Thailand Data Center and Cloud Services Market Outlook to 2027

Driven by rapid adoption to Digitalization, Strong Governments Initiatives and Huge Investments in the region

Region:Asia

Author(s):Mr. Chitra Vasu Behl

Product Code:KR1305

February 2023

159

About the Report

The report provides a comprehensive analysis of the potential of Data Center and Cloud Services Market in Thailand. The report covers an overview and genesis, market size in terms of revenue generated and deep dive into the competitive scenario of the industry.

The market segmentation includes by types of data center facilities, by type of co-location, by end-user data centres, by type of cloud, by types of cloud services, types of end-users and by clients-cloud; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

According to Ken Research estimates, the Thailand and Cloud Services Market grew from approximately USD 440 Mn and USD 445 Mn respectively in 2017 to about USD 550 Mn and USD 1,390 Mn respectively in 2022. The data centre and cloud servicesmarket is forecasted to grow further into USD 840 and USD 3600 Mn respectively by 2027, owing to the new government policies, Major investments, digitization, high-density demand and tech-savvy population.

- Colocation demand will come from local governments, travel & tourism, BFSI Sector, & Hospital. In contrast, Hyperscale demand will come from content providers & cloud operators, e-commerce companies and others for high-density racks requirement.

- With 90.0% of Thai organizations having built at least one software-driven product or service that brought in new business opportunities, spending on software as a service for application development and deployment will rise more in near future.

- The 'Cloud First' initiative by the Thailand government aims to shift 80% of public data to hybrid cloud systems, which will enable the public sector to develop services quickly without investing a lot of money in ICT infrastructures, such as data centres or servers.

Key Trends by Market Segment:

By Region basis Number of Data Centers: Bangkok is the most preferred region for data centre companies in Thailand for both operators and end users. The construction of Special Economic Zones (SEZs) and Free Trade Zones (FTZs) and the availability of infrastructure will attract investors to develop data centre facilities in the coming years.

By Type of Clients: Due to rise in small businesses (SMEs), high consumption of online media streaming and developing economy, a greater number of Local customers are generating majority of the cloud services demand in Thailand as compared to the global clients. Additionally, major cloud service providers are also exploring to set up their own data centers in Thailand to meet the demands of end users.

