts. Without adaptation strategies, spice production could face further declines, affecting both domestic supply and export potential. This reduction in yield not only creates supply shortages but also raises concerns about long-term sustainability in spice farming.

Vietnam Spice Market Future Outlook

The Vietnam Spice Market is poised for continued growth, driven by increasing global demand for premium and organic spices, as well as government initiatives to boost export capacity. The integration of modern agricultural practices and the expansion of spice cultivation into newer regions are expected to create additional growth opportunities. The market is also likely to see the adoption of advanced processing techniques, ensuring the consistent quality of spices for both domestic consumption and export.

Future Market Opportunities

- Growing Market for Value-Added Products: Vietnam's spice industry has immense potential for expanding into value-added products like spice oils and extracts. In 2023, global demand for spice oils reached all time high, with Vietnam emerging as a key supplier. The Vietnamese government is encouraging farmers and businesses to shift from raw spice exports to more lucrative value-added products, which can fetch higher prices in international markets. Vietnam's significant production and export of cinnamon, including a total export volume of 89,383 tons in 2023, driven by demand from the cosmetics and pharmaceutical industries.

- Expansion of Organic and Fair Trade Certification: Vietnamese spice producers are increasingly seeking organic and fair trade certifications to meet growing global demand for sustainably sourced spices. In 2022, the Ministry of Agriculture reported that majority of spice farms had received organic certification, a substantial increase from 2021. Fairtrade-certified spices from Vietnam grew remarkably in 2023, allowing exporters to tap into niche markets in Europe and North America. These certifications offer premium pricing opportunities, which could further boost revenue for Vietnamese spice farmers and exporters.

Scope of the Report

|

By Spice |

Black Pepper Cinnamon Star Anise Cardamom Others (Turmeric, Ginger) |

|

By Application |

Food & Beverage Pharmaceuticals Cosmetics Household/Personal Care Products |

|

By Distribution Channel |

Direct Sales Online Retailers Supermarkets/Hypermarkets Specialty Stores |

|

By Processing |

Ground Spices Whole Spices Spice Oils and Extracts Organic and Non-Organic |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Spice Exporters

Food and Beverage Manufacturers

Pharmaceutical Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development, Ministry of Industry and Trade)

Organic Certification Bodies

Retail Chains (Supermarkets and Specialty Stores)

Cosmetic and Personal Care Product Manufacturers

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Tran Chau

Dace

Phuc Sinh Group

McCormick & Company

Olam International

Vietnam Organic Spice Company

Thien Huong Food Joint Stock Co.

Nam Viet Foods & Beverage Co., Ltd.

Nedspice

Rajesh Spices

Saigon Cinnamon

DGF Vietnam

Ceylon Exports & Trading

Ever Organic

Gia Lai Spice Co.

Table of Contents

01 Vietnam Spice Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02 Vietnam Spice Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03 Vietnam Spice Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Global Demand for Organic Spices

