Vietnam Telecom Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD2872

December 2024

90

About the Report

Vietnam Telecom Market Overview

- The Vietnam Telecom Market is valued at USD 7 billion, based on a five-year historical analysis. This market growth has been fueled by the rapid expansion of mobile internet users and the government's robust digital transformation initiatives, such as the E-Government and Smart City projects. Vietnam's increasing smartphone penetration has also driven demand for mobile data services, contributing to the overall market size.

- Northern Vietnam, particularly Hanoi, and Southern Vietnam, with Ho Chi Minh City, dominate the Vietnam Telecom Market due to their status as key economic hubs. These cities benefit from advanced infrastructure, higher income levels, and substantial foreign direct investment. Their dominance in the market stems from both the concentration of businesses and consumers requiring telecom services, making them the focal point for telecom providers operations.

- Vietnam has established a formal spectrum auction framework that regulates the allocation of frequencies for telecom operators. In 2024, the Ministry of Information and Communications conducted an auction that released additional 5G spectrum for telecom companies, facilitating the expansion of 5G networks.

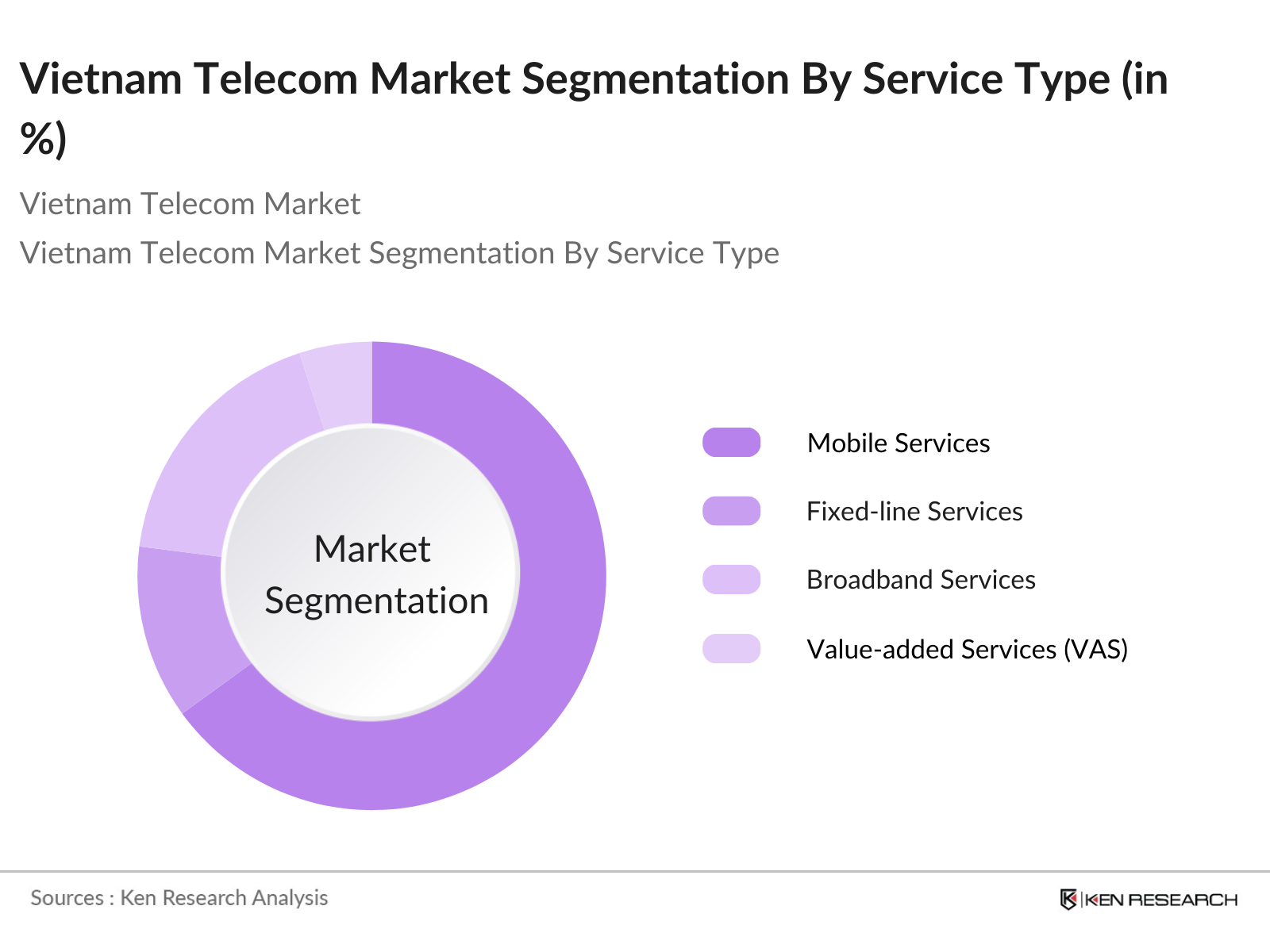

Vietnam Telecom Market Segmentation

By Service Type: The market is segmented by service type into mobile services, fixed-line services, broadband services, and value-added services (VAS) such as OTT and IoT services. Recently, mobile services have held a dominant market share under this segmentation due to the country's high rate of smartphone adoption and widespread 4G network availability.