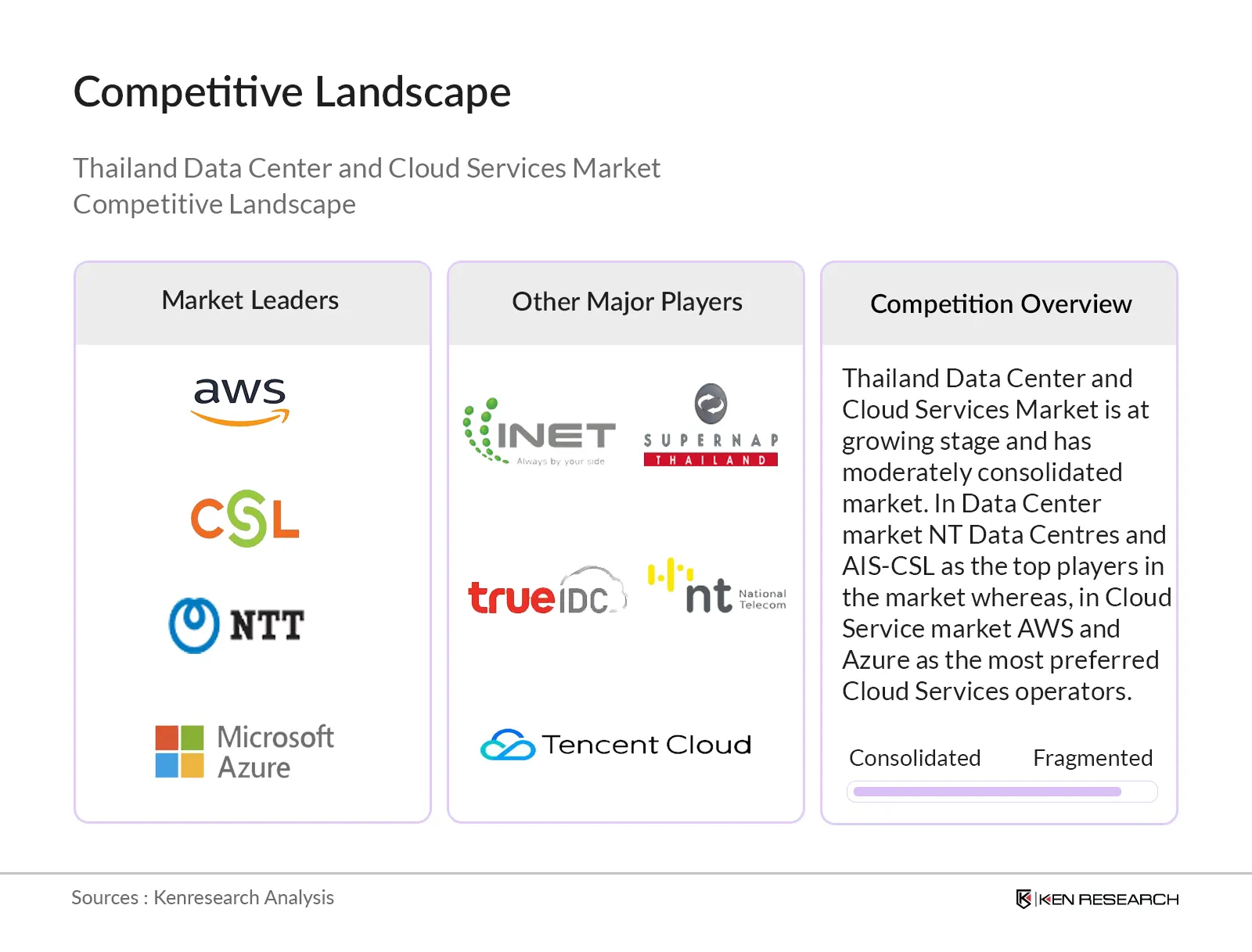

Competitive Landscape:

Future Outlook:

The Thailand Data Center and witnessed significant growth during the period 2017-2022, owing to increasing tech savvy population, major investments in the sector, rapid surge in data demand, intensifying digitalization and rising data traffic. And, in future the Thailand data center and cloud service market is going to growth owning to 5G services, new market entrants and collaborations and upcoming data centers in the forecasted period 2022-2027.

Scope of the Report

|

Thailand Data Center Market Segmentation |

|

|

By type of Data Center Facilities |

Co-Location Managed Hyperscale |

|

By type of Co-Location |

Wholesale Retail |

|

By End-User Data Center |

BFSI Government E-Commerce IT & Telecom Others |

|

By Region basis Number of Data Centers |

Bangkok Chon Buri Nonthaburi Others |

|

Thailand Cloud Services Market Segmentations |

|

|

By type of Cloud Service |

Infrastructure as a Service (IaaS) Software as a Service (SaaS) Platform as a Service (PaaS) |

|

By type of End-Users |

SME and BFSI E-Commerce, Retail and Logistics Media, Entertainment and Gaming Government Others |

|

By Clients-Cloud |

Domestic Clients Global Clients |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Data Center Industry

Cloud Services Industry

Data Center Manufacturing Companies

Data Center Operators

Cloud Services Operators

Co-Location Providers

Uptime ranking association

Telecom Industry

IT/ITes Industry

Government Sector

Retail Sector

Transport and Logistics Companies

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

Thailand Data Center Companies

NT Data Centers

AIS-CSL

INET

True IDC

NTT Thailand

TCC Technology

Super nap

Pacific Internet

AIMS

ST Telemedia

Etix Everywhere

UIH

Jastel Network

Proen IDC

Bridge Data Centers

Kirz Co.

