Vietnam Tractor Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD3300

October 2024

84

About the Report

Vietnam Tractor Market Overview

- The Vietnam Tractor Market is valued at 5 thousand units by volume, driven primarily by the increasing mechanization of agriculture in the country. The demand for more efficient farming techniques and the adoption of modern farming equipment have contributed to the market's growth. This growth has been further accelerated by favorable government policies, including subsidies for purchasing agricultural equipment, which is fostering widespread adoption among small and large-scale farmers alike. Additionally, the expansion of export-oriented farming is another key driver, pushing the need for tractors to enhance productivity.

- The market is dominated by cities like Hanoi and Ho Chi Minh City, which are key hubs for agricultural innovation and development. Additionally, rural areas in the Mekong Delta and Red River Delta also hold importance due to their reliance on agriculture. These regions are characterized by larger farming operations that require mechanization to meet growing demand for agricultural products, both for domestic consumption and export. The dominant position of these cities is due to their concentration of farming activities and greater access to government support.

- Vietnam imposes an average tariff of 15% on imported tractors, as per the Ministry of Finance. However, the government has introduced tariff reductions on environmentally friendly and electric tractors to encourage their adoption. As of 2023, import duties on electric tractors were reduced by 5%, which has facilitated the entry of newer, more advanced models into the Vietnamese market, helping farmers upgrade their equipment more cost-effectively.

