Vietnam Complex (NPK) Fertilizer Market Outlook to 2022

NPK 16-16-8 will Continue to be Widely Used Complex Fertilizer

Region:Asia

Product Code:KR605

March 2018

59

About the Report

Vietnam Complex Fertilizer Market Segmentation

By Product Form: Blended form of complex fertilizers was widely used in Vietnam owing to lower capital investment required in producing the same. Blended complex fertilizers comprised for ~% of the market share as compared to ~% by granulated or fused complex fertilizers.

By Product Type: Complex fertilizers comprising of three primary nutrients (nitrogen, phosphorous and potassium) was widely consumed in Vietnam and accounted for ~% market share in 2017. On the other hand, complex fertilizers comprising of two nutrients accounted for ~% market share in 2017.

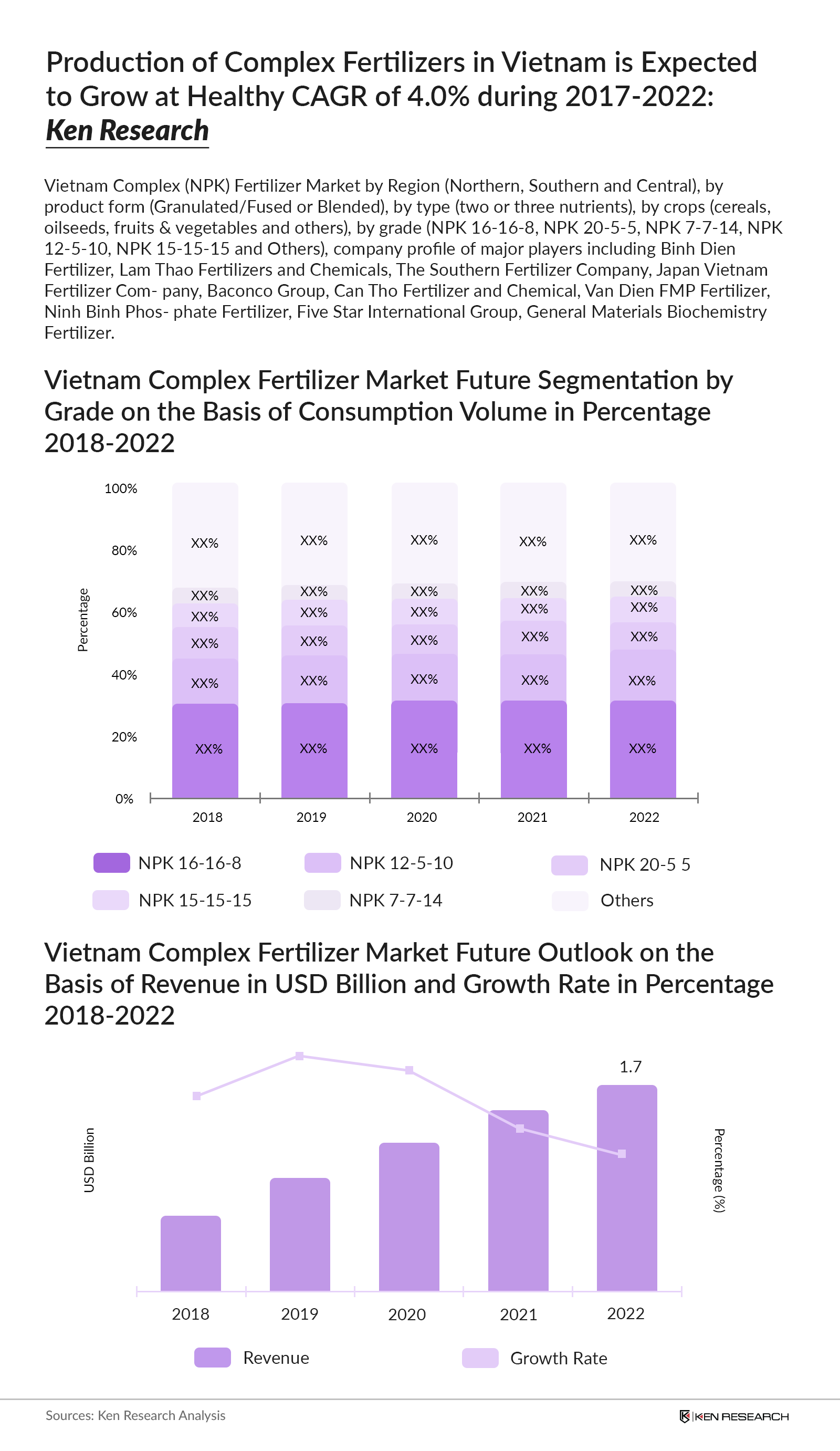

By Grade: NPK 16-16-8 was the most widely used complex fertilizer in Vietnam and accounted for ~% market share in overall complex fertilizer market in 2017. NPK 20-5-5, NPK 7-7-14, NPK 12-5-10 and NPK 15-15-15 were other popularly used fertilizer grade which comprised for ~%, ~%, ~% and ~% market share respectively in 2017. All other grades/formulas of complex fertilizers together comprised for about ~% of the market share in 2017.