Thailand Cloud Services Providers

AWS

Azure

Google

Huawei

Alibaba

Tencent

VMware

Thai Data Cloud

NT-IRIS Cloud

AIS Business Cloud

True IDC Cloud

NTT Thailand

Super nap GWS

INET Cloud

UIH-HM Cloud

Table of Contents

1. Executive Summary

1.1 Executive Summary: Thailand Data Center Market, 2017-2027

1.2 Executive Summary: Thailand Cloud Services Market, 2017-2027

1.3 Executive Summary: Thailand Government Regulations Overview for Data Center and Cloud Services Market

2. Country Overview

2.1 Country Demographics of Thailand, 2022

2.2 Population Analysis of Thailand, 2022

2.3 Smartphone and Internet Usage in Thailand, 2022

2.4 Thailand Digital Industry Outlook, 2022

2.5 Demand Drivers for Data Consumption

3. Regional Analysis of DC Market

3.1 Data Center Market Attractiveness Result Matrix, 2022

3.2 Cross Comparison of Thailand Data Center Market with Other Countries

4. Ecosystem for Thailand Data Center and Cloud Services Market

4.1 Supply Side Ecosystem of Thailand Data Center and Cloud Services Market

4.2 Demand Side Ecosystem of Thailand Data Center and Cloud Services Market

5. Government Regulations in Thailand Data Center and Cloud Services Market

5.1 Key Government Bodies

5.2 BOI’s Criteria for Granting Promotion Incentives for Data Centers and Cloud Services Market

5.3 Thailand Data Centers VAT Exemption

5.4 Regulatory and Investment Setup Process

6. Thailand Data Center Market Overview

6.1 Business Cycle and Genesis of Thailand Data Center Market

6.2 Timeline of Major Players in Thailand Data Center Market

6.3 Market Sizing Analysis of Thailand Data Center Market, 2017-2022

7. Thailand Data Center Market Segmentation

7.1 By Type of Data Centers, 2022

7.2 By Type of Co-Location Data Centers, 2022

7.3 By Region, 2022

7.4 By End-User Data Center, 2022

8. End User Analysis of Thailand Data Center Market

8.1 Addressable End User Purchase Behaviour Analysis in Thailand Data Center Market

8.2 By Type of End Users, 2022

8.3 Cross Comparison of End Users in Thailand Data Center Market

8.4 Snapshot on BFSI Sector in Thailand, 2022

8.5 Snapshot on IT Sector in Thailand, 2022

8.6 End User Decision Making Parameters

8.7 Pain Points faced by End Users

8.8 Data Centre Location Selection Criteria

9. Industry Analysis of Thailand Data Center Market

9.1 SWOT Analysis of Thailand Data Center Market

9.2 Growth Drivers and Enablers in Thailand Data Center Market

9.3 Recent Trends in Thailand Data Center Market

9.4 Challenges and Bottlenecks in Thailand Data Center Market

10. Competition Framework of Thailand Data Center Market

10.1 Competitive Landscape of Thailand Data Center Market

10.2 Market Share of Major Data Center Companies on the basis of Number of Data Centers, 2022

10.3 Market Share of Major Data Center Companies on the basis of Whitespace Area (sqm), 2022

10.4 Market Share of Major Data Center Companies on the basis of Number of Racks, 2022

10.5 Market Share of Major Data Center Companies on the basis of Available Racks, 2022

10.6 Cross Comparison of Major Players in Thailand Data Center Market (on the basis of Year of Inception, Location, Employees, Gross Floor Area, Whitespace Area, No.

of Data Centers, No. of Data Halls, No. of Racks, Tier Level, PUE, Power Line, IT Load, Occupancy Rate, Uptime SLA, Routes Available, Power Operators, USPs, Certifications, Technology and Facilities, Services, Major Clients, No. of Clients, Expansion Plan)

10.7 Price Sheet of Major Players for Colocation Services

11. Snapshot of Data Center Construction Companies in Thailand

11.1 Data Center Construction Industry Structure & Project Flow

11.2 Role of Key Stakeholders in Data Center Construction Industry

11.3 Factors Leading to Outsourcing of Data Center Construction Industry

11.4 Cross Comparison of Major Players in Data Center Construction Market (on the basis of Year of Inception, HQ, Employees, No. of Data Center Projects, Description of Data Centers, Other Major Projects / Clients)