Vietnam Tractor Market Segmentation

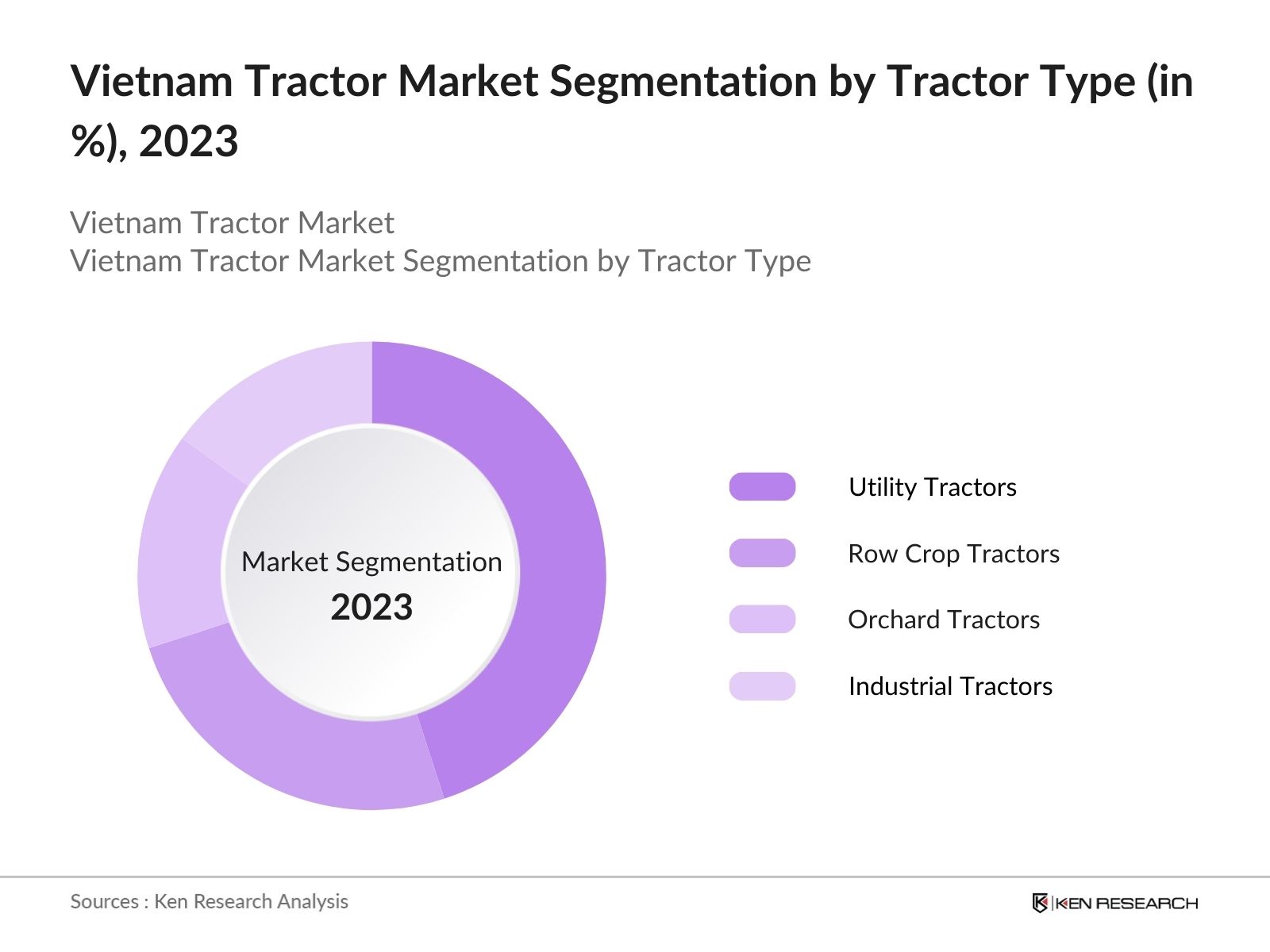

- By Tractor Type: The market is segmented by tractor type into utility tractors, row crop tractors, orchard tractors, and industrial tractors. Utility tractors have a dominant market share under this segmentation. This is mainly due to their versatility in performing multiple functions, such as plowing, tilling, and transporting materials. Utility tractors are particularly favored by farmers in Vietnam as they cater to various farm sizes and terrains. With increasing demand for mechanized solutions in both large-scale and small-scale farming, utility tractors have cemented their position as the preferred choice in this segment.