By Crops: Complex fertilizers in Vietnam were majorly utilized for cultivation of cereals and comprised for about ~% of the market share in 2017, in terms of consumption volume. Oilseeds, Fruits and vegetables and all others accounted for ~%, ~% and ~% market share, respectively.

Competition Scenario: Vietnam complex fertilizer market is very competitive with more than ~ major NPK producers and over ~ small scale companies. The country's domestic production has been sufficient to meet the consumption demand in the last few years. However, most NPK manufacturers operated at about ~% of their installed capacity and production is not advanced in terms of technology as majority of companies were involved in producing lower quality blended complex fertilizers.

Vietnam's complex fertilizer market is fairly concentrated with top 5 players together comprising for ~% of the market share. Binh Dien Fertilizer emerged as the market leader, in terms of revenue, by accounting for ~% market share in 2017. Lam Thao Fertilizers and Chemicals was the second largest player in this space and comprised for ~% market share. The Southern Fertilizer Company, Japan Vietnam Fertilizer Company and Baconco Group comprised for ~%, ~% and ~% market share, respectively. Other prominent players included Can Tho Fertilizer and Chemical, Van Dien FMP Fertilizer, Ninh Binh Phosphate Fertilizer, Five Star International Group, General Materials Biochemistry Fertilizer and several more.

Vietnam Complex Fertilizer Market Future Outlook and Projections: Despite a balanced demand and supply equilibrium, domestic manufacturers keep investing in NPK projects. Several new and existing players are expected to setup new manufacturing plants or enhance the production capacity of existing sites. For instance, Taekwnag Co. announced its plan to build a NPK plant with production capacity of 360,000 MT per year by the end of 2018. Consumption of complex fertilizers in Vietnam is expected to grow at a CAGR of ~% during the period 2017-2022. Ken Research estimates the consumption of complex fertilizer to grow in the next five years, rising from ~ million MT in 2018 to 4.7 million MT by 2022. Complex fertilizers market is anticipated to be worth USD ~ million by 2022 rising from USD ~ million in 2018. This represents growth at a CAGR of ~% during the period 2017-2022.

Key Topics Covered in the Report:

- Asia Complex Fertilizer Market Size by Revenue

- Value Chain Analysis of Vietnam Complex Fertilizer Market

- Vietnam Complex Fertilizer Market Size

- Vietnam Complex Fertilizer Market Segmentation By Form, By Type, By Grade, by Crops, By Regions

- Trade Scenario

- Market Share Analysis of Major Players

- Company Profiles of Major Players

- Future Outlook and Projection for Vietnam Complex Fertilizer Market

- Analyst Recommendations

- Future Outlook and Projection for Asia Complex Fertilizer Market

Products

Companies

- Binh Dien Fertilizer,

- Lam Thao Fertilizers and Chemicals,

- The Southern Fertilizer Company,

- Japan Vietnam Fertilizer Company,

- Baconco Group,

- Can Tho Fertilizer and Chemical,

- Van Dien FMP Fertilizer,

- Ninh Binh Phosphate Fertilizer,

- Five Star International Group,

- General Materials Biochemistry Fertilizer

Table of Contents

1. Executive Summary

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Size and Modeling

Approach - Market Sizing

Variables (Dependent and Independent)

Multi Factor Based Sensitivity Model

Limitations

Final Conclusion

3. Asia Complex Fertilizer Market Size, 2012-2017

4. Value Chain Analysis of Vietnam Complex Fertilizer Market

5. Vietnam Complex Fertilizer Market Overview and Size, 2012-2017

6. Market Segmentation, 2017

6.1. By Form (Granulated/Fused or Blended), 2017

6.2. By Type (Two or Three Nutrients), 2017

6.3. By Grade, 2012-2017

6.4. By Crop (Cereals, Oilseeds, Fruits and Vegetables and Other), 2017

6.5. By Region (North, South and Central), 2017

7. Trade Scenario

7.1. Imports, 2011-2015

Import Duty

7.2. Exports, 2011-2015

Export Duty

8. Market Share of Major Players, 2017

Comparison of Major Players by Installed Capacity, Best Selling Grades, 2017

9. Company Profiles

9.1. Binh Dien Fertilizer

9.2. Lam Thao Fertilizers and Chemicals

9.3. The Southern Fertilizer Company

9.4. Japan Vietnam Fertilizer Company

9.5. Baconco Group

10. Future Outlook and Projections, 2018-2022

By Grade, 2018-2022

11. Analyst Recommendations

12. Asia Complex Fertilizer Market Future Outlook and Projections

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.