12. Future Outlook of Thailand Data Center Market

12.1 Future Market Size Analysis of Thailand Data Center Market, 2022-2027

12.2 Future Segmentation by Type of Data Centers, 2027

12.3 Future Segmentation by Type of Colocation Services, 2027

12.4 Future Segmentation by Region, 2027

12.5 Future Segmentation by Type of End Users, 2027

12.6 Upcoming Data Centers in Thailand Data Center Market

12.7 Timeline of Data Centers in Today, Tomorrow and Future

13. Thailand Cloud Services Market Overview

13.1 Business Cycle and Genesis of Thailand Cloud Services Market

13.2 Timeline of Major Players in Thailand Cloud Services Market

13.3 Cloud Services Present Scenario and Delivery Model

13.4 Market Size Analysis of Thailand Cloud Services Market, 2017-2022

14. Thailand Cloud Services Market Segmentation

14.1 By Type of Cloud Services, 2022

14.2 By Type of Clients, 2022

14.3 By Type of End-User, 2022

15. End User Analysis of Thailand Cloud Services Market

15.1 Addressable End User Purchase Behaviour Analysis in Thailand Cloud Services Market

15.2 By Type of End Users, 2022

15.3 Cross Comparison of End Users in Thailand Cloud Services Market

16. Industry Analysis of Thailand Cloud Services Market

16.1 Porter’s Diamond Model Analysis of Thailand Cloud Services Market

16.2 Growth Drivers and Enablers in Thailand Cloud Services Market

16.3 Challenges and Bottlenecks in Thailand Data Center Market

17. Competition Framework of Thailand Data Center Market

17.1 Competitive Landscape of Thailand Cloud Services Market

17.2 Rankings of Major Players in Thailand Cloud Services Market

17.3 Cross Comparison of Major Players in Thailand Cloud Services Market (on the basis of Location, No. of Data Centers, Services, Certifications, Key End Use Industries, Major Clients, Hosting on other Data Centers, Recent Developments)

17.4 Price Sheet of Major Players for Cloud Services

18. Future Outlook of Thailand Cloud Services Market

18.1 Future Market Size Analysis of Thailand Cloud Services Market, 2022-2027

18.2 Future Segmentation by Type of Cloud Services, 2027

18.3 Future Segmentation by Type of Clients, 2027

18.4 By Type of End Users, 2027

19. Covid-19 Impact on Thailand Data Center and Cloud Services Market

19.1 Covid-19 impact on Market Size of Thailand Data Center and Cloud Services Market

19.2 Covid-19 impact on End Users in Thailand Data Center and Cloud Services Market

19.3 Data Center Best Practices to be followed post-Covid-19 crisis

20. Case Study Analysis

20.1 International Case Study – Google Data Center

20.2 International Case Study- Sify Solution to a Retail Giant

20.3 International Case Study- Alibaba Cloud Expansion in KSA Region

21. Market Opportunities and Analyst Recommendations

21.1 Future Opportunities

21.2 Key Attributes for Success

21.3 How to Operationalize Business Operation for Data Center in Thailand

21.4 Regional Analysis of Well-Suited Location for Investments and Operations for Data Centers and Cloud Operators in Thailand

21.5 Outlook to Stakeholders Viewpoints and Opportunities

21.6 Impact of Cloud and Edge Computing on Industries

21.7 Why should Operators pay attention to Cloud and Edge Computing and how Operators should consider to Engage in this Trend

21.8 Iceberg Model for Cloud Costing

22. Industry Speak

22.1 Interview Summary for Thailand Data Center Market

22.2 Interview Summary for Thailand Cloud Services Market

23. Research Methodology

23.1 Market Definitions and Assumptions

23.2 Market Abbreviations

23.3 Market Sizing Approach

23.4 Consolidated Research Approach

23.5 Primary Research Approach

23.6 Sample-Size Inclusion

23.7 Limitations and Future Conclusion

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on data center and cloud services over the years, penetration of internet to compute overall revenue generated from data center and cloud services. We will also review end users’ statistics to understand revenue generated amount which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple data center, cloud services providing channels, and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from data center and cloud services providers.

Frequently Asked Questions

01 How big is Thailand Data Center and Cloud Services Market?

The Thailand Data Center and Cloud Services Market reached USD 550 Mn and USD 1,390 Mn respectively in 2022.

02 What are the growth factors of Thailand data center and cloud services market?

Geographic location, new government policies, growing urban population, and switch to cloud adoption are some of the factors driving the growth of Thailand data center and cloud services market.

03 Who are the top data center players in Thailand?

AIS-CSL and NT Data Centers are top players in the Thailand Data center market.

04 What is the future of Thailand data center and cloud services market?

The Thailand data center and cloud services market is expected to reach USD 840 Mn and USD 3600 Mn respectively by 2027.

05 Which is the most preferred region for data center companies in Thailand?

Bangkok is the most preferred region for data center companies in Thailand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.