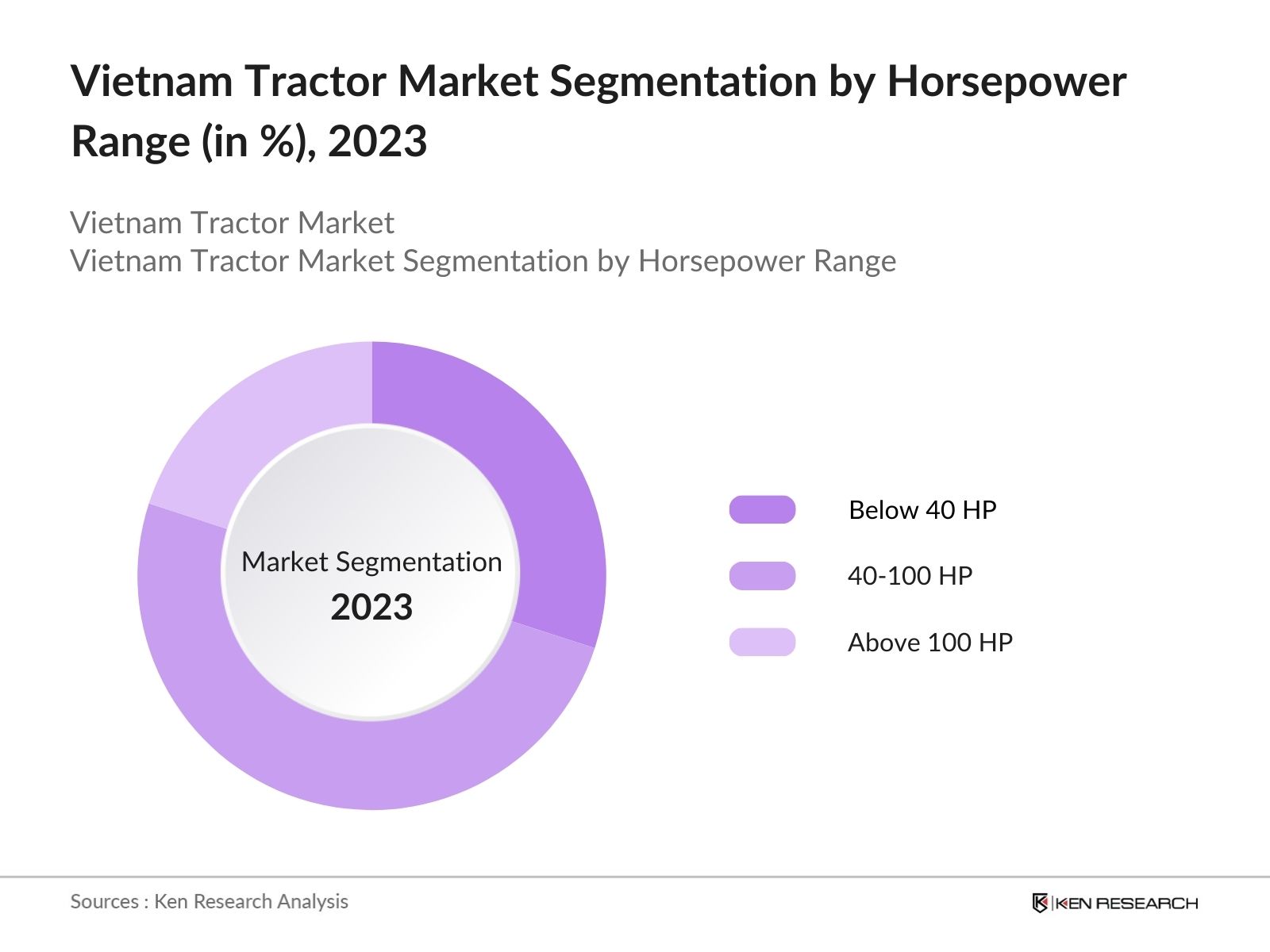

- By Horsepower Range: The market is further segmented by horsepower range into below 40 HP, 40-100 HP, and above 100 HP tractors. Tractors within the 40-100 HP range dominate the market, primarily because they strike a balance between affordability and power. They are ideal for medium-sized farms and can handle a variety of tasks, from basic soil preparation to transportation of goods. Their ability to function in varied terrain, coupled with government incentives to upgrade machinery, has resulted in their widespread adoption across both commercial and smallholder farms in Vietnam.

Vietnam Tractor Market Competitive Landscape

The Vietnam Tractor Market is dominated by both global and local players, with international brands like John Deere and Kubota leading the charge. Local manufacturers such as Vinacomin have also gained traction due to their affordable pricing and alignment with local farming needs. The competitive landscape is characterized by a mix of product innovation, distribution networks, and after-sales service, which are critical for capturing market share in Vietnam. The dominance of these players is indicative of their ability to leverage both advanced technology and government-backed programs.

|

Company Name |

Year Established |

Headquarters |

Revenue (USD) |

Number of Employees |

Market Share |

R&D Investment |

Product Innovation |

Customer Satisfaction |

Distribution Network |

|---|---|---|---|---|---|---|---|---|---|

|

John Deere |

1837 |

Moline, USA |

|||||||

|

Kubota Corporation |

1890 |

Osaka, Japan |

|||||||

|

Vinacomin |

1996 |

Hanoi, Vietnam |

|||||||

|

Massey Ferguson |

1847 |

Duluth, USA |

|||||||

|

Tractors and Farm Equipment |

1960 |

Chennai, India |

Vietnam Tractor Industry Analysis

Growth Drivers

- Mechanization of Agriculture: The mechanization of agriculture in Vietnam has been rising steadily, with an increased adoption of tractors and farming equipment. As of 2023, 60% of agricultural activities in Vietnam involve some form of mechanization, up from 50% in 2020, according to the Ministry of Agriculture and Rural Development. This shift has been driven by the need to increase productivity to support a growing population of over 98 million people in 2024, as per World Bank data. The government has encouraged mechanization to mitigate labor shortages in rural areas and boost agricultural output.

- Government Subsidies and Support: Vietnams government has allocated over VND 10 trillion in subsidies and financial support programs aimed at promoting the purchase of agricultural machinery, including tractors, in 2024. The Ministry of Finance introduced these initiatives to assist farmers in acquiring modern equipment at reduced costs. The government's Agricultural Equipment Mechanization Strategy has facilitated the purchase of 150,000 tractors by small- and medium-scale farmers in the past two years, ly boosting mechanization across the country.

- Growing Demand for Efficient Farming Equipment: Vietnam's agricultural sector, which accounts for about 14% of the nation's GDP in 2024, continues to demand more efficient farming equipment to meet growing agricultural export needs. In 2023, the country exported over 7 million tons of rice, up from 6.3 million tons in 2022, as reported by the General Statistics Office of Vietnam. This surge in exports has encouraged farmers to invest in tractors and mechanized solutions to boost crop yields and maintain Vietnams competitive position in the global agricultural market.