3.1.2. Government Support for Agricultural Expansion (Subsidies, Policies)

3.1.3. Expanding Export Opportunities (Trade Agreements, Global Partnerships)

3.1.4. Modernization of Agricultural Practices (Climate-Resilient Farming)

3.2. Market Challenges

3.2.1. Fluctuating Global Spice Prices (Export Revenue Volatility)

3.2.2. Climate Change Impact on Spice Production (Yield Reduction)

3.2.3. Labor Shortages in Spice Farming (Skilled Workforce)

3.3. Opportunities

3.3.1. Growing Market for Value-Added Products (Spice Oils, Extracts)

3.3.2. Expansion of Organic and Fair Trade Certification

3.3.3. Increasing Investments in Advanced Processing Technologies

3.4. Trends

3.4.1. Rise of Sustainable and Ethical Sourcing in Spices

3.4.2. Integration of Digital Agriculture Solutions

3.4.3. Growing Popularity of Specialty Spices (Regional Flavors, Gourmet)

3.5. Government Regulation

3.5.1. Agricultural Incentives and Subsidies for Farmers

3.5.2. Compliance with International Quality Standards (Organic, Fair Trade)

3.5.3. Policies Promoting Sustainable Farming (Eco-Friendly Practices)

3.5.4. Support for Export-Oriented Spice Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem Analysis

04 Vietnam Spice Market Segmentation

4.1. By Spice Type (In Value %) 4.1.1. Black Pepper

4.1.2. Cinnamon

4.1.3. Star Anise

4.1.4. Cardamom

4.1.5. Others (Turmeric, Ginger)

4.2. By Application (In Value %)

4.2.1. Food & Beverage

4.2.2. Pharmaceuticals

4.2.3. Cosmetics

4.2.4. Household/Personal Care Products

4.3. By Region (In Value %)

4.3.1. Northern Vietnam

4.3.2. Central Vietnam

4.3.3. Southern Vietnam

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Online Retailers

4.4.3. Supermarkets/Hypermarkets

4.4.4. Specialty Stores

4.5. By Processing Type (In Value %)

4.5.1. Ground Spices

4.5.2. Whole Spices

4.5.3. Spice Oils and Extracts

4.5.4. Organic and Non-Organic

05 Vietnam Spice Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tran Chau

5.1.2. Dace

5.1.3. Phuc Sinh Group

5.1.4. McCormick & Company

5.1.5. Olam International

5.1.6. Vietnam Organic Spice Company

5.1.7. Thien Huong Food Joint Stock Co.

5.1.8. Nam Viet Foods & Beverage Co., Ltd.

5.1.9. Nedspice

5.1.10. Rajesh Spices

5.1.11. Saigon Cinnamon

5.1.12. DGF Vietnam

5.1.13. Ceylon Exports & Trading

5.1.14. Ever Organic

5.1.15. Gia Lai Spice Co.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Key Products, Organic Certifications, Export Markets, Supply Chain Partnerships, R&D Investments, ESG Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06 Vietnam Spice Market Regulatory Framework

6.1. Organic Certification Process

6.2. Quality Control and Safety Standards

6.3. Trade and Export Regulations

6.4. Labeling and Packaging Requirements

07 Vietnam Spice Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08 Vietnam Spice Market Future Segmentation

8.1. By Spice Type (In Value %)

8.2. By Application (In Value %)

8.3. By Region (In Value %)

8.4. By Processing Type (In Value %)

8.5. By Distribution Channel (In Value %)

09 Vietnam Spice Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the entire ecosystem of the Vietnam Spice Market. This includes an in-depth analysis of key stakeholders, such as producers, distributors, and exporters. Secondary data is collected from proprietary databases and credible industry sources to identify critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

Historical market data for the spice sector is compiled and analyzed to understand production trends, export volumes, and consumption patterns. The market structure is constructed by assessing supply-demand dynamics, pricing trends, and the contribution of different segments to overall revenue.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the future trajectory of the Vietnam Spice Market are developed and validated through interviews with industry experts. These experts include agricultural specialists, spice exporters, and representatives from government bodies. This step helps refine market forecasts and validate assumptions based on real-world insights.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the data collected and performing a bottom-up analysis to estimate market size and growth prospects. Data from multiple sources is cross-referenced to ensure accuracy, and the findings are compiled into a comprehensive market report tailored to industry professionals.

Frequently Asked Questions

01 How big is the Vietnam Spice Market?

The Vietnam Spice Market is valued at USD 1.4 billion, driven by the countrys robust spice production and growing global demand for organic products.

02 What are the challenges in the Vietnam Spice Market?

Key challenges in the Vietnam Spice Market include fluctuating global spice prices and the impact of climate change on production, which affects crop yields and export volumes.

03 Who are the major players in the Vietnam Spice Market?

Major players in the Vietnam Spice Market include Tran Chau, Dace, Phuc Sinh Group, McCormick & Company, and Olam International, all known for their leadership in spice production and exports.

04 What are the growth drivers of the Vietnam Spice Market?

Growth drivers include increasing global demand for organic spices, government-backed agricultural development, and expansion into value-added spice products like essential oils.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.