Vietnam Tea Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7824

November 2024

92

About the Report

Vietnam Tea Market Overview

- The Vietnam tea market is valued at USD 2 billion, based on a five-year historical analysis. The market is driven by several factors, including increasing domestic consumption due to growing health awareness among the population and a rise in the export of tea products. Tea has become a staple in Vietnamese culture, and its export growth is particularly fueled by demand in countries like China, Russia, and Pakistan, where Vietnamese tea varieties, especially green tea, are highly sought after.

- Vietnam is dominated by cities and regions such as Thai Nguyen, Lam Dong, and Phu Tho, which are recognized for their favorable climatic conditions and large-scale tea plantations. Thai Nguyen, in particular, is renowned for producing high-quality green tea, which has gained both domestic and international acclaim. These regions benefit from well-established supply chains, experienced tea farmers, and strong government support, positioning them as key players in the tea industry.

- The Vietnamese government has implemented strict tea export standards to ensure the quality and safety of products in international markets. In 2022, new regulations were introduced, mandating rigorous testing for pesticide residues, microbial contamination, and quality grading for all tea exports. These standards align with international trade requirements, particularly for key markets such as the EU and Japan. Compliance with these standards has improved Vietnams reputation as a high-quality tea producer and increased market access.

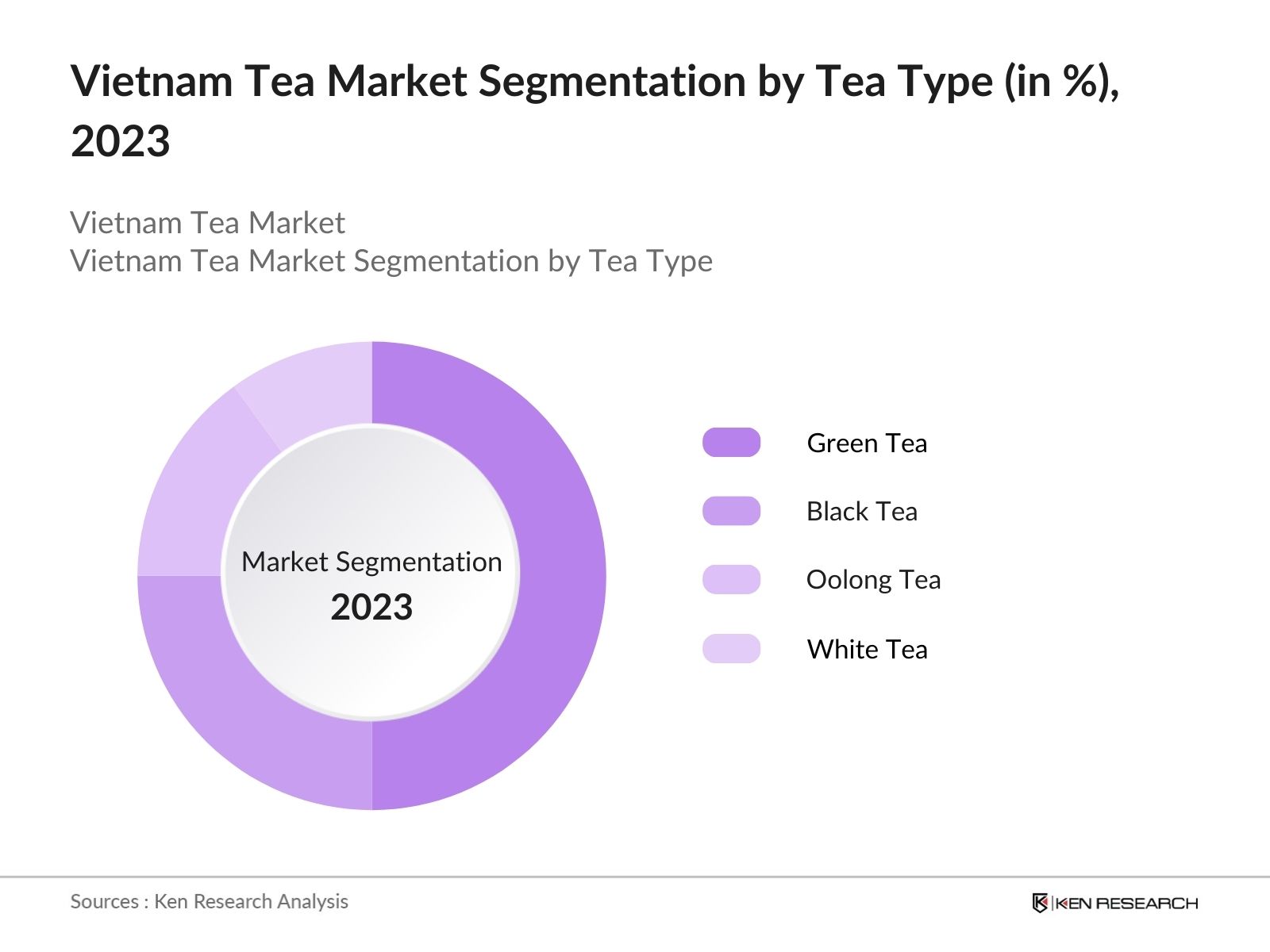

Vietnam Tea Market Segmentation

By Tea Type: The Vietnam tea market is segmented by tea type into green tea, black tea, oolong tea, white tea, and herbal/flavored tea. Green tea holds a dominant market share in this segment, as it is deeply ingrained in Vietnamese tradition and widely consumed both domestically and internationally. Green tea from regions like Thai Nguyen has earned a strong reputation for its quality, helping this sub-segment maintain its leading position.

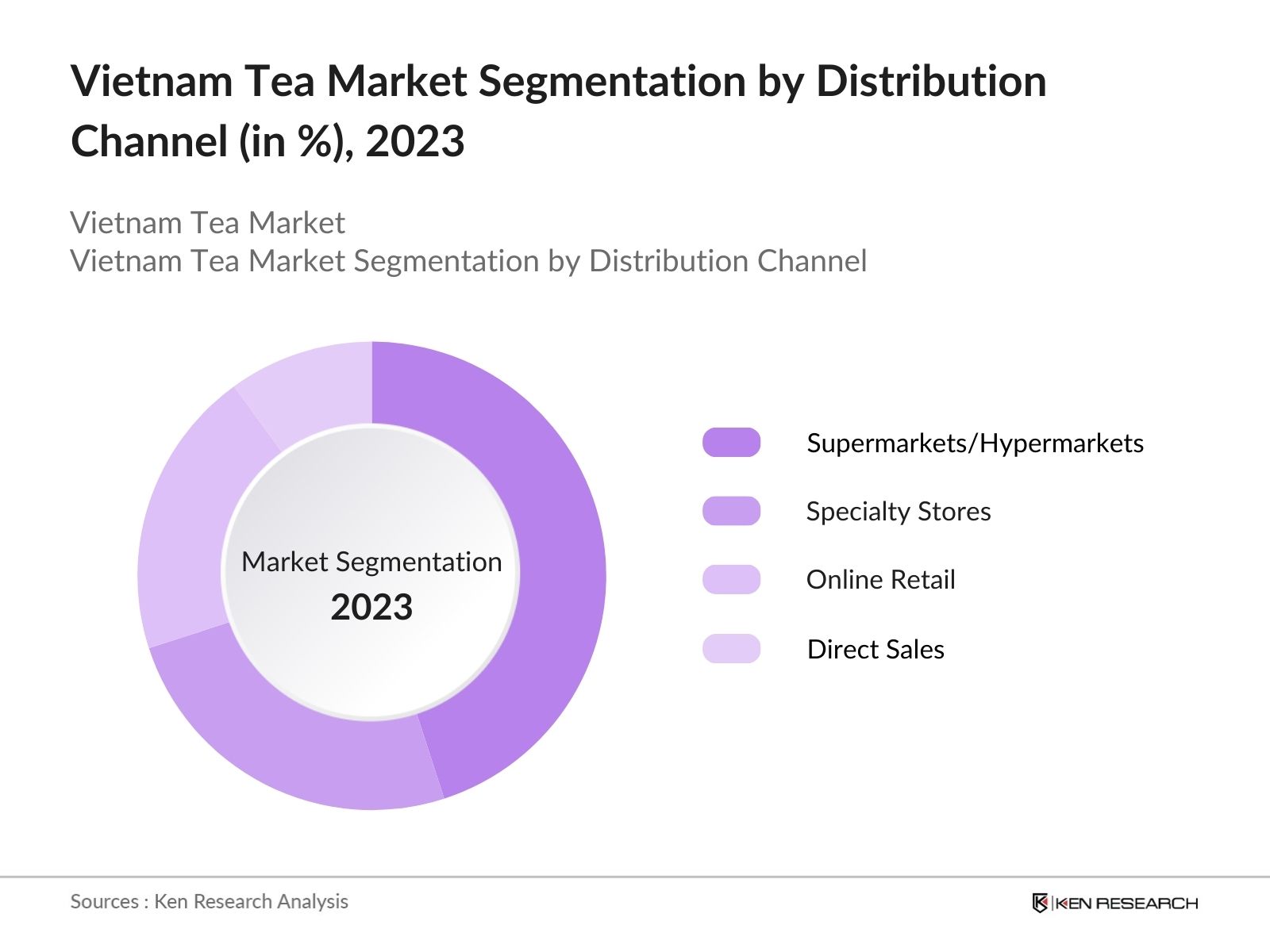

By Distribution Channel: Vietnams tea market is segmented by distribution channel into supermarkets/hypermarkets, specialty stores, online retail, and direct sales. Supermarkets and hypermarkets dominate the distribution channel due to their widespread presence across urban areas and convenience for customers. They offer a broad variety of tea products and brands, catering to both local and imported tea demand.

Vietnam Tea Market Competitive Landscape

The Vietnam tea market is dominated by a few key players, including well-established domestic companies and expanding international brands. Local companies like Thai Nguyen Tea Joint Stock Company and Vietnam National Tea Corporation (VINATEA) have significant influence due to their longstanding presence, vast production capacities, and strong distribution networks.

Vietnam Tea Industry Analysis

Growth Drivers

- Increasing Domestic Consumption: Vietnams domestic tea consumption is rising due to a growing middle class and shifting cultural preferences. In 2023, the Vietnamese middle class is projected to reach 40 million people, with rising incomes driving higher demand for tea, particularly premium and health-focused varieties. The Vietnam Tea Association notes that Vietnams per capita tea consumption reached 1.4 kg in 2022, reflecting increased local demand. Domestic retail sales have expanded in urban areas, driven by the expansion of caf chains and tea shops catering to younger consumers.

- Rising Health Awareness: As health consciousness increases, more Vietnamese consumers are turning to tea for its reported health benefits. Green tea, known for its antioxidants, has seen significant growth, especially among urban populations. The Ministry of Health in Vietnam has reported a 20% increase in demand for health-promoting beverages, including tea, from 2022 to 2023. Vietnamese consumers are also showing interest in herbal teas, driven by a rise in wellness trends and fitness culture.

- Expanding Export Opportunities: Vietnam is the worlds seventh-largest tea exporter, with tea export volumes reaching 130,000 tons in 2022, according to the Vietnam Tea Association. Vietnam's major export markets include China, Pakistan, and Taiwan. Recent trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) and the EU-Vietnam Free Trade Agreement (EVFTA), have opened new avenues for Vietnamese tea in international markets by reducing tariffs and streamlining trade regulations.

Market Challenges

- Price Volatility: The tea industry in Vietnam faces significant price volatility, especially in export markets. The average export price of Vietnamese tea fluctuated between $1.50 and $2.10 per kilogram in 2023 due to varying global demand and production levels. The volatility is attributed to shifts in global trade policies, exchange rate fluctuations, and inconsistent crop yields. Local tea leaf prices are also affected by the competition between smallholder farmers, contributing to an unstable supply chain.

- Climate Change Impact on Crop Yield: Vietnam's tea production is increasingly threatened by climate change, with rising temperatures and irregular rainfall patterns affecting crop yields. According to the National Center for Hydro-Meteorological Forecasting, Vietnam experienced erratic rainfall in major tea-growing regions like the northern provinces, reducing output by nearly 10% in 2023 compared to previous years.

Vietnam Tea Market Future Outlook

Over the next five years, the Vietnam tea market is expected to experience robust growth, driven by increasing international demand for premium and organic tea varieties. Additionally, advancements in farming techniques, along with the adoption of sustainable agriculture practices, will help boost production volumes. The continued expansion of Vietnams tea export market to regions like the Middle East, Africa, and Europe will further fuel the market's expansion, especially with rising awareness about the health benefits of various tea types.

Market Opportunities

- Organic and Specialty Tea Demand: The demand for organic and specialty teas has risen significantly in global markets. Vietnam, with its favorable growing conditions, has an opportunity to capitalize on this trend. The Ministry of Agriculture and Rural Development reported that organic tea production in Vietnam reached 20,000 hectares by 2023, with plans for expansion. Specialty teas, including jasmine, oolong, and lotus teas, are gaining traction in premium markets such as the EU and Japan, where consumers are willing to pay higher prices for unique and sustainably produced tea.

- Growth in Online Retail Channels: Online retail is becoming a significant growth channel for Vietnamese tea producers. The e-commerce market in Vietnam reached a transaction value of $20 billion in 2022, driven by increased internet penetration and smartphone use. The shift toward online platforms provides tea producers with a direct-to-consumer (D2C) sales channel, bypassing traditional intermediaries. Major online retailers, including Tiki and Shopee, have seen a growing number of tea products listed on their platforms, providing smaller tea producers access to a broader consumer base.

Scope of the Report

|

By Tea Type |

Green Tea Black Tea Oolong Tea White Tea Herbal/Flavored Tea |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail Direct Sales |

|

By Packaging Type |

Loose Leaf Tea Tea Bags Bottled Tea Canned Tea |

|

By End User |

Household Food Service (Restaurants, Cafes) Industrial (Ready-to-Drink Tea Manufacturers) |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam Export Markets (Europe, USA, Middle East, Africa) |

Products

Key Target Audience

Tea Exporters

Domestic Retailers

Large-Scale Tea Farms

Tea Processing Companies

International Buyers (China, Russia, Pakistan)

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development)

Online Retailers

Companies

Players Mentioned in the Report

Thai Nguyen Tea Joint Stock Company

Vietnam National Tea Corporation (VINATEA)

Tan Cuong Hoang Binh Tea JSC

Phu Da Tea Joint Stock Company

Hiep Thanh Tea Co., Ltd.

Do Huu Tea Company

Dong Nai Tea Corporation

Cau Dat Farm

BLao Tea JSC

Hanoi Tea Processing and Exporting JSC

Table of Contents

1. Vietnam Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Tea Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Tea Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Domestic Consumption

3.1.2. Rising Health Awareness

3.1.3. Expanding Export Opportunities

3.1.4. Government Support for Tea Farming

3.2. Market Challenges

3.2.1. Price Volatility (Tea Leaf Prices, Export Price Fluctuations)

3.2.2. Climate Change Impact on Crop Yield

3.2.3. Fragmented Supply Chain (Smallholder Farmers, Distribution Inefficiencies)

3.3. Opportunities

3.3.1. Organic and Specialty Tea Demand

3.3.2. Growth in Online Retail Channels

3.3.3. Expansion in Non-traditional Markets (Middle East, Africa)

3.4. Trends

3.4.1. Emergence of Premium Tea Brands

3.4.2. Innovative Packaging Solutions

3.4.3. Collaboration with Global Tea Brands

3.5. Government Regulation

3.5.1. Tea Export Standards

3.5.2. Pesticide Residue Regulations

3.5.3. Sustainable Farming Initiatives

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem (Farmers, Distributors, Retailers, Exporters)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Tea Market Segmentation

4.1. By Tea Type (In Value %)

4.1.1. Green Tea

4.1.2. Black Tea

4.1.3. Oolong Tea

4.1.4. White Tea

4.1.5. Herbal/Flavored Tea

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Specialty Stores

4.2.3. Online Retail

4.2.4. Direct Sales

4.3. By Packaging Type (In Value %)

4.3.1. Loose Leaf Tea

4.3.2. Tea Bags

4.3.3. Bottled Tea

4.3.4. Canned Tea

4.4. By End User (In Value %)

4.4.1. Household

4.4.2. Food Service (Restaurants, Cafes)

4.4.3. Industrial (Ready-to-Drink Tea Manufacturers)

4.5. By Region (In Value %)

4.5.1. Northern Vietnam (Highland Tea Producing Regions)

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

4.5.4. Export Markets (Europe, USA, Middle East, Africa)

5. Vietnam Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thai Nguyen Tea Joint Stock Company

5.1.2. Vietnam National Tea Corporation (VINATEA)

5.1.3. Tan Cuong Hoang Binh Tea JSC

5.1.4. Phu Da Tea Joint Stock Company

5.1.5. Hanoi Tea Processing and Exporting JSC

5.1.6. Hiep Thanh Tea Co., Ltd.

5.1.7. Tan Hiep Phat Group (THP)

5.1.8. Do Huu Tea Company

5.1.9. BLao Tea JSC

5.1.10. Cau Dat Farm

5.1.11. Dong Nai Tea Corporation

5.1.12. Hien Minh Tea Company

5.1.13. Trung Nguyen Legend Group

5.1.14. Highlands Tea Company

5.1.15. Fafimex Vietnam

5.2. Cross Comparison Parameters (Annual Revenue, Market Share, Number of Employees, Production Capacity, Export Volume, Retail Presence, Product Diversification, Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Government Support and Grants

5.9. Private Equity and Venture Capital Investments

6. Vietnam Tea Market Regulatory Framework

6.1. Export Quality Standards

6.2. Organic Tea Certification

6.3. Pesticide and Chemical Residue Laws

6.4. Industry Licensing and Compliance

7. Vietnam Tea Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Tea Future Market Segmentation

8.1. By Tea Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Diversification Strategies

9.3. Marketing Initiatives

9.4. Emerging Market Opportunities

Research Methodology

Step 1: Identification of Key Variables

In this phase, we construct a comprehensive ecosystem map identifying all major stakeholders in the Vietnam Tea Market. This includes tea producers, exporters, distributors, and retailers. Extensive desk research is conducted using secondary and proprietary databases to gather industry-level information, helping to define key market variables such as production capacity, market drivers, and consumer preferences.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data on the Vietnam tea market. The analysis focuses on evaluating the ratio of production to export volumes, understanding consumer behavior trends, and measuring market penetration across various distribution channels. The gathered data is used to create reliable market estimates for future growth projections.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed from the desk research are validated through interviews with industry experts from tea manufacturing and exporting companies. These interviews help refine and corroborate the market data, providing insights into operational challenges, emerging trends, and opportunities in the sector.

Step 4: Research Synthesis and Final Output

In the final phase, insights from multiple tea manufacturers are combined with the quantitative data gathered from the bottom-up research approach. This ensures that the final market report provides a holistic view of the Vietnam tea market, covering production, export, and domestic consumption trends.

Frequently Asked Questions

01 How big is the Vietnam Tea Market?

The Vietnam tea market is valued at USD 2 billion, based on a five-year historical analysis. The market is driven by several factors, including increasing domestic consumption due to growing health awareness among the population and a rise in the export of tea products.

02 What are the challenges in the Vietnam Tea Market?

Challenges include the fragmented supply chain, climate change affecting crop yields, and volatile tea prices, especially in the international market, where Vietnamese tea faces stiff competition.

03 Who are the major players in the Vietnam Tea Market?

Key players include Thai Nguyen Tea Joint Stock Company, Vietnam National Tea Corporation (VINATEA), Tan Cuong Hoang Binh Tea JSC, and Phu Da Tea Joint Stock Company. These companies have extensive production capacities and strong export networks.

04 What are the growth drivers of the Vietnam Tea Market?

The market is driven by increased consumer preference for health-beneficial products like green tea, the rising demand for organic tea, and Vietnam's growing exports to non-traditional markets such as the Middle East and Africa.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.