Market Challenges

- High Equipment Costs: The cost of tractors remains a barrier for small- and medium-scale farmers in Vietnam, where the average income per capita in rural areas was only USD 2,800 in 2023, as per the General Statistics Office. A standard tractor can cost upwards of VND 500 million (USD 21,000), making it difficult for farmers to afford without government subsidies. Despite financing options, the high cost of ownership continues to be a challenge in increasing mechanization rates.

- Lack of Skilled Labor for Operating Advanced Machinery: Vietnam faces a shortage of skilled labor capable of operating advanced tractors and agricultural machinery, particularly in rural areas. A 2023 report from the Ministry of Labor shows that nearly 40% of the agricultural workforce lacks the necessary training to operate modern machinery. This has slowed the adoption of technologically advanced tractors and limited the benefits of mechanization. Government programs aimed at technical training have been introduced, but adoption remains slow.

Vietnam Tractor Market Future Outlook

Over the next five years, the Vietnam Tractor Market is expected to experience growth, driven by increased agricultural mechanization, advancements in tractor technology, and government support. Key areas of growth will include smart tractors equipped with AI and IoT for precision farming, as well as the rising demand for eco-friendly electric tractors. The growing emphasis on sustainable farming practices is also expected to fuel demand for advanced tractor models, particularly in export-driven sectors such as rice and coffee production.

Future Market Opportunities

- Technological Integration: The adoption of modern technologies such as GPS, AI, and automation in tractors presents a growth opportunity for Vietnams agricultural sector. By 2024, over 15% of tractors in Vietnam are expected to be equipped with GPS tracking systems, enabling precision farming techniques. This technological shift is primarily driven by the governments Digital Transformation in Agriculture initiative, which aims to modernize farming practices across the country.

- Expansion of Tractors in Small-Scale Farming: The demand for small and medium-sized tractors designed for fragmented land is increasing. In 2023, around 40,000 small-sized tractors (under 30 HP) were sold, primarily to smallholder farmers, according to the General Statistics Office of Vietnam. This trend is expected to continue, as the government provides targeted subsidies and promotes mechanization even in small-scale farming, contributing to higher productivity levels for these farmers.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Tractor Type |

Utility Tractors |

|

Row Crop Tractors |

|

|

Orchard Tractors |

|

|

Industrial Tractors |

|

|

Horsepower Range |

Below 40 HP |

|

40-100 HP |

|

|

Above 100 HP |

|

|

Application |

Agriculture |

|

Construction |

|

|

Forestry |

|

|

Drive Type |

2-Wheel Drive |

|

4-Wheel Drive |

|

|

Region |

Northern Vietnam |

|

Central Vietnam |

|

|

Southern Vietnam |

Products

Key Target Audience

Agricultural Equipment Manufacturers

Tractor Distributors

Large-Scale Farming Enterprises

Smallholder Farmers

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development)

Banks and Financial Institutes

Agricultural Cooperatives

Agricultural Exporters

Companies

Players Mentioned in the Report

John Deere

Kubota Corporation

Vinacomin

Massey Ferguson

Tractors and Farm Equipment

CLAAS Group

Yanmar Holdings Co., Ltd.

Mahindra & Mahindra Ltd.

Sonalika Group

Iseki & Co., Ltd.

Dongfeng Farm

Foton Lovol International Heavy Industry Co., Ltd.

Escorts Group

JCB

Shandong Wuzheng Group

Table of Contents

1. Vietnam Tractor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Tractor Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Tractor Market Analysis