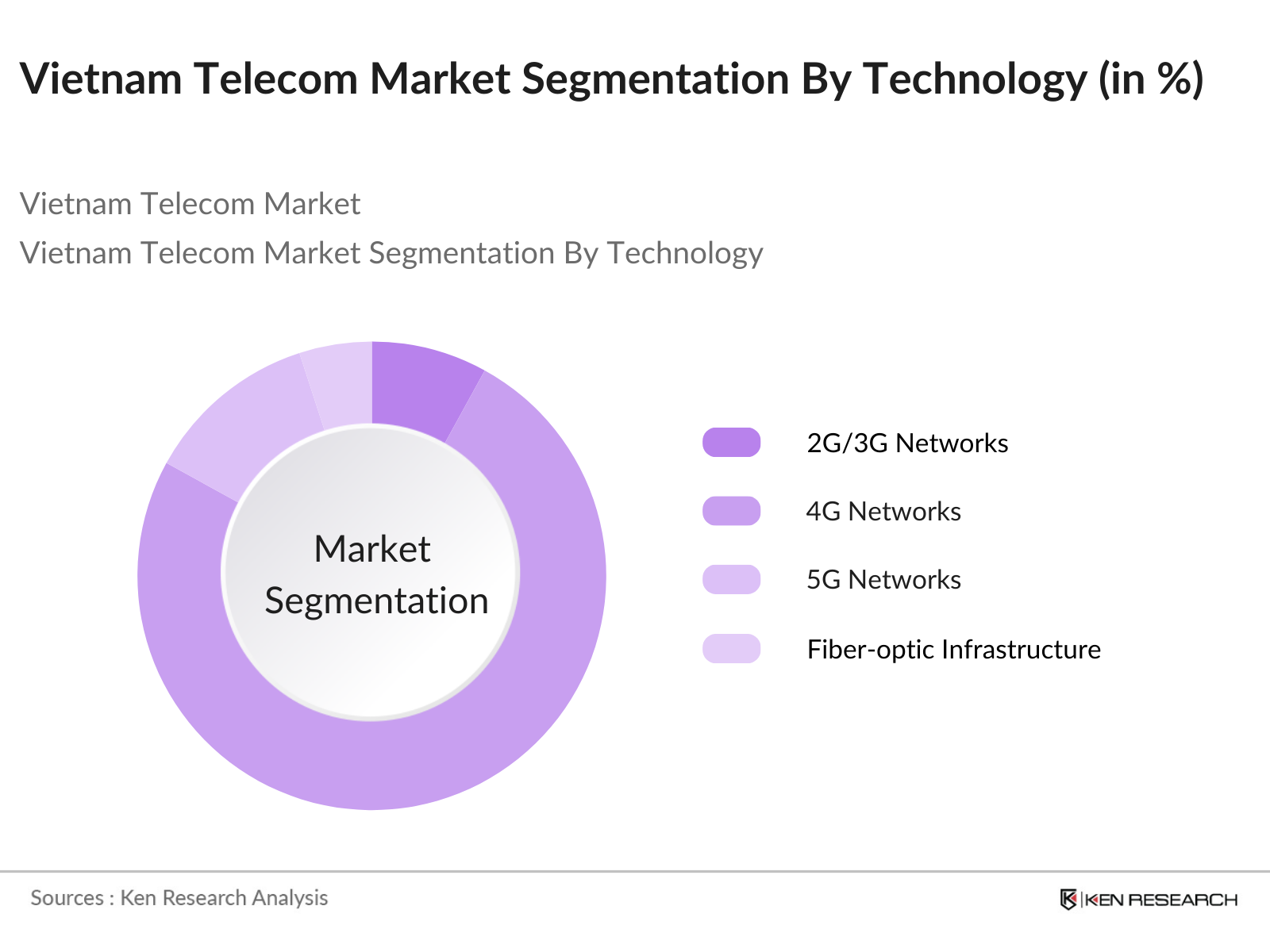

By Technology: The market is further segmented by technology into 2G/3G networks, 4G networks, 5G networks, and fiber-optic infrastructure. The 4G networks currently dominate the market share as the most widely available technology, largely due to extensive deployment by major players. However, with ongoing investments and government support for 5G infrastructure, this newer technology is expected to gain prominence shortly.

Vietnam Telecom Market Competitive Landscape

The Vietnam Telecom market is dominated by several major players, including both local and international companies. These players have established themselves through extensive infrastructure investments, government partnerships, and aggressive marketing strategies. Viettel, the largest telecom provider, continues to lead with its comprehensive coverage and innovative service offerings. Meanwhile, VNPT and Mobifone maintain their positions as strong competitors, leveraging customer loyalty and reliable network services.

Vietnam Telecom Market Analysis

Growth Drivers

- Increasing Mobile Internet Subscribers: As of 2024, Vietnam has over 150 million mobile internet subscribers, supported by the growing accessibility of affordable mobile devices. The General Statistics Office of Vietnam reports that mobile internet traffic increased by 20% from 2022 to 2024, driven by the expansion of 4G and 5G services. Additionally, the rise in mobile-first internet access has contributed to the proliferation of e-commerce and digital services. Mobile data consumption averages 4.5 GB per user monthly, reflecting increased engagement with online platforms and digital solutions.

- Rising Smartphone Penetration: By 2024, Vietnam has reached over 97 million smartphone users, with smartphone penetration standing at around 89% of the total population, according to the Ministry of Information and Communications. This widespread usage is fueled by affordable mobile devices and increasing consumer preference for smartphones as the primary mode of internet access. The average price of a smartphone in Vietnam is approximately USD 150, making it accessible to both urban and rural populations.

- Government Support (Public-Private Partnerships, National Telecom Policies): Vietnams telecom sector has benefited from robust government support, particularly through public-private partnerships and favorable telecom policies. The government has implemented initiatives like the National Telecommunications Development Plan (2021-2025), which aims to modernize telecom infrastructure and encourage foreign investment.

Market Challenges

- Infrastructure Gaps in Rural Areas: While urban areas in Vietnam enjoy widespread telecom access, rural regions still face significant infrastructure challenges. As of 2024, only 65% of rural areas have access to 4G services, and 5G coverage remains limited. The Ministry of Planning and Investment reports that over 15 million people in rural areas still lack reliable internet access, primarily due to underdeveloped telecom infrastructure.