3.1. Growth Drivers

3.1.1. Mechanization of Agriculture

3.1.2. Government Subsidies and Support

3.1.3. Growing Demand for Efficient Farming Equipment

3.1.4. Rise in Agricultural Exports

3.2. Market Challenges

3.2.1. High Equipment Costs

3.2.2. Lack of Skilled Labor for Operating Advanced Machinery

3.2.3. Fragmented Agricultural Land Ownership

3.3. Opportunities

3.3.1. Technological Integration (e.g., GPS, AI, and Automation)

3.3.2. Expansion of Tractors in Small-scale Farming

3.3.3. Rising Demand for Electric and Eco-friendly Tractors

3.4. Trends

3.4.1. Adoption of Precision Farming Technologies

3.4.2. Increase in Tractor Leasing and Renting Services

3.4.3. Integration of IoT and Telematics in Tractor Operations

3.5. Government Regulations

3.5.1. Import Tariffs on Agricultural Equipment

3.5.2. Environmental and Emission Regulations

3.5.3. Farm Mechanization Policies

3.5.4. Financial Support for Agricultural Equipment Purchase

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Tractor Market Segmentation

4.1. By Tractor Type (In Value %)

4.1.1. Utility Tractors

4.1.2. Row Crop Tractors

4.1.3. Orchard Tractors

4.1.4. Industrial Tractors

4.2. By Horsepower Range (In Value %)

4.2.1. Below 40 HP

4.2.2. 40-100 HP

4.2.3. Above 100 HP

4.3. By Application (In Value %)

4.3.1. Agriculture

4.3.2. Construction

4.3.3. Forestry

4.4. By Drive Type (In Value %)

4.4.1. 2-Wheel Drive

4.4.2. 4-Wheel Drive

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Tractor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. John Deere

5.1.2. CNH Industrial

5.1.3. Kubota Corporation

5.1.4. Mahindra & Mahindra Ltd.

5.1.5. Massey Ferguson

5.1.6. CLAAS Group

5.1.7. Yanmar Holdings Co., Ltd.

5.1.8. Escorts Group

5.1.9. Iseki & Co., Ltd.

5.1.10. Tractors and Farm Equipment Limited (TAFE)

5.1.11. Sonalika Group

5.1.12. Dongfeng Farm

5.1.13. Foton Lovol International Heavy Industry Co., Ltd.

5.1.14. JCB

5.1.15. Shandong Wuzheng Group

5.2. Cross Comparison Parameters (Revenue, Tractor Sales Volume, Market Share, Regional Presence, Product Portfolio, R&D Investment, Product Innovation, Customer Satisfaction)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Vietnam Tractor Market Regulatory Framework

6.1. Environmental Standards and Emission Norms

6.2. Safety Regulations and Certification Processes

6.3. Compliance with Agricultural Machinery Standards

7. Vietnam Tractor Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Tractor Market Future Segmentation

8.1. By Tractor Type (In Value %)

8.2. By Horsepower Range (In Value %)

8.3. By Application (In Value %)

8.4. By Drive Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Tractor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Cohort Analysis

9.3. Key Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, the research team constructed an ecosystem map of the Vietnam Tractor Market, encompassing key stakeholders such as manufacturers, distributors, and end-users. Secondary databases and proprietary reports were used to identify critical variables influencing the market.

Step 2: Market Analysis and Construction

Historical data on the Vietnam Tractor Market was compiled, focusing on market penetration and revenue generation. This data was analyzed to ensure accuracy and to build a reliable revenue model for the current market size.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These interviews provided valuable insights into operational dynamics and helped refine market projections.

Step 4: Research Synthesis and Final Output

In the final phase, interactions with leading tractor manufacturers were conducted to gain deeper insights into sales performance and consumer preferences. This information was synthesized with secondary data to create a comprehensive, validated market report.

Frequently Asked Questions

01. How big is the Vietnam Tractor Market?

The Vietnam Tractor Market is valued at 5 thousand units by volume, supported by rising mechanization in agriculture and government incentives aimed at increasing productivity across the country.

02. What are the challenges in the Vietnam Tractor Market?

Key challenges in the Vietnam Tractor Market include high equipment costs, fragmented land ownership, and a lack of skilled labor for operating modern tractors. Additionally, smaller farmers may find it difficult to adopt mechanization due to financial constraints.

03. Who are the major players in the Vietnam Tractor Market?

Key players in the Vietnam Tractor market include global brands like John Deere and Kubota Corporation, along with local manufacturers such as Vinacomin, which offer affordable and locally adapted tractor models.

04. What are the growth drivers of the Vietnam Tractor Market?

Growth in the Vietnam Tractor market is driven by factors such as increasing mechanization, government subsidies, and rising agricultural exports. The adoption of precision farming technologies and eco-friendly tractors also contributes to market expansion.

05. What are the key opportunities in the Vietnam Tractor Market?

Opportunities in the Vietnam Tractor market include the expansion of electric tractors, leasing options for smallholder farmers, and smart tractor technologies that enhance productivity in large-scale farming operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.