- Intense Market Competition (Price Wars, Service Differentiation): Vietnam's telecom market is characterized by intense competition, especially among the top players, including Viettel, Vinaphone, and MobiFone. These companies frequently engage in price wars to attract customers, driving down profit margins. As of 2024, average telecom service prices have dropped by 10% compared to 2022, leading to a challenging environment for smaller operators.

Vietnam Telecom Market Future Outlook

Over the next five years, the Vietnam Telecom Market is expected to experience significant growth driven by increasing demand for mobile data services, the continued expansion of 5G networks, and the governments push for digital transformation across sectors. The implementation of smart city initiatives and the rise of IoT and AI-driven applications are also expected to contribute to the robust development of the telecom industry.

Market Opportunities

- Expansion of 5G Networks: Vietnam is rapidly expanding its 5G network, with 25 provinces expected to have partial 5G coverage by the end of 2024. The Ministry of Information and Communications reports that around 10 million users will have access to 5G services by the end of the year, driven by partnerships with leading global telecom equipment providers.

- IoT and Cloud-based Services Growth: The demand for IoT and cloud-based services in Vietnam is experiencing significant growth, particularly in sectors like agriculture, healthcare, and manufacturing. As of 2024, over 2 million IoT-connected devices were in use in smart city projects and industrial applications across the country. Vietnam's IoT ecosystem is being driven by increasing investments in smart city development and cloud infrastructure, supported by favorable government policies.

Scope of the Report

|

By Service Type |

Mobile Services (Prepaid, Postpaid) Fixed-line Services Broadband Services (Fiber, DSL, Satellite) Value-added Services (VAS) (OTT, IoT) |

|

By Subscriber Type |

Residential Enterprise Government Wholesale |

|

By Technology |

2G/3G Networks 4G Networks 5G Networks Fiber-optic Infrastructure |

|

By Provider Type |

Public Operators Private Operators Virtual Network Operators (MVNOs) Northern Vietnam |

|

By Region |

Northern Central Southern |

Products

Key Target Audience

Telecom Operators

Mobile Network Providers

Government and Regulatory Bodies

Internet Service Providers (ISPs)

IoT and Smart City Solution Providers

Investors and Venture Capitalist Firms

Public and Private Sector Enterprises

Device Manufacturers (Mobile and IoT devices)

Companies

Players Mentioned in the Report

Viettel Group

VNPT Group

Mobifone

FPT Telecom

Vietnamobile

CMC Telecom

Gtel Mobile

SCTV

Indochina Telecom

NetNam Corporation

Table of Contents

1. Vietnam Telecom Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Mobile penetration rate, Fixed-line saturation rate, Internet user growth)

1.4 Market Segmentation Overview

2. Vietnam Telecom Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones (Launch of 5G networks, Fiber-optic deployment, Mobile broadband adoption)

3. Vietnam Telecom Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Mobile Internet Subscribers

3.1.2 Digital Transformation Initiatives (E-Government, Smart Cities)

3.1.3 Rising Smartphone Penetration

3.1.4 Government Support (Public-private partnerships, National Telecom Policies)

3.2 Market Challenges

3.2.1 Infrastructure Gaps in Rural Areas

3.2.2 Intense Market Competition (Price wars, Service differentiation)

3.2.3 Regulatory Compliance Issues (Spectrum allocation, Service quality benchmarks)

3.3 Opportunities

3.3.1 Expansion of 5G Networks

3.3.2 IoT and Cloud-based Services Growth

3.3.3 Foreign Investment Influx (M&A activity, JV partnerships)

3.4 Trends

3.4.1 Increased Investment in 5G Technology

3.4.2 Adoption of IoT for Smart Cities

3.4.3 Rising Demand for OTT Services (Streaming services, VoIP growth)

3.5 Government Regulation

3.5.1 National Telecom Policy

3.5.2 Spectrum Auction Framework

3.5.3 Cybersecurity Laws and Telecom Compliance

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Stakeholder Ecosystem (Telecom providers, Government bodies, Equipment suppliers)

3.8 Porters Five Forces (Competitive rivalry, Bargaining power of suppliers and buyers, Threat of new entrants and substitutes)

3.9 Competitive Ecosystem (Domestic operators vs foreign entrants)

Vietnam Telecom Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Mobile Services (Prepaid, Postpaid)

4.1.2 Fixed-line Services

4.1.3 Broadband Services (Fiber, DSL, Satellite)

4.1.4 Value-added Services (VAS) (OTT, IoT services)

4.2 By Subscriber Type (In Value %)

4.2.1 Residential

4.2.2 Enterprise

4.2.3 Government

4.2.4 Wholesale

4.3 By Technology (In Value %)

4.3.1 2G/3G Networks

4.3.2 4G Networks

4.3.3 5G Networks

4.3.4 Fiber-optic Infrastructure

4.4 By Provider Type (In Value %)

4.4.1 Public Operators

4.4.2 Private Operators

4.4.3 Virtual Network Operators (MVNOs)

4.5 By Region (In Value %)

4.5.1 Northern

4.5.2 Central

4.5.3 Southern

5. Vietnam Telecom Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Viettel Group

5.1.2 VNPT Group (Vietnam Posts and Telecommunications Group)

5.1.3 Mobifone Corporation

5.1.4 Vinaphone

5.1.5 FPT Telecom

5.1.6 Vietnamobile

5.1.7 Indochina Telecom

5.1.8 CMC Telecom

5.1.9 Gtel Mobile

5.1.10 SCTV (Saigon Cable Television)

5.1.11 VTC Telecommunications

5.1.12 NetNam Corporation

5.1.13 SPT (Saigon Postel Corporation)

5.1.14 VNTT (Vietnam Technology and Telecommunication Joint Stock Company)

5.1.15 HT Mobile

5.2 Cross Comparison Parameters (Market share, Subscriber base, Network coverage, Service diversification, Technology adoption, Revenue, ARPU, Infrastructure investment)

5.3 Market Share Analysis (Mobile vs Fixed-line, Regional splits)

5.4 Strategic Initiatives (5G rollout, IoT integration, Smart City development projects)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Vietnam Telecom Market Regulatory Framework

6.1 Spectrum Allocation Policies

6.2 Telecom Licensing Requirements

6.3 Telecom Infrastructure Sharing Regulations

6.4 Cybersecurity Standards and Data Privacy Laws

7. Vietnam Telecom Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Vietnam Telecom Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Subscriber Type (In Value %)

8.3 By Technology (In Value %)

8.4 By Provider Type (In Value %)

8.5 By Region (In Value %)

9. Vietnam Telecom Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Telecom Market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Vietnam Telecom Market. This includes assessing market penetration, subscriber base growth, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics ensures the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple telecom operators to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam Telecom Market.

Frequently Asked Questions

01. How big is the Vietnam Telecom Market?

The Vietnam telecom market is valued at USD 7 billion, driven by rapid smartphone adoption, expanding 4G and 5G networks, and digital transformation efforts across the country.

02. What are the challenges in the Vietnam Telecom Market?

Key challenges in the Vietnam telecom market include infrastructure gaps in rural areas, intense market competition leading to price wars, and regulatory compliance related to spectrum allocation and service quality benchmarks.

03. Who are the major players in the Vietnam Telecom Market?

Vietnam telecom market include Viettel Group, VNPT Group, Mobifone, FPT Telecom, and CMC Telecom. These companies dominate due to extensive network coverage, strong subscriber bases, and ongoing investments in next-gen technologies like 5G and IoT.

04. What are the growth drivers of the Vietnam Telecom Market?

The Vietnam telecom market is propelled by increasing mobile internet subscribers, growing demand for digital services, and government-backed initiatives to enhance telecom infrastructure, such as the expansion of 5G networks and smart